Profit From The Rush To Alternative Assets With Blackstone And Brookfield (NYSE:BAM)

Table of Contents

imaginima/iStock via Getty Images

Blackstone Inc. (NYSE:BX) and Brookfield Asset Management Inc. (NYSE:BAM) are among the very best in the global alternative asset management business, with over $1.5 trillion in assets under management between the two of them.

We believe that alternative assets will see a prolonged boom over the remainder of this decade and possibly even beyond due to numerous macro factors which we will discuss in this article.

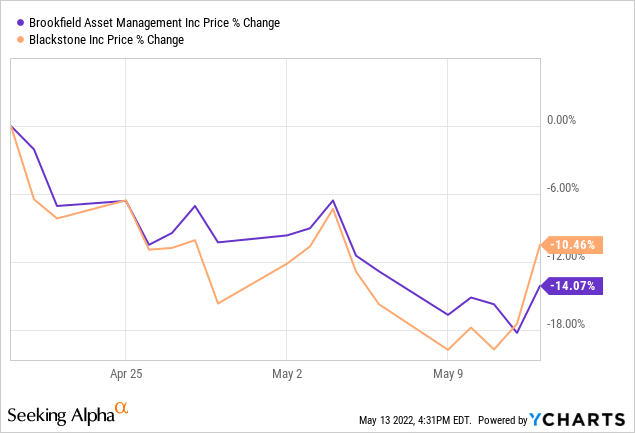

Given that BX’s and BAM’s share prices have recently seen sharp pullbacks alongside broader market turbulence despite posting strong results, we believe now is an opportune time to add shares.

Why We Are Bullish On Alternative Asset Managers

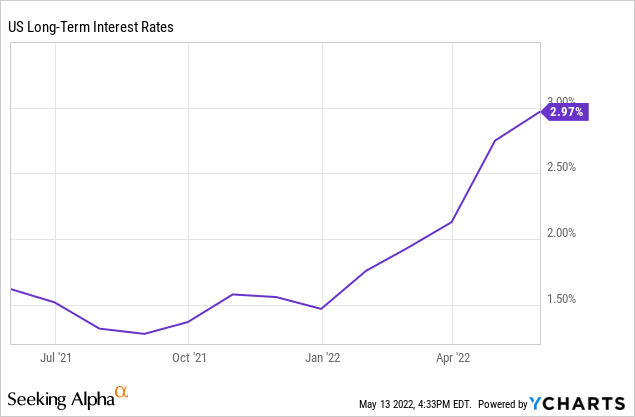

The main bear case on alternative assets right now is that interest rates are rising. Interest rates have risen considerably in recent months and look poised to head still higher before heading lower:

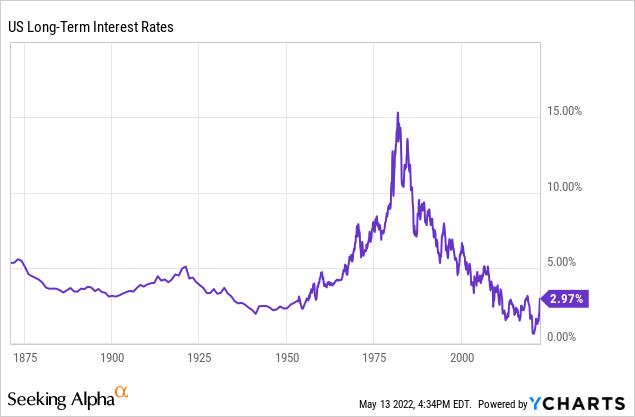

However, when zooming out for some historical perspective, we can easily see that interest rates remain on the low end of the historical spectrum:

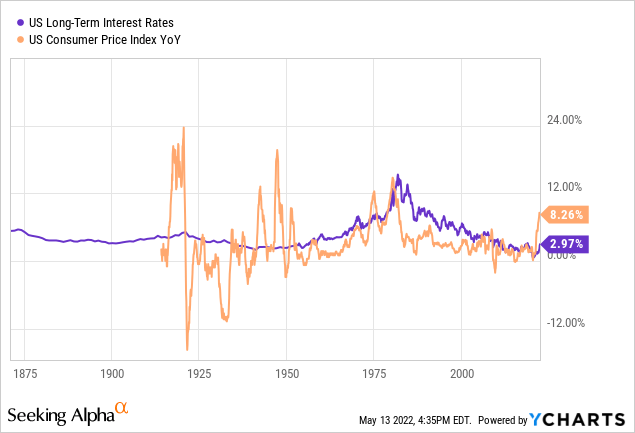

Interest rates look even lower when compared to the inflation rate:

This final point is key, because alternative assets typically benefit from high inflation but are hurt by high interest rates. As a result, when real interest rates (i.e., the difference between the inflation rate and the nominal interest rate) are negative, it bodes well for alternative assets and when real interest rates are meaningfully positive, it can bode poorly for alternative assets.

High interest rates hurt alternative assets for the following reasons:

- It makes leverage more expensive and typically more difficult to get. Given that alternative asset investments typically have a lot of leverage applied to them, this can reduce cash flow yield as well as total return potential for these investments.

- It increases the risk-free premium on alternative assets. If an investor can achieve a 5% yield on U.S. government bonds, they are much less likely to buy a toll road or warehouse at a 5% cap rate, given that the government bonds are generally viewed as carrying far less risk.

Alternatively, high inflation rates help alternative assets because:

- It drives up the replacement cost of alternative assets, giving them a greater barrier to entry and therefore more pricing power. This in turn pushes the value and cash flow capability of such assets higher.

- High inflation is generally a symptom of strong economic activity, which means that demand for alternative assets is generally stronger.

The forward outlook for alternative assets remains very positive. This is because the real interest rate is deeply in the red at the moment and unlikely to move into the black anytime soon due to the likelihood of persistently high inflation for the foreseeable future. Combined with the incredibly high U.S. government debt and deficit, this makes raising interest rates too high untenable.

Third, there is a large and growing wealth gap across the major economies of the globe. In order to combat the growing resentment and political and social unrest among the general populations of these countries, governments will likely increasingly lean into infrastructure projects to help improve the livelihoods of the lower income segments of society. This has already taken place in the two largest economies of the world. China has undertaken massive infrastructure and construction initiatives to prop up its economic growth, while the U.S. recently passed a bipartisan infrastructure bill and that effort is likely to continue in the future.

Fourth, with the U.S. and China increasingly butting heads on the global stage and competing in developing countries for geopolitical influence, access to valuable natural resources, and strategic military base installations, these countries are increasingly investing in developing the infrastructure of these other nations. While much of the money for these developments is coming from governments, many times the fulfillment of these contracts and even the ownership and/or operation of these assets is privatized due to efficiency, capability, and risk mitigation considerations.

All four of these macro trends points to one strong conclusion: real assets are likely to see a boom in the coming years, with competitively-positioned global alternative asset managers like BAM and BX poised to benefit immensely.

As BAM put it on slide 7 of their September 2021 Investor Presentation, in 2000 institutional investors only allocated 5% of their assets to alternatives. In 2021, that number had risen to 30%. By 2030, that number is expected to have doubled to 60%. With trillions of dollars pouring into the space, BAM and BX should have another stellar decade ahead of them.

BX Stock Valuation

In addition to the bullish macro trends for the company, BX stock looks attractively valued at the moment.

The forward price to earnings ratio is 17.37x, which is well below its five-year average of 26.51x. The price to free cash flow ratio also looks steeply discounted compared to its five-year average, with the current ratio standing at 8.41x compared to its five-year average of 13.09x. Finally, its forward dividend yield is 4.84%, which looks very attractive compared to its five-year average of 3.27%.

Most impressively, analysts forecast rapid growth in earnings per share, free cash flow, and dividend per share over the next half decade, with 12.8%, 27.2%, and 11.5% CAGRs forecast for each, respectively.

This strong growth will likely be fueled by continued robust fundraising for its various investment funds coupled with performance incentive fees on these funds as BX’s superior investing insights, asset management talent, and deal flow combine with the bullish macro picture for alternative assets to drive continued robust returns for its clients and shareholders.

While real estate and private equity have been BX’s two big bread-and-butter investment sectors, BX is also accelerating its growth in retail and insurance investments, more than doubling the size of its presence in these spaces over the past year.

As long as inflation continues to outstrip interest rates – which we think is highly likely over the long-term given that it is the only way that most heavily indebted governments (including the United States) can remain solvent – BX’s vast real estate and private equity empires should continue to generate strong returns, which should drive the stock higher as well over time.

BAM Stock Valuation

BAM stock also looks attractively valued, though its valuation metrics are a bit different from BX’s. On a price to Adjusted Funds From Operations (i.e., AFFO) basis, BAM looks deeply undervalued as it trades at just 11.03x compared to its five-year average of 15.98x. On a price to FFO basis, BAM is also undervalued, with a 15.62x current multiple compared to its five-year average of 17.41x, despite analysts expecting FFO per share to see an impressive 18% CAGR over the next half decade.

This growth will be driven by BAM’s numerous growth initiatives, ranging from its robust green energy/ESG funds (BEP)(BEPC), its world-leading infrastructure business (BIP)(BIPC), its growing private equity business (BBU)(BBUC), its credit business led by Oaktree (OAK), as well as its new ventures into insurance (BAMR), technology, and attracting investments from smaller investors in addition to its robust institutional investor network.

Another way of looking at BAM’s valuation is to look at the sum of its parts. Its annualized asset management fees as of Q1 2022 stood at $1.9 billion, while its net carried interest stood at $2.2 billion. Applying a 20x multiple to asset management fees and a 5x multiple to its net carried interest implies a valuation of $49 billion for the asset management business. Meanwhile, the invested capital balance sheet had a net value of $56.9 billion. In total, that puts the total net value of the business at $105.9 billion, compared to its current market cap of $78.3 billion. This implies a valuation upside of ~35% for the stock.

Investor Takeaway

The macro outlook for alternative assets is extremely bullish right now, and both BX and BAM are positioned exceptionally well to benefit from it. Their terrific track records of generating market-crushing returns for clients and impressive global scale and deal flow combine to give them access to an incredible flow of additional assets to manage. On top of that, their shares look undervalued at the moment and appear poised to generate strong outperformance in the future for investors at current prices.

With that said, we believe that a better opportunity exists in the alternative asset management space in Patria Investments (PAX), so we are not personally long either of these names at the moment.

)