Alibaba Stock: Another Hit On Margins (NYSE:BABA)

Table of Contents

maybefalse/iStock Unreleased by means of Getty Illustrations or photos

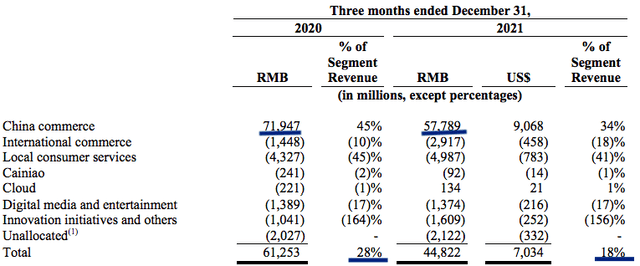

Alibaba (NYSE:BABA) experienced claimed a large drop in its EBITA within just main commerce small business in the previous quarter. Main commerce in China is the biggest contributor to its revenue and consequently we saw a large dip in Alibaba’s cash flow and margin in the past quarter. This margin decline could keep on in the around expression as the limitations thanks to the pandemic are nevertheless being imposed on big cities. Alibaba’s EBITA in main commerce arrived at RMB 57.8 billion, down from RMB 71.9 billion in the yr-in the past quarter. Most of this decrease was owing to better financial investment in Taobao Offers, Neighborhood Marketplaces, Local Buyer Support and Lazada.

We should really see far better margins in the medium time period as the aggressive stress declines thanks to reduced financial commitment by Tencent (OTCPK:TCEHY) in Alibaba’s rivals like JD.com (JD), Pinduoduo (PDD), Meituan, and other individuals. Alibaba’s cloud platform will also be the principal driver for margin growth in excess of the following few quarters. Even with a lessen margin in this earnings contact, Alibaba could see much better bullish sentiment if it continues to exhibit robust development in cloud, intercontinental locations, subscriptions, delivery, and other essential enterprise segments.

Drop In Margins

The decline in margins inside of main commerce small business is thanks to ramping up of investments in a number of strategic initiatives. The increasing competitiveness from Pinduoduo forced Alibaba to launch Taobao Promotions wherever the margins are lower. This assistance presently has about 240 million annual active buyers. Alibaba also invested in Ele.me to boost its shipping community. An additional significant expenditure activity was in Lazada in Southeast Asia. Lazada is competing towards Sea Limited and Alibaba has established a focus on to hit $100 billion gross items worth within just this enterprise.

Figure 1: Decrease in core commerce EBITA is driving the in general margins lower.

The margin decline in commerce section was rather high. The overall EBITA margin in the calendar year-back quarter was 28% which declined to 18% in the past quarter.

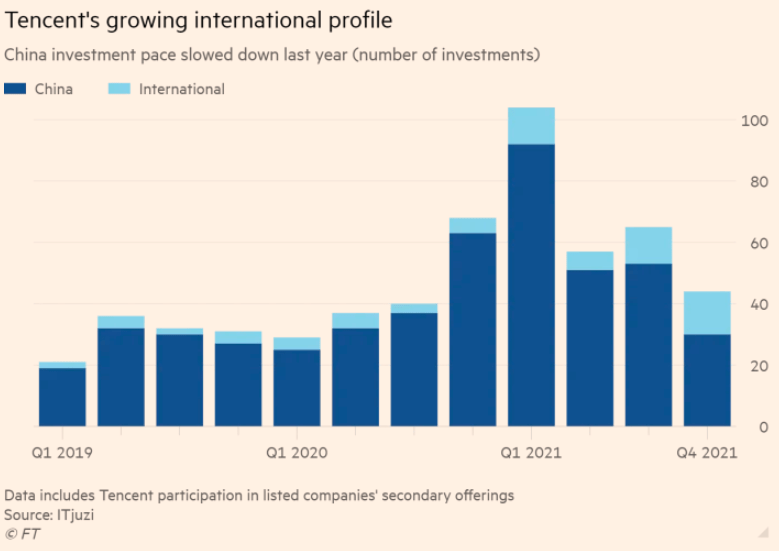

Tencent’s Withdrawal

Tencent has observed important regulatory headwinds in new quarters. It is Alibaba’s major rival which has invested in a quantity of companies that directly compete with Alibaba. Tencent is now seeking to divest its stake in these providers to avoid antitrust action by regulators.

It has now declared a reduction in stake in JD from 17% to 2.3%. There could also be a reduction in strategic partnership in which JD works by using Tencent’s platform to boost its services. Tencent may possibly also divest from PDD, Meituan and other startups. At the exact time, Tencent is increasing financial investment exterior China. This will lower the aggressive strain on Alibaba in several small business segments.

Money Situations

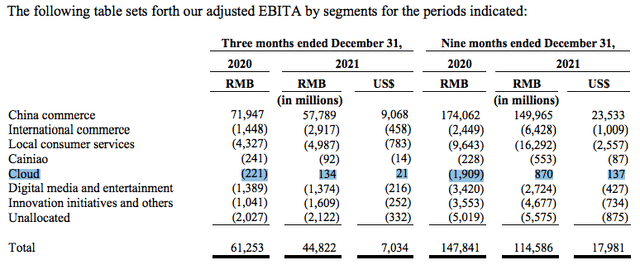

Figure 2: Decrease financial investment by Tencent in China.

Significance Of Cloud Company

Alibaba Cloud is currently showing annualized income amount of $12 billion.

Determine 3: Advancement in cloud business enterprise in contrast to calendar year in the past quarter.

In the 9 months ending December 31, 2020 Alibaba noted EBITA of adverse RMB 1.9 billion. In the newest nine-month interval this has modified to beneficial RMB .87 billion. The margin swing in this interval was from unfavorable 4% to good 2 %. A lot of cloud companies have struggled with decrease margins in the first stages. Soon after reaching a larger revenue base, they are ready to leverage the economies of scale to provide better margins.

We have previously viewed this in Google’s ((GOOG)(GOOGL)) cloud small business. Google was capable to produce a 16 proportion point improvement in margin on a YoY basis in the preceding quarter. Alibaba really should also be equipped to show enhancement in cloud margins as the earnings foundation boosts and we see improved economies of scale.

A further issue working in favor of Alibaba Cloud is the quick international progress proven by the company. Not too long ago, Alibaba opened its third knowledge middle in Germany and it now right competes with Amazon (AMZN), Microsoft (MSFT), Google, and other cloud providers in the beneficial European location. It need to be famous that Alibaba Cloud has many options which are very similar to Amazon’s AWS simply because both of those of these cloud operations started with their e-commerce small business. This would make it a lot easier for clients to use Alibaba Cloud instead of AWS in scenario they get better discount rates.

A lot of consumers are focusing on employing the companies of various cloud providers instead of a single cloud corporation. This ought to help Alibaba Cloud achieve sector share as customers try to diversify their cloud vendors.

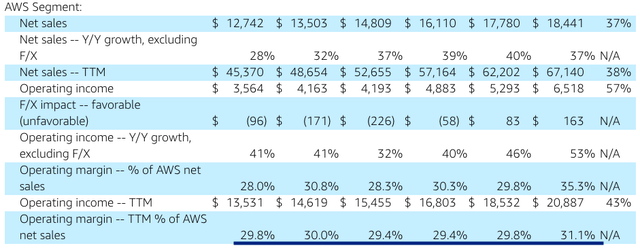

Determine 4: Amazon’s AWS has shown functioning margin of near to 30% in the last number of quarters.

Amazon’s AWS frequently demonstrates operating margin of 30%. There is a massive margin hole between Alibaba Cloud and AWS. Alibaba Cloud has previously shown an advancement of 6 share details in margins in the initially three-quarters of this fiscal. Additional advancement is likely as Alibaba ramps up its intercontinental expense in cloud small business.

Hence, we should see a good deal of margin enhancement in Alibaba Cloud because of to far better economies of scale, global growth, and usage of a number of cloud companies by shoppers, and thus see a reduction in margin hole with AWS.

Are Margins Critical?

If Alibaba can show immediate progress in intercontinental areas, the margins may well consider a back again seat for Wall Road in evaluating the stock. The corporation is making an attempt to replicate the business design it has made in China in other locations. It tries to attain a great share of the ecommerce current market in a new area and then launches other products and services like payment, cloud, supply, subscriptions, and so forth. within these destinations. Alibaba has now established alone in Southeast Asia. It owns Lazada which is a important player in the ecommerce marketplace of Southeast Asia.

Lazada had $21 billion gross merchandise benefit in accordance to the latest estimates in comparison with Sea Constrained which had $35 billion GMV. Sea Limited is investing at near to $50 billion marketplace cap. Therefore, Lazada could also have a large standalone valuation. Alibaba also owns a significant stake in Trendyol which is the top e-commerce corporation in Turkey with a valuation of about $16 billion.

By close of this ten years, Alibaba’s international small business could be value far more than its Chinese company. All through the growth section in global areas, the margins will undergo as the enterprise tries to commit in warehousing, logistics and appeals to new shoppers by means of bargains. Wall Road could ignore margins in this period of time if Alibaba’s administration can supply large more than enough expansion in worldwide markets. The the latest YoY development in Lazada was 82% which shows that large investment can provide a solid development from a superior profits foundation.

Effect On Inventory

Alibaba is investing at a modest valuation various even if we price in the regulatory worries confronted by the company. The organization has a selection of progress motorists that it can use to produce much better figures in the future. The core enterprise is continue to really potent and it has been ready to retain its marketplace share even with the advancement of impressive disruptors like PDD.

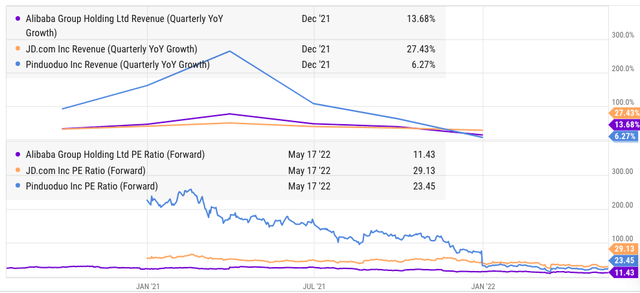

Determine 5: Alibaba’s forward PE ratio is noticeably decrease than that of JD and PDD.

The income growth is still strong in a quantity of significant firms like cloud, international commerce, Ele.me and some others. The forward P/E ratio of Alibaba is near to single digit which does not mirror the main strengths. We could nonetheless see some margin headwinds because of to pandemic constraints in the in close proximity to term. Nevertheless, in the medium to extended phrase, the earnings advancement and margin likely of the organization are promising.

Traders must glimpse previous the shorter-phrase margin fluctuation and gauge the extensive-time period growth of important segments like cloud, intercontinental commerce, subscriptions, and level of competition with Tencent.

Trader Takeaway

Alibaba has seen a dip in margins as the enterprise invests in its strategic initiatives. We should really see reduced competitive tension on Alibaba in the medium time period as Tencent lessens its stake and partnership in JD, PDD, Meituan and other folks. Tencent is also directing more expenditure in global locations which should really be favorable for Alibaba in China. Alibaba’s cloud company will be the major margin driver in the subsequent handful of quarters.

Alibaba’s international expansion will also place significantly less notice on the margins. If Alibaba can rapidly expand in Southeast Asia and Europe across products and services like ecommerce, cloud, payments, shipping and delivery, and other people, then it can boost the very long-expression progress runway for the corporation.