A Note On Masonite International Corporation’s (NYSE:DOOR) ROE and Debt To Equity

Table of Contents

One of the best investments we can make is in our possess know-how and talent set. With that in mind, this report will operate as a result of how we can use Return On Fairness (ROE) to much better understand a company. To maintain the lesson grounded in practicality, we will use ROE to superior comprehend Masonite Global Company (NYSE:Door).

ROE or return on fairness is a practical instrument to assess how efficiently a organization can deliver returns on the expenditure it acquired from its shareholders. Put an additional way, it reveals the firm’s good results at turning shareholder investments into profits.

Verify out our most current analysis for Masonite Intercontinental

How To Compute Return On Equity?

The method for return on equity is:

Return on Equity = Web Financial gain (from continuing functions) ÷ Shareholders’ Equity

So, primarily based on the higher than components, the ROE for Masonite Worldwide is:

14% = US$99m ÷ US$700m (Dependent on the trailing twelve months to January 2022).

The ‘return’ refers to a company’s earnings over the very last year. An additional way to assume of that is that for each $1 worth of equity, the business was capable to gain $.14 in gain.

Does Masonite Global Have A Great Return On Equity?

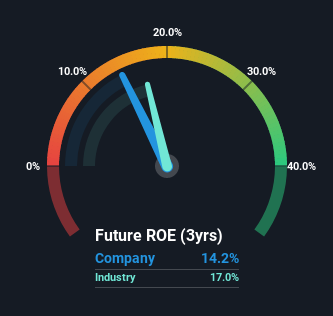

By evaluating a company’s ROE with its sector common, we can get a fast evaluate of how superior it is. On the other hand, this process is only useful as a tough look at, due to the fact firms do vary pretty a bit in the same market classification. The image beneath shows that Masonite Global has an ROE that is approximately in line with the Making marketplace average (17%).

That isn’t really remarkable, but it is respectable. Whilst the ROE is similar to the market, we should continue to execute even further checks to see if the company’s ROE is currently being boosted by large debt amounts. If a company takes on as well much debt, it is at increased threat of defaulting on interest payments. Our pitfalls dashboardshould really have the 3 challenges we have identified for Masonite Intercontinental.

The Importance Of Credit card debt To Return On Equity

Practically all corporations have to have revenue to invest in the small business, to mature earnings. The money for expenditure can come from prior yr earnings (retained earnings), issuing new shares, or borrowing. In the initially and next situations, the ROE will replicate this use of money for financial investment in the enterprise. In the latter scenario, the personal debt required for progress will boost returns, but will not affect the shareholders’ equity. Therefore the use of credit card debt can enhance ROE, albeit along with more possibility in the case of stormy climate, metaphorically speaking.

Combining Masonite International’s Credit card debt And Its 14% Return On Fairness

Masonite Global clearly utilizes a higher quantity of debt to strengthen returns, as it has a credit card debt to equity ratio of 1.24. There’s no doubt its ROE is decent, but the really substantial financial debt the enterprise carries is not also thrilling to see. Investors must think carefully about how a company may possibly carry out if it was not able to borrow so very easily, mainly because credit rating marketplaces do alter more than time.

Summary

Return on fairness is practical for evaluating the high-quality of diverse corporations. Firms that can realize higher returns on equity without as well a lot debt are generally of superior high quality. If two providers have the identical ROE, then I would commonly want the just one with considerably less debt.

But when a organization is large quality, the market generally bids it up to a cost that displays this. The level at which profits are probable to mature, relative to the anticipations of revenue development reflected in the current price, need to be regarded as, way too. So you may want to consider a peek at this facts-loaded interactive graph of forecasts for the company.

But observe: Masonite Worldwide may perhaps not be the very best stock to purchase. So get a peek at this free of charge record of exciting organizations with large ROE and low debt.

Have responses on this post? Concerned about the content material? Get in contact with us directly. Alternatively, electronic mail editorial-group (at) simplywallst.com.

This article by Basically Wall St is common in mother nature. We deliver commentary based mostly on historic details and analyst forecasts only applying an unbiased methodology and our content articles are not meant to be financial guidance. It does not represent a suggestion to buy or sell any stock, and does not acquire account of your goals, or your money condition. We goal to provide you lengthy-time period focused analysis pushed by elementary info. Take note that our analysis may perhaps not aspect in the hottest selling price-delicate organization announcements or qualitative product. Just Wall St has no placement in any stocks outlined.