6 Steps to Create a Small Business Budget (+Templates)

Table of Contents

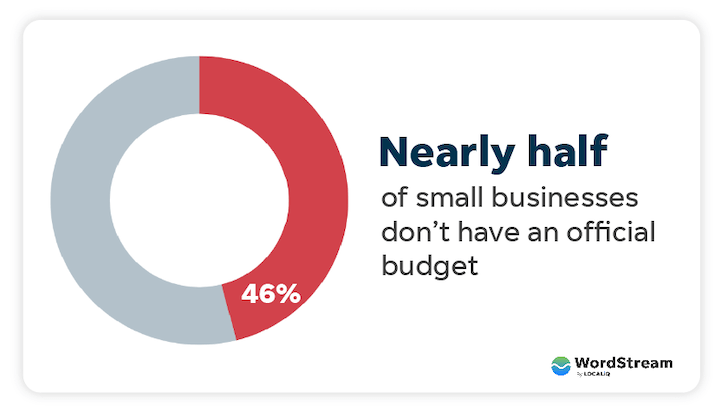

If you want to be thriving in organization, then you want to know where by each greenback goes. It’s not ample to have a tough idea—it requirements to be on paper. That is in which a organization budget will come in. But in accordance to a research by Clutch, 46% of tiny enterprises really don’t have a declared price range. Which is almost half 😮.

Budgeting can be overwhelming, but don’t worry—you really don’t will need a economical or accounting qualifications to build a little organization finances. In this publish, I’m likely to include all of the budgeting principles you require to know, present you how to build a tiny business enterprise finances, and then deliver templates so you’re not starting up from scratch.

Table of contents

Why you need a smaller business budget

In a nutshell, budgeting forces you to concentrate on your organization aims and serves as a compass to know if you’re headed in the proper direction. Furthermore, every business goes as a result of money fluctuations more than time. Budgeting allows you navigate these, from late payments to getting the rug pulled out from underneath you. Right here are the crucial benefits of owning a small enterprise spending budget:

- Financial wellness examine. It allows you know if you have sufficient resources for producing revenue, running expenses, and enlargement.

- Realize long-term targets. Know no matter whether you need to reduce charges or improve profits to realize your strategic, operational, and fiscal plans.

- Expand your business. Traders or loan providers will initial glance at your profits and expenditures before investing in you.

- Maintain money safety. It assists preserve the doors open in situation of a recession, off month, a downturn, sluggish payments, and delayed checks.

- Capitalize on opportunities. With a spending budget in area, you won’t pass up out on any precious alternatives for profitability.

Knowing how a great deal funds is coming in and heading out enables you to give each individual penny a “job” and use each individual greenback to your business’s best benefit.

How to develop a modest enterprise price range in 6 steps

Now that you recognize how crucial a price range is, here’s how you can build a person so you can assure easy small business procedure and facilitate productive funds flow:

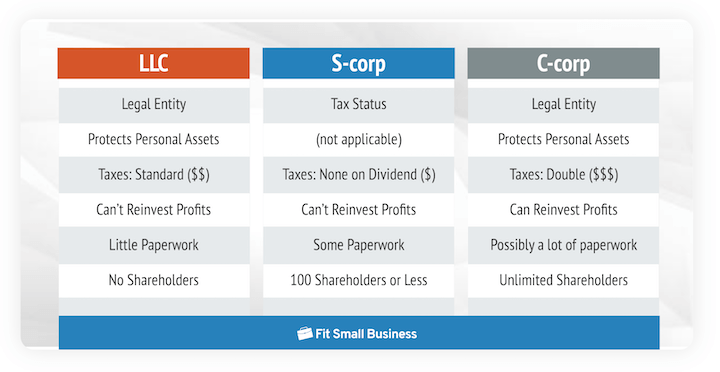

1. Individual your company finances from your individual funds

This is a single of the cardinal policies to be successful in organization. It’s tempting for tiny organization owners to blend business and particular finances, but it almost generally qualified prospects to catastrophe. Disaster in a few types:

- Stagnation: Without an precise watch of your economic position—that is, how the small business is doing with regard to its objective, you are not likely to progress.

- Taxation: It helps you take care of things like organization bills for taxation uses

- Litigation: Mixing budgets blurs the authorized line in between you (the enterprise operator) and your business enterprise. It shields you from liabilities and your individual belongings in situation of litigation

But how do you do that? Below are a pair of measures you can just take when making your funds.

- Utilize for a organization checking account and credit card.

- Use independent accounting techniques for particular budgets and business enterprise finance

Separating the two allows you handle your modest business enterprise like an independent entity. Aside from tax advantages, you established your enterprise up for increased revenue margins. Be aware also that minority-owned businesses can sign-up as a minority company business to obtain supplemental aid.

2. Established apart a contingency fund for emergencies

Murphy’s regulation states, “Anything that can go improper will go improper.” That’s why you must set apart a contingency fund for your company.

If this is not the initially company you’ve started, you know you will usually get surprise bills when you minimum assume it. For illustration, let’s say you run a printing business enterprise. Then suitable soon after receiving a existence-transforming contract, your primary printer breaks down just before you even start. That is when a contingency fund saves the working day.

A contingency fund for emergencies will safeguard your company when these sudden prices come up. So while it’s tempting to commit that additional revenue to acquire that new MacBook you do not require, really do not do it. For now, set apart some of that income. A fantastic rule of thumb is to established aside a few to six months of your little enterprise functioning bills.

It will prepare you and your organization in case a single of your pieces of gear breaks down, or you have to have to swap it. Of system, you could constantly choose out a bank loan, but it wouldn’t damage to have more alternatives.

3. Establish your revenue streams

Grant Cardone likes to say “Cash stream is king.” In which does your cash appear from? How much and how often does it occur in? For modest small business budgeting to do the job, you need to have the answers to these issues.

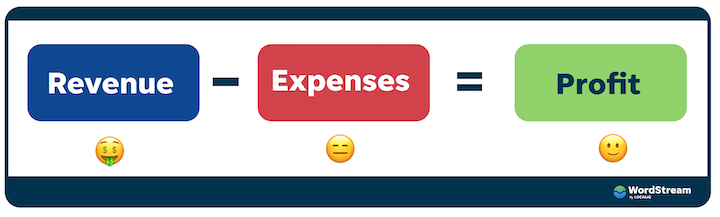

That indicates tallying all your revenue (not revenue) sources just about every month. In scenario you don’t know the distinction among revenue and revenue, income is all the revenue your business enterprise generates before expenses. Soon after subtracting bills, then you are still left with a financial gain.

Sum up your profits for the 12 months and divide it by 12 to come across your month to month money or earnings. Applying this information, you can search at how your profits alterations above time. This will support you uncover and deal with seasonal styles and downturns.

4. Ascertain your preset expenditures

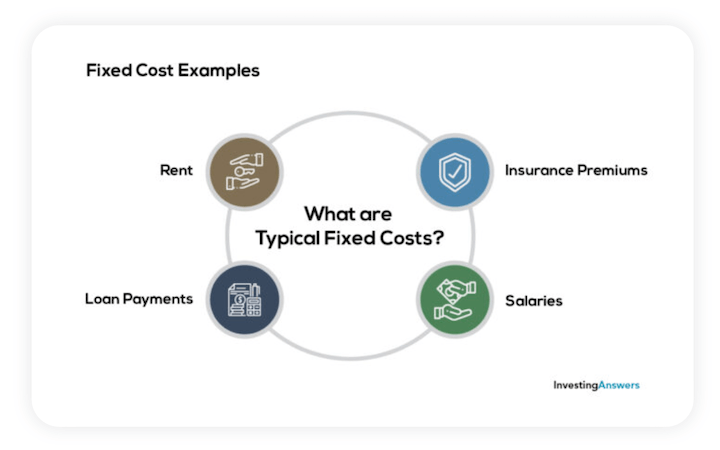

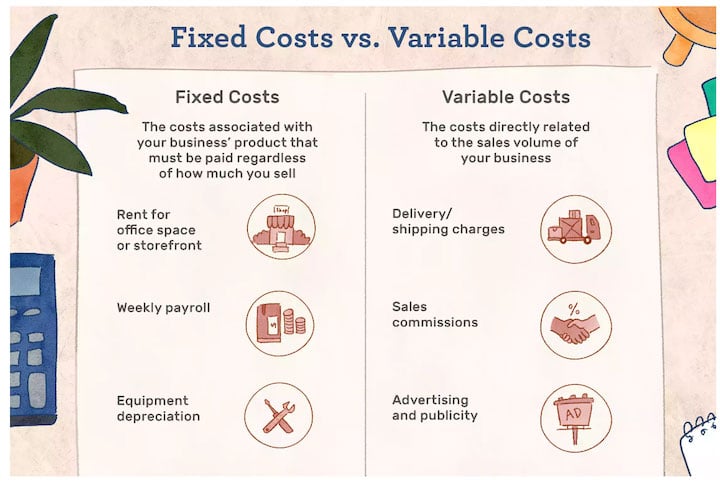

The following move in creating a small organization budget is to consist of all your fastened prices. Fixed prices are recurring expenses that are very important for your small business operations. These operating costs possibly occur up every single day, week, month, or year. That consists of every little thing from lease, money owed, utilities, and payroll fees to taxes and insurance policy.

That stated, no two businesses are the same. So just take some time to establish any other fixed prices needed to run your enterprise. At the time you have discovered them, sum them up to get a specific figure of your fixed prices on a month-to-month basis. If your company is new, then you can challenge these values.

But assure you aspect in these monthly charges as element of your business budget. That way, you can set aside money to deal with them. After you have done that, the future move is subtracting them from your revenue.

5. Identify your variable prices

As you went through your fixed expenditures, you in all probability recognized other inconsistent expenditures in your business. These inconsistent charges are known as variable expenditures or expenditures mainly because they modify dependent on how you use them. They include things like utilities, advertising costs, expert growth , supplies, your salary, etcetera.

For instance, you might boost generation expenditures to get far more raw components to match the expanding attractiveness of specified goods. Or if you are operating a SaaS organization, you might need to devote a lot more finances in certain seasons to get a lot more shoppers.

Discretionary expenditures

Discretionary expenditures are also viewed as variable expenditures mainly because whilst they are awesome to have, they’re not important for your company. These involve factors like training, consulting, etc., which may possibly aid boost profitability.

You want to lessen your variable charges in lean months, setting up with discretionary bills. And when your earnings are on the uptrend, you can allocate a lot more funds to variable bills to enable you increase speedier.

Tally all your variable expenditures at the stop of every thirty day period. This paints a crystal clear picture of how they fluctuate depending on enterprise effectiveness so you can make precise predictions.

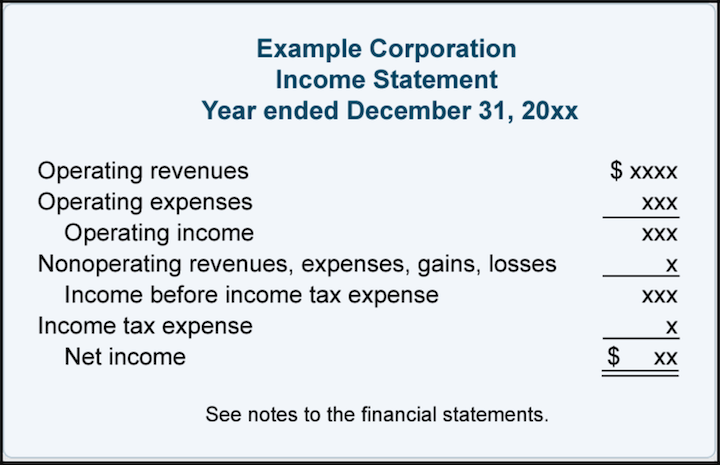

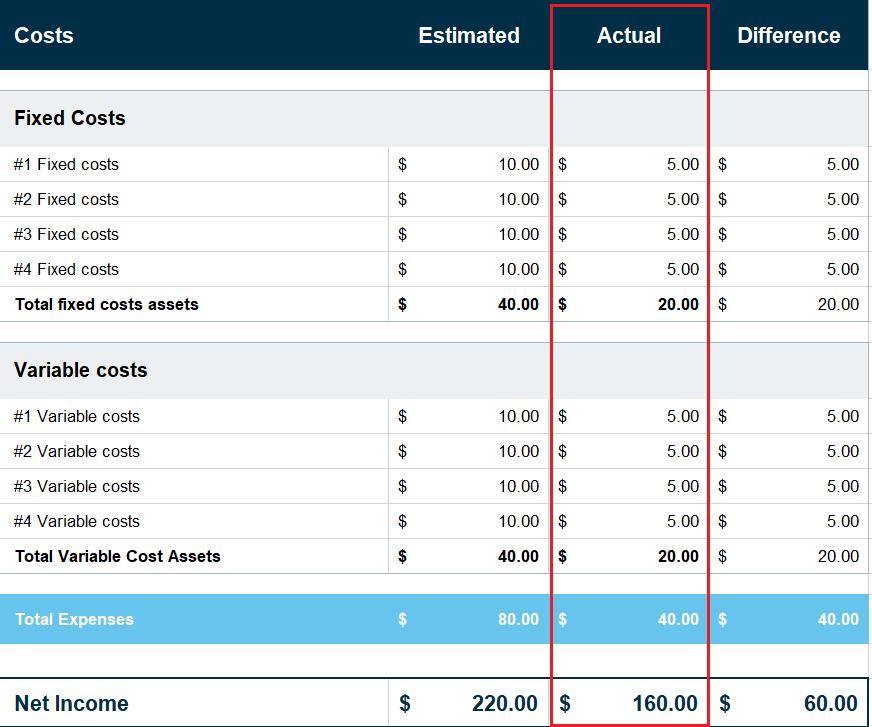

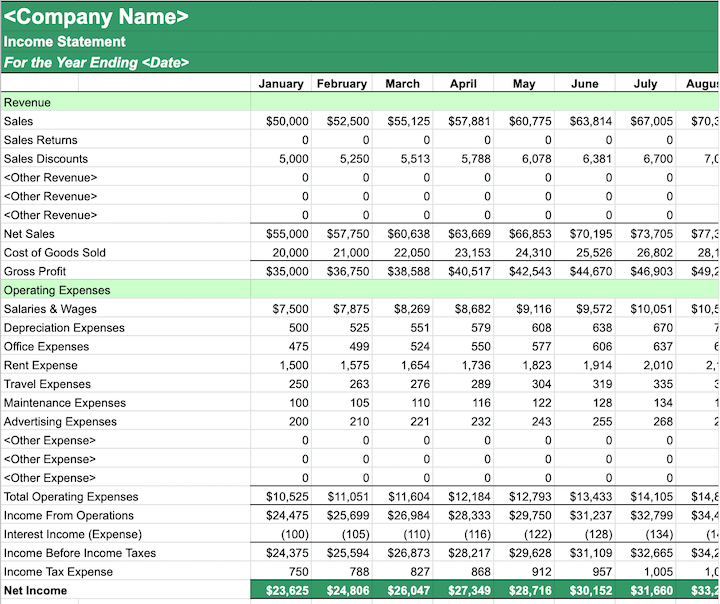

6. Generate a gain and decline assertion

After gathering all the knowledge over, it is time to assemble all the parts of the jigsaw puzzle to make sense of it all. That signifies making a income and loss (P&L) or earnings assertion, like the a person proven underneath.

You have possibly listened to of a P&L assertion, and it’s possibly providing you a headache just contemplating about it. But it does not have to be that way. Which is simply because you’ve already finished the major lifting by amassing all the knowledge points. All that is remaining is to sum up your revenue streams and subtract the whole of all your expenditures for the month.

With any luck ,, you are going to get a optimistic determine in the end—in which scenario, congratulations for the reason that you’re building a revenue. If you get a negative figure, don’t get worried about it. Why? You now know the place your money is likely and can make the necessary changes to transform a income.

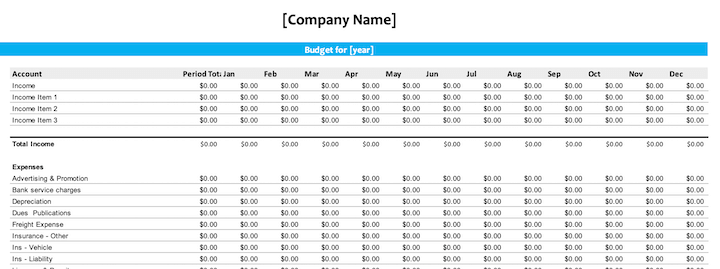

Compact organization funds templates

No matter if you’re hunting to enhance a little internet marketing spending plan or get a firm grasp on all of your bills, there is anything in this list of small organization internet marketing budget templates for absolutely everyone.

Capterra

Capterra’s smaller enterprise funds template is quick to use and employs all of the factors we outlined earlier mentioned, like mounted expenses, variable costs, income, and gain. You can use it in Excel or Google Sheets.

Template Lab

Template Lab’s small enterprise funds template section gives you a few different templates to get the job done with, in word doc and spreadsheet structure. These templates are helpful for itemizing your costs.

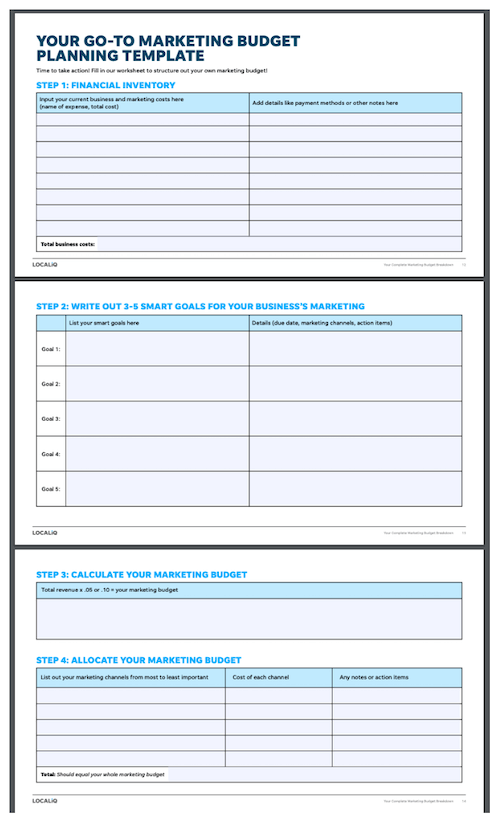

LocaliQ’s marketing price range template

LocaliQ’s Complete Guidebook to Marketing Budgets not only provides you with a marketing and advertising funds template, but also walks you through the marketing spending plan basic principles.

Functional Spreadsheets’ Cash flow statement template

To create an profits statement, you can use this revenue statement Google Sheet template to enter your revenue and fees.

Generate your compact business enterprise finances currently

No matter whether it is your to start with or 2nd business enterprise, mastering modest company budgeting principles is the vital to success. Abide by these ways to create a tiny company spending plan:

- Create individual company and particular accounts.

- Set apart cash for an crisis fund.

- Discover your income streams.

- Identify your mounted costs.

- Identify your variable expenses.

- Create a income/decline profits statement.

With a tiny company funds, you’ll have perception into how your business is doing, which will then help you make the ideal money choices to prosper. Great luck!

About the writer

Jon Morgan is the founder of two successful e-commerce and SaaS businesses. He’s passionate about sharing what he has realized from working with business owners by Undertaking Smarter.