Is Apple Stock A Good Pick If The Economy Enters A Recession? (NASDAQ:AAPL)

Table of Contents

Shahid Jamil

Introduction

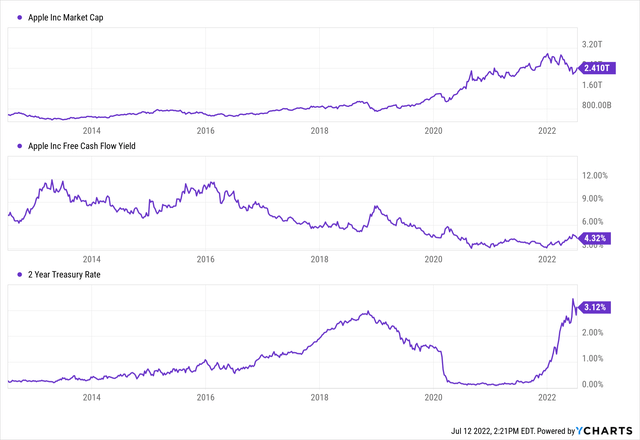

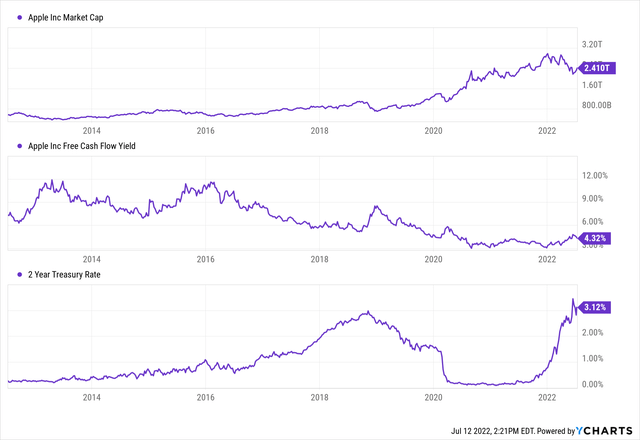

Since the turn of the year, Apple Inc (NASDAQ:AAPL) stock has lost roughly $600B in market capitalization. Considering the heightened volatility that we have seen in equity markets in 2022 (especially in tech stocks), I think it is fair to say that Apple is a relative outperformer. In my last note on Apple (Apple Vs. Microsoft Vs. Treasury Bonds: The Battle of Safe Havens), I assigned AAPL a neutral rating (at $167 per share) as I could see the market demanding a higher free cash flow yield from the stock amidst rampant inflation, surging interest rates, and an increasingly hawkish FED.

At one point in June, Apple was down by ~30% from its highs. With the growing clamor about an impending recession, treasury yields are stabilizing (after coming down quite a bit from their highs), and inflation expectations are dropping rapidly, with commodity prices collapsing in a jiffy – just look at Copper, Wheat, and Oil.

While the FED may be forced to make a U-turn on its quantitative tightening program in the event of a recession, I don’t think that policy flip is coming anytime soon (unless the inflation numbers cooldown). With that being said, I have always maintained that the FED will fail to raise interest rates above 3.5-4% without causing excruciating economic damage. If inflation subsides in the coming months and the FED hits the pause button, we could get a goldilocks scenario where risk assets get re-rated higher. While I wish for such an outcome, history shows that the FED is unlikely to stop until something breaks, and if you heard Jerome Powell’s latest Fed meeting comments, you know that the FED is ready to induce a recession to stop inflation.

What Is The Prediction For Apple Stock?

Out of 28 Wall Street analysts covering Apple, 22 rate it a Buy, 6 rate it a Hold, and none rate it a Sell. While 12-month price targets are spread across a wide range from $130 on the lower end to $210 on the upper end, the average price target of $184.68 indicates an upside of ~25%. The consensus among Wall Street analysts is still clearly bullish.

Considering the complicated macroeconomic environment we just discussed, it is fair to question the consensus outlook for Apple’s stock, which remains broadly bullish. Is Apple immune to an economic recession? What happens if/when earnings estimates need to be adjusted lower during a recession?

Is Apple A Recession-Resistant Stock?

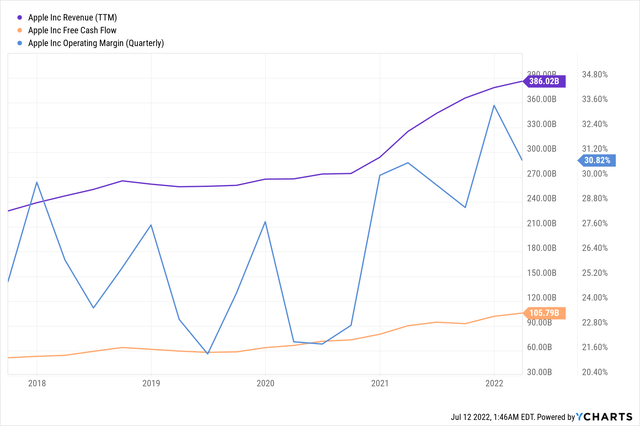

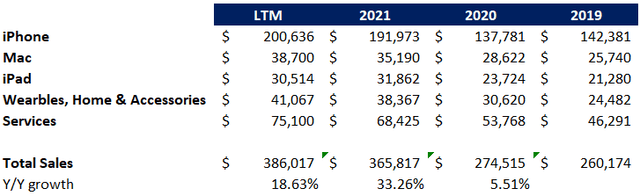

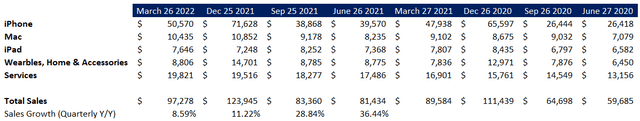

In 2020-21, Apple’s revenue growth shot up as the “5G supercycle” coincided with a liquidity pump (loose fiscal and monetary policies). During the past couple of years, Apple has recorded massive sales growth along with enhanced profitability. From a consumer perspective, higher disposable income and free money (stimulus checks) led to a rise in consumer demand (market share growth) for Apple’s premium devices. Also, the need for home offices boosted the demand for Apple’s products. Personally, I don’t think this excess demand will stick in the post-pandemic era, especially in the event of a recession.

The recent strength in Apple’s financial results is spread across all of its business segments. As you may know, Wearables and Services have served as the major drivers of growth at Apple for the last few years, and these businesses are still growing at a healthy clip. However, the growth in iPhone, Mac, and iPad is already slowing down drastically, and I wouldn’t be surprised to see a 15-20% dip in Apple’s sales if we go through a deep recession.

While a major chunk of the margin improvement at Apple is coming from the rise of its high-margin (70% gross margin) Services business [sustainable], the gains across other revenue segments like the iPhone, Mac, iPad, and Wearables are likely unsustainable. Hence, we could see heightened volatility in PnL at Apple in the event of a recession.

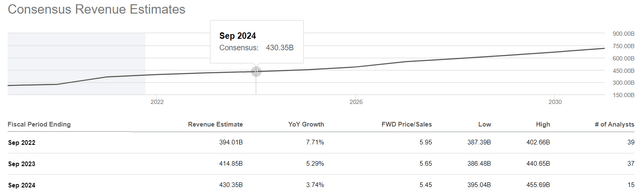

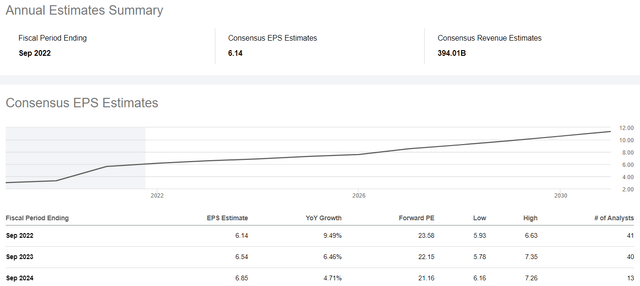

With all of this being said, Apple’s management is not seeing a demand shortfall in the near future (as per commentary from the Q1 earnings call, which called for an $8B impact on revenues from ongoing issues, including the war in eastern Europe and COVID lockdowns in China). A recent report from Reuters highlighted that Apple’s iPhone sales stayed strong in July despite a slowdown in the smartphone market. Moreover, consensus analyst estimates for revenue and earnings suggest steady growth for Apple over the coming years.

With that being said, I don’t think these projections are factoring in a potential recession. In the event of a recession, I see these analyst expectations getting adjusted lower by 15-20%. If my understanding of Apple’s revenue jump in 2021 proves to be correct, the FED pulling back on liquidity and the lack of government stimulus checks will hurt Apple’s revenue this year. I think the next three quarterly reports will be very informative. With the weakness in China’s smartphone market and a strong dollar, I am expecting a subdued Q2 report from Apple, which is set to be released on 28th July 2022.

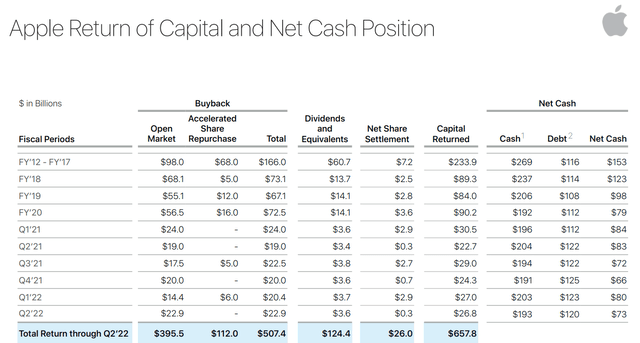

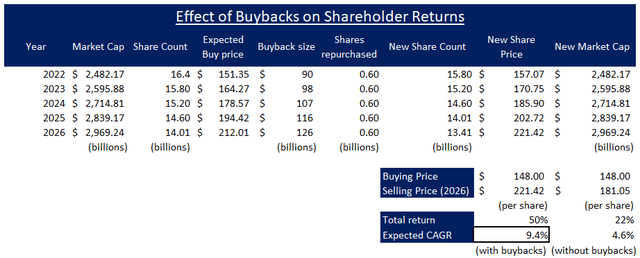

Despite returning ~$657.8B to its shareholders via stock buybacks ($507.4B) and dividends ($124.4B) over the last ten years or so, Apple’s balance sheet has ~$73B in net cash. With Apple producing ~$100B per year in free cash flow, the company may not achieve its net cash neutral goal for many more years to come. Considering Apple’s financials, its management is likely to continue its aggressive stock buyback program to boost shareholder returns (as they have done in the years gone by).

In a nutshell, Apple has a pristine balance sheet, and while a stagflationary (recessionary) environment could lead to near-term business volatility (revenue and profitability), the tech giant should be able to get through any downturn virtually unscathed. However, I can’t say the same thing about Apple’s stock.

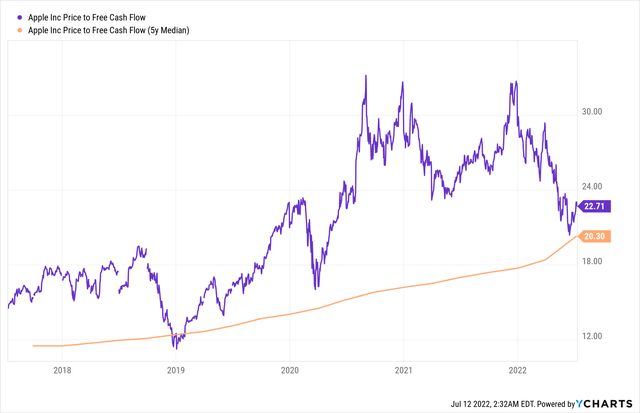

Today, Apple’s stock is sitting roughly 20% off its all-time highs, and historically such dips have been fantastic buying opportunities; however, Apple’s P/FCF trading multiple of 23x is still well above the 5-yr Median P/FCF. Hence, Apple’s mean reversion is not over yet.

If we were to experience an earnings recession, I would expect to see lower treasury rates, which is a boost for (bond-like) Apple stock. However, Apple’s free cash flows will come under pressure, and I believe that the net effect here would be lower stock prices.

With Apple’s stock still trading above its mean trading multiples, I don’t think the stock is pricing in a recession at this stage (like many other tech companies are, for e.g., Meta Platforms (META) or AMD (AMD), etc.). If we were to undergo a deep economic recession like what we saw in 2008-09, Apple’s multiples could go down to much lower levels (10-12x P/FCF). Hence, I do not see Apple as a recession-proof stock.

Apple’s Fair Value and Expected Return

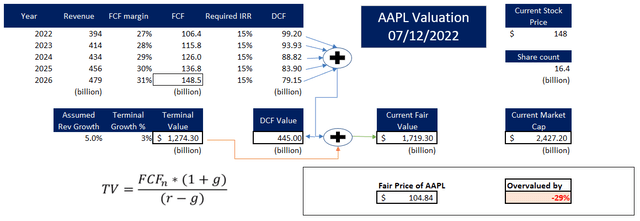

To find the fair value and expected return of Apple, we will use TQI’s Valuation model, which is a simplified discounted cash flow model, with the following assumptions:

| 2022E revenue | $394B |

| Forward 4.5-Yr Revenue Growth Rate (%) | 5% |

| Terminal Growth Rate (%) | 3% |

| Optimized FCF Margin (%) | 27-31% |

| Discount Rate / Required IRR (%) | 15% |

| Exit Multiple [P/FCF] | 15-25x |

Results:

Under TQI’s required IRR [discount rate] of 15%, Apple’s fair value came out to be ~$1.72T ($104.84 per share). With the stock trading at ~$146, it is currently trading at a significant premium to its fair value.

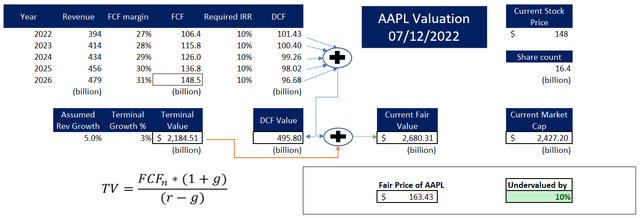

Now, Apple is a tremendous business that enjoys monopolistic powers as the gatekeeper to 1.8B devices (1B+ iPhones). While building this model, I pondered if a lower discount rate would be more appropriate for evaluating Apple. For a safe DGI investment, I would be happy to use a lower discount rate as Apple certainly fits the bill. However, I wasn’t sure about this idea, and so I decided to leverage the power of TQI Network’s shared intelligence. We conducted the following poll at our community on 12th July 2022:

Poll results from TQI Network (Author’s community)

Since the early results from this poll were leaning towards a 10% discount rate for Apple, I ran a valuation based on this rate too. If you are a DGI investor or if you agree with the poll consensus that Apple deserves a lower discount rate due to the quality of its business, then Apple’s fair value is $163, i.e., it is undervalued by 10%. I know two different valuations for a single company sounds ridiculous, but this is exactly how the market prices assets (as a hive mind of multiple participants). An asset’s value lies in the eye of the beholder. For Investor-A, Apple could be worth $104.84 per share, and at the same time, Apple could be worth $163.43 per share for Investor-B (assuming Investor-B has a lower required IRR than Investor-A).

While the fair value estimation for Apple is tricky, I am leaning towards utilizing a 10% discount rate (as I think of Apple as a DGI investment anyways). Alright, now that we have discussed Apple’s fair value, let’s try to determine its expected CAGR returns.

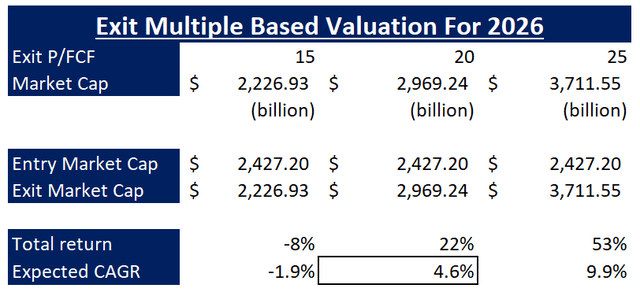

To do so, we will utilize an approach based on exit multiples (widely used in the PE/VC world). In the base case, I am assuming that Apple’s P/FCF will contract by 10% from the current multiple to reach 20x P/FCF at the end of 2026. Considering long-term average treasury rates of 5%, a P/FCF multiple of 20x (inverse of 5%) is very reasonable (immutable laws of money). The bear and bull case assumptions are self-explanatory, but if you have any questions, feel free to send them in the comments section of this note.

According to my base case, Apple’s market cap will reach $2.97T by the end of 2026, which would reflect a return of 4.6% per year. However, these numbers do not include the effect of Apple’s humongous capital return program.

Through its buyback program, Apple could boost its shareholder returns from 4.6% to 9.4% per year. Apple’s current dividend yield is below 1%, which is not very significant. However, as a DGI investment, Apple would be a fine bet to make. Before we make an investment decision, let’s run it through TQI’s Quantamental Analysis before making an investment decision.

Is AAPL Stock A Buy, Sell, or Hold?

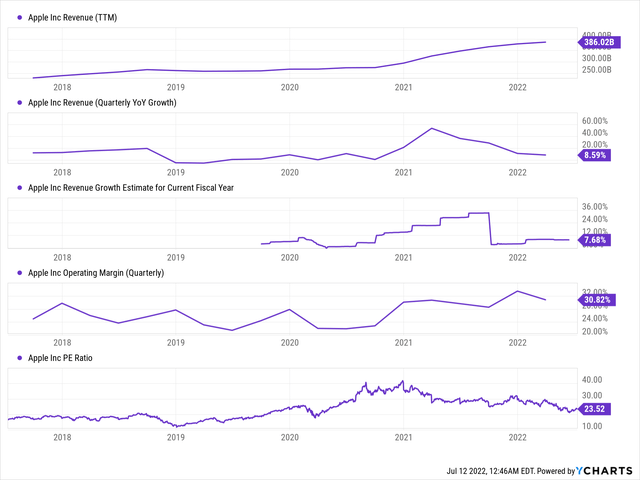

After experiencing rapid growth in late 2020 and early 2021, Apple’s sales growth has been slowing down over the last few quarters, and this trend is expected to continue over the coming quarters.

While I agree that the in-housing of chips is boosting Apple’s product margins, the majority of improvement in Apple’s margin profile stems from the growth in its higher-margin Services business. According to the latest data from the company, Apple has 785M subscriptions (including third-party apps on its platforms). With an estimated device base of 1.8B, Apple’s Services business can continue to grow at a healthy clip for years to come. FYI, Apple’s device base is expanding too.

Overall, Apple’s business fundamentals are stronger than ever, but future growth is unlikely to be spectacular. In the event of a recession, I would expect Apple’s revenues to fall by 15-20% as consumer demand falls off. With historically low unemployment and rising wages (likely to be sticky), I don’t think betting on an imminent slowdown is sensible.

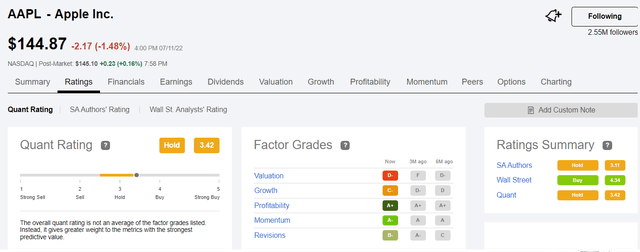

Now, let’s take a look at quantitative factor grades for Apple. In the TQI Quantamental Analysis methodology, we simplify our quantitative data analysis by utilizing Seeking Alpha’s Quant Rating system.

According to this system, Apple’s Quant Rating currently stands at 3.42, which makes it a Hold. While Apple’s profitability grade of “A+” is indicative of its high-quality business, the decline in Momentum (from A to A-) and Revision (from A- to B-) factor grades in the past three months are indicative of impending business weakness. After recent valuation moderation, Apple’s Valuation grade has improved from “F” to “D-“; however, “D-” is still a poor grade. Lastly, Apple’s Growth rating of “C-” aligns with our outlook for slower growth rates for the foreseeable future. Overall, Apple’s quantitative factor grades are neutral.

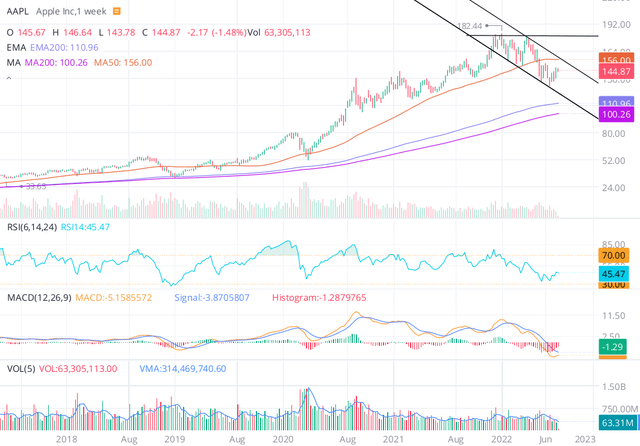

The last part of TQI’s QA methodology is a technical check. As you can see below, Apple’s chart is in a technical correction with a double top at ~$180. With the stock trading below 50-DMA, I think Apple’s stock has run out of its bullish momentum (at least for now). Under TQI’s 15% discount rate, Apple is worth ~$105 per share, and if the falling wedge pattern in Apple holds up, we could very well slide down to these levels in the coming months. With an RSI of 45, Apple is not oversold.

Coincidentally, the 200DMA and 200EMA are in the range of $100-110. If Apple were to break down to these levels, I think that would be a great entry point for long-term investors. However, for now, I think Apple is in no man’s land (technically).

Concluding Thoughts

Due to its incredible business moats, robust financial performance, rock-solid balance sheet, and humongous capital return program, Apple is widely regarded as a safe-haven investment by retail and institutional investors alike. While I think Apple is an incredible business, its heavy reliance on consumer products like the iPhone makes it vulnerable to economic cycles. Furthermore, Apple’s stock is still trading well above its long-term average trading multiples, which leaves room for further valuation multiple contraction. As we saw today, Apple is not a recession-proof business or stock.

With an expected CAGR return of 4.6% (9.4% with buybacks), AAPL falls short of my investment hurdle rate of 15%. Hence, I can’t wrap my head around the idea of buying Apple for a sense of safety in my GARP/Value portfolio. For a DGI investor with a lower required IRR, Apple could be a worthwhile investment at current levels.

Key Takeaway: I rate Apple neutral at $146; however, I think it is a modest buy for DGI investors at current levels.

Over the last decade, Apple delivered spectacular returns to shareholders, but I don’t think it can meaningfully outperform the market for the foreseeable future. With that said, I believe that Meta Platforms Inc has the potential to replicate Apple’s 10-yr performance over the next decade. If you are interested in learning more about my bullish thesis on Meta, head over to –

Please share your thoughts, questions, and/or concerns in the comments section below.

Housekeeping Note: I’ll soon be launching a Marketplace service on Seeking Alpha focused on generating long-term outperformance through financial engineering. While “The Quantamental Investor” won’t be live until early September, we are already building an exclusive (and free) community for retail investors at TQI Network. You can find more details in my profile bio. Stay tuned for more updates!

)