Best Buy Stock: Good Long Term Initiatives, But Near Term Margin Woes (NYSE:BBY)

Table of Contents

Scott Olson/Getty Visuals News

Financial investment Thesis

Greatest Buy’s (NYSE:BBY) inventory has declined ~10% considering that it described its Q4 earnings. While the company’s EPS was in line with the estimates and revenues a little bit skipped anticipations, the real bummer was its steering for a 12 months-in excess of-year decrease in margins. Whilst the company supplied encouraging FY25 targets, with predicted revenues to be all-around $53.3-$56.5 billion and working margins beating FY22 degrees, there is a honest quantity of uncertainty related with them. So, I consider buyers will aim on the around-expression margin headwinds for now.

I be expecting running margins to deteriorate in the in the vicinity of foreseeable future due to their investment in technological know-how, remodelling stores, wellbeing business enterprise, and the new membership program – Totaltech. I believe the stock price will trade sideways until eventually the gains from these investments start out to demonstrate optimistic final results on the functioning margin and revenue front. Provided these in the vicinity of-expression concerns, I have a neutral ranking on the inventory.

BBY Q4 Earnings

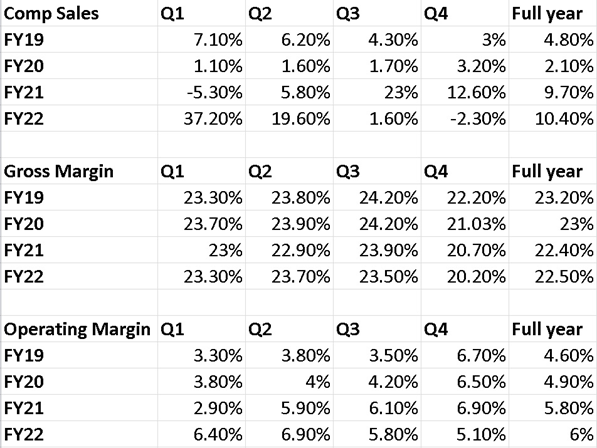

Earlier this thirty day period, Best Purchase described Q4 revenues of ~$16.37 billion as opposed to the consensus estimate of ~$16.59 billion, and lowering 3.37% year around year because of to constrained stock and the momentary reduction in-retail outlet several hours in January since of Omicron-linked staffing challenges. Exact-store income have been down ~2.3%, whilst modified diluted earnings for every share diminished 21.5% to $2.73, in line with the consensus forecast of $2.73. The gross earnings margin fell to 20.2%, down 50 foundation points Y/Y. Working cash flow dropped by 28% to ~$836 million in Q4 FY22, down from ~$1161 million the preceding year’s very same quarter. The fourth quarter’s internet income was down by 28.79% to ~$652.28 million from ~$916 million.

Ideal Buy’s comp product sales, gross margin and working margins in the final 4 years (Enterprise Data, GS Analytics Study)

Lengthy Phrase Initiatives and Around Term Margin Headwinds

The company documented an functioning margin of 6% for the comprehensive calendar year FY22, a growth of 20 basis details as opposed to FY21, generally attributable to a need-source mismatch and much less advertising actions which led to a greater profits realization and circulation-through rewards to the working margin. In FY23, administration expects a decrease in comp profits in the assortment of 1% to 4%, with functioning margins at 5.4% down by 60 foundation factors compared to FY22, and an envisioned FY23 diluted EPS of involving $8.85 and $9.15. This decrease in working margin is a final result of its greater investment pursuits in technologies, remodelling suppliers, overall health organization, and the new membership program – Totaltech.

The business launched this new membership application nationally in mid-October which includes a listing of products and services and benefits comprising extended warranties, free set up, VIP entry to devoted team chats, no cost delivery, amid lots of other folks. They have noticed the subscribers expending 20% far more than they would have if they did not subscribe to the membership. Management is optimistic about the plan which they imagine must persuade the customers to shop additional. But the firm will have to bear the in the vicinity of-term money load as before it utilized to demand separately for these added benefits while now it is bundled in the membership. This should influence the profits realization and gross margin. Having said that, in the medium to very long phrase, management expects to get sufficient memberships from this initiative so that incremental revenue much more than offset any impression on revenues and income, and the company is still ready to boost operating margins.

Another major initiative management is having is in the direction of concentrating on the overall health care industry. Technological innovation has develop into an integral portion of our each day program and the pandemic has only accelerated this system. With the development of technologies in health care, the company estimates that the in-dwelling health-related providers might develop to a $265 billion sector by 2025 with 61% of sufferers preferring to choose medical center treatment providers at house. This provides an possibility for enlargement of its well being organization by delivering health and fitness and safety remedies, as nicely as including health and wellness items to its catalogue.

Physical fitness and wellness, on your own, is a $34 billion marketplace. About the final 12 months, the company elevated its assortment by 650% in this category. It strategies to offer a extra quality buying expertise for these categories in 90 retailers in the up coming 18 months. Management believes that the expanded choices ought to make it possible for shoppers to store from a vast selection of assortments, as a result driving incremental product sales. Even so, these investments need to set strain on the operating margin in the upcoming many years by way of elevated SG&A charges.

Previous year, the corporation introduced its Lively manufacturer, which features particular crisis reaction products that offer 1-touch obtain to the firm’s caring centre in the function of an crisis, these kinds of as fall detection. They additional 348,000 new subscribers that are utilizing these equipment with profits progress of 15% YoY. The Energetic manufacturer recently founded a partnership with Apple (AAPL) to make its wellness and security services obtainable on Apple Observe. In addition, it collaborated with Alexa, which is set to debut this spring.

In November, the company also obtained Latest Health and fitness, a support that connects patients with their doctors and will allow them to obtain treatment at house. Existing Overall health has been forming strategic partnerships with Baptist Overall health, Mount Sinai, AbbVie (ABBV), the Defense Overall health Company, and other folks in buy to deliver patients with a seamless digital treatment practical experience.

In addition, the company is also foraying into personalized electric transportation (electric bikes) and outdoor living goods which collectively constitute a TAM of ~$33 billion.

In personalized electrical transportation, they have currently launched 250 new items together with an added 500 accessories close to these items. They program to include bodily assortments to their 900 stores and a additional top quality expertise in 90 stores around the up coming 18 months.

For outside residing, they obtained Yardbird, a foremost top quality out of doors home furnishings business, to strengthen its nationwide place in this classification. This spring, Yardbirds products and solutions will be available in the Southern California industry. This acquisition alongside with its partnership with Traeger, Weber, and Bromic should propel its advancement in this rapidly-expanding industry in the coming long run.

The firm intends to remodel its suppliers in buy to accommodate extra house for the new categories alongside with incorporating extra space for repair solutions, additional Geek squad presence for purchaser interaction, committed house for quality items such as appliances, home theatre, and audio, and more allotted area for Microsoft (MSFT) and Apple stores. They intend to remodel 50 destinations in fiscal calendar year ’23 and approximately 300 destinations by fiscal year ’25. The organization is also investing in technology to assist its omnichannel initiative as a lot more and more individuals shift on the web for buying.

Very best Buy has been investing in a wide variety of locations to assure its extensive-phrase achievements. But these gains will be recognized only just after a several many years even though the company’s operating margins will drop in the around expression as a outcome of upfront expenses from these initiatives. There are also some in close proximity to-expression headwinds thanks to increased inflation, the possibility of climbing desire fees, and the unwinding of stimulus fuelled demand from customers that need to further more pressure the all round operating income. Although I will be carefully watching when these long-phrase initiatives begin to aid the company’s fiscal overall performance, for now, I am on the sidelines offered the around-expression expected deterioration in running margins.

Valuation and Conclusion

According to consensus expectation, the firm profits is envisioned to drop 2.82% in the recent yr and its EPS is predicted to decrease from $10.01 in FY22 to $9.00 in FY23. The stock is investing at ~11x FY23 EPS which is affordable. However, there is a good bit of uncertainty involved with the firm’s prolonged-expression initiative and I never think the inventory will see a meaningful upside until its enterprise basically starts viewing the optimistic impression of these initiatives. So, I have a neutral rating on this stock.