Apple: Buybacks, New Subscriptions, And Record Revenues (NASDAQ:AAPL)

Table of Contents

Justin Sullivan/Getty Images News

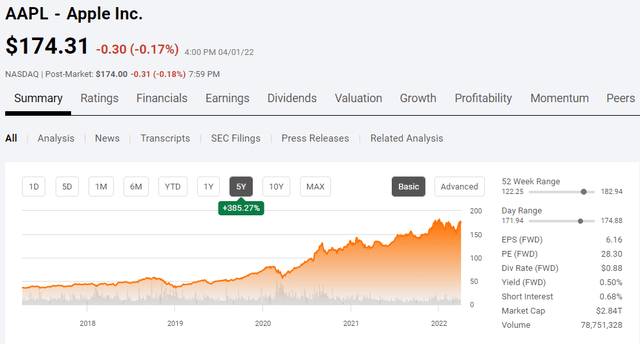

If there is one stock you can count on in a volatile market, it’s Apple (NASDAQ:AAPL). I am shocked to see 6 sell and 8 hold articles compared to 11 buy articles on Seeking Alpha during March. AAPL is the largest holding in many of the most significant mutual and exchange-traded funds ((ETFs)), has generated over $100 billion in free cash flow (FCF) over the trailing twelve months (TTM), and is forecasted for a record revenue in their 2022 Q2, and continues to aggressively buy back shares. Sometimes the best defense is a strong offense, and AAPL generates the largest amount of profit and FCF than any other company in the market. Looking at AAPL’s track record, I am not sure why anyone would want to bet against them. AAPL’s return of capital is unmatched while continuously generating shareholder appreciation for its investors.

For long-term investors, I still believe there is never a bad time to invest in AAPL, even if you’re buying around the highs. AAPL is the most shareholder-friendly company as they have returned more than $600 billion to shareholders over the last decade. AAPL continues to innovate, create new revenue streams, and generate long-lasting growth. Buying shares of AAPL every month, quarter, or year has been a winning method, and I believe AAPL’s best days are still on the horizon. I am invested in AAPL for the long-term and plan on continuing to add to my position regardless of shares being priced at $150 or $200. Earnings season is around the corner, and AAPL is expected to report on 4/28/22. I believe we’re going to see a record Q2 with tens of billions in buybacks and plans for new revenue streams, including iPhone subscriptions, AR, and VR. At $174.31 per share and a market cap of $2.9 trillion, I believe AAPL is still a buy.

Seeking Alpha

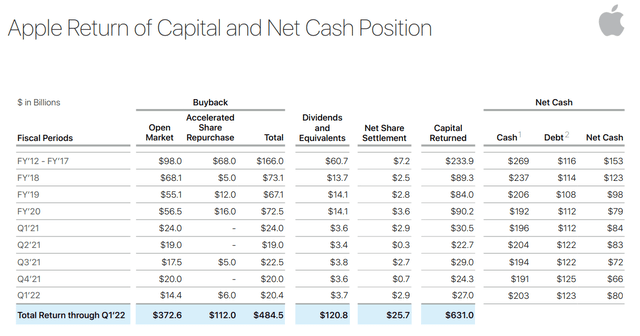

Apple has returned more capital than any other company to its shareholders and will continue to maintain this reputation.

Since the fiscal year 2012, AAPL has allocated $484.5 billion to buybacks, $372.6 billion worth on the open market, and $112 billion from its accelerated share repurchase program. Over the past 17 quarters, AAPL has allocated $318.6 billion toward buybacks at an average quarterly rate of $18.74 billion. In Q1 of 2022, AAPL returned nearly $27 billion to shareholders, including buying back $14.4 billion worth of shares on the open market and $6 billion through its share repurchase program.

AAPL does not report on a calendar year as their fiscal year runs 10/1 thru 9/30. The Jan – Mar quarter is AAPL’s Q2, and the results will be reported at the end of April. Q2 2022 spans 13 trading weeks, and if AAPL buys back shares at their average quarterly rate, they will spend $1.44 billion on buybacks per week. At an average price of $165 per share, AAPL would end up buying back 8.74 million shares per week during Q2, ultimately reducing their overall share count by 113.58 million shares.

Buying back shares isn’t just a vote of confidence or an alternative to dividends for returning capital to shareholders. Buying back shares has long-lasting financial impacts on AAPL’s quarterly results. With every share that is repurchased, the amount of revenue and earnings each share represents increases. As each share is taken off the table, AAPL can manufacture a larger EPS number without adding a single $1 of revenue or earnings. As of their last report, AAPL had $63.91 billion in total cash and short-term investments in their current assets and an additional $138.68 billion in long-term investments under their long-term assets. I think it’s hard not to be bullish on AAPL when they are buying back shares hand over fist while still maintaining enough cash to implement any long-term strategic plans in their pipeline.

Apple

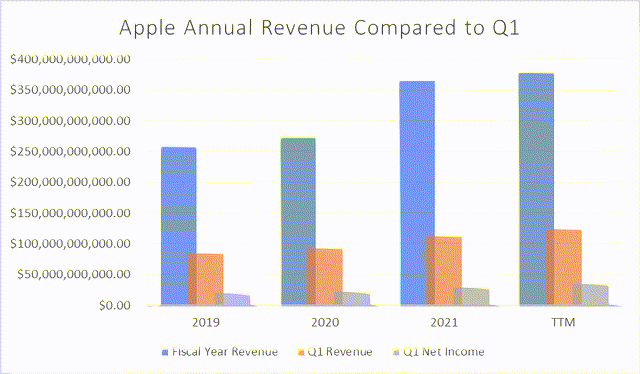

Apple is forging a path for a record 2022 in revenue, net income, and free cash flow

Arguments have been made that AAPL isn’t an innovative company and senior leadership has lost its way. The devil is in the details, and I look to the financial statements for validation when it comes to growth. AAPL is one of the largest revenue-generating companies in America and generates the most net income and FCF. In the fiscal year of 2021, AAPL generated $365.82 billion in revenue and $94.68 billion in net income. To put this in perspective, AAPL generated an average of $1 billion per day in revenue and $259.4 million of net income each day in their fiscal 2021 year. While Walmart (WMT) and Amazon (AMZN) generated more revenue than AAPL in 2021, their net incomes came in at $13.67 billion for WMT and $33.36 billion for AMZN. I think the individuals who believe AAPL’s best days are behind them are incorrect, and the numbers speak for themselves. When a company is making $259.4 million each day in profits, they have cracked the code and has an indefinite amount of the secret sauce.

AAPL set a new corporate record in 2021, generating $365.82 billion in revenue and $94.68 billion in net income. AAPL set the tone, smashing estimates in Q1 of 2021, generating $111.44 billion in revenue and $28.76 billion in net income. Q1 ended up representing 30.46% of their annual revenue and 30.37% of their net income. AAPL has done an excellent job at growing the top and bottom line. In 2020 AAPL’s Q1 revenue grew by $7.51 billion (8.91%) YoY, then in 2021 by another $19.62 billion (21.37%). In the fiscal year 2022, AAPL generated an additional $12.51 billion of revenue and grew YoY by 11.22%. The same holds true for its profits. In 2020 AAPL witnessed its Q1 net income grow by $2.27 billion (11.37%) YoY, then by an additional $6.52 billion (29.32%) YoY in Q1 of 2021. AAPL’s net income in Q1 of 2022 followed the same growth trend, growing by an additional $5.88 billion (20.43%) YoY.

AAPL set the tone with its offense in 2022, starting the year with another record Q1. In 2021 AAPL had generated 30.56% of revenue and 30.37% of its net income in Q1 for the entire year. If I inserted Q1 of 2022 into the 2021 annual numbers, AAPL would have generated 33.88% of their revenue and 36.57% of their net income in Q1. AAPL is ahead of the game once again and has started 2022 in a position of power. Regardless of supply chain issues or geopolitical tensions, AAPL has found a way to innovate and grow. We’re heading into earnings season, and AAPL is ahead of Q1 2021 by $12.51 billion in revenue and $5.88 billion in net income. Q1 sets the tone for the entire year and looking back over the past several years, growth in Q1 YoY leads to annual YoY growth in revenue and net income. On the Q1 2022 earnings call Luca Maestri indicated that AAPL would not provide revenue guidance in the form of numbers. Luca mentioned that AAPL expects to see YoY revenue growth in Q2, setting a new Q2 revenue record and coming in between a 42.5 – 43.5% gross margin. If AAPL can deliver on this projection, they could be 4% ahead of where they were on revenue and 7% from where they were on net income in the first half of 2022 compared to 2021.

Seeking Alpha, Steven Fiorillo

Apple’s new iPhone subscription idea could manifest itself into additional revenue and profits

Apple One was introduced to the AAPL ecosystem in 2020, which bundles Apple Music, Apple TV+, Apple Arcade, Apple New+, Apple Fitness, and iCloud. Subscriptions have been a massive success, helping diversify AAPL’s revenue mix while creating reoccurring revenue. Two-thirds of iPhone owners have an iCloud subscription in some capacity, while half have an Apple Music subscription and 1/3rd have an Apple TV+ subscription. Over the past four years, Services quarterly revenue has increased by $10.39 billion (113.78%) from $9.13 billion to $19.52 billion.

Apple, Steven Fiorillo

Creating an iPhone subscription plan and/or bundling it with some of its current services could become a revenue generator and profit center. Bundling an iPhone subscription with AAPL’s other services could help boost subscriber rates and usage while helping them scale other business lines. A subscription model could increase customer loyalty and could open up the door for new customers as the market for refurbished devices would expand at lower price points.

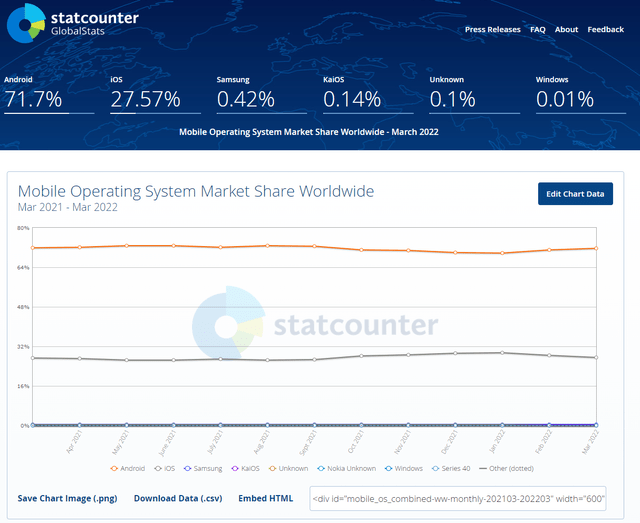

I am hoping that AAPL provides more information on this possible business venture on the Q2 call. I think an iPhone subscription plan could become a home run. AAPL could implement a first-year subscription rate that covers the depreciation rate on a new iPhone and the cost of insurance. As subscribers upgrade to the latest models, previous-generation models could be recycled for parts, refurbished, and sold to retailers, carriers, or consumers. AAPL selling one-year-old devices could allow AAPL to recover most of their cost on the devices, making most of the subscription plan pure profit. There is a possibility that a subscription plan could become as profitable as the current model of selling phones directly while creating a larger secondary market for refurbished devices at an affordable price point. This could attract new customers who were priced out of purchasing new equipment, penetrating a segment of the economy where customers are more price sensitive. Currently, Android has 71.7% of the global mobile operating system market, while iOS accounts for 27.57%. This strategy could help AAPL penetrate Android’s dominance. As a byproduct, this could also increase the level of revenue generated from services.

Stat Counter

Conclusion

As a long-term investor, I don’t believe there is ever a bad time to invest in shares of AAPL. There is a reason why AAPL is one of the largest holdings in many traditional index funds, and its track record for generating capital appreciation for shareholders is impeccable. Based on the previous 17 quarters, AAPL has allocated an average of $18.74 billion to buybacks, and at an average price of $165 per share, AAPL would be on track to buy back 113.58 million shares in Q2 2022, which is roughly 8.74 million shares per week. In 2021 AAPL generated over $250 million in pure profit daily. I believe AAPL’s best days are still ahead of them as they have several exciting opportunities, including an iPhone subscription model, AR/VR, the Metaverse, and autonomous vehicles. AAPL has set the tone with a record Q1 and has projected a record Q2 which is right around the corner. I believe AAPL is still a buy and will continue to outperform for years to come.

)