Target (TGT) to Tackle Excess Inventory, Slashes Margin View

Concentrate on Corporation TGT declared aggressive actions to enhance its stock for the relaxation of fiscal 2022 in reaction to the challenging working environment, many thanks to soaring inflation and shifting consumer behavior. The actions incorporate extra markdowns, taking away surplus stock and canceling orders. Some other notable initiatives are the addition of incremental holding ability near ports to permit offer-chain flexibility, pricing actions in a bid to mitigate large transportation and fuel costs, and operating with suppliers to shorten journey time in the supply-chain procedure.

We note that stock rose 43% year over calendar year in the last reported quarter. Target ended up carrying superior stock in many types, wherein the slowdown in gross sales was extra pronounced than envisioned. Also, the initial-quarter fiscal 2022 operating margin contracted 450 foundation points to 5.3%.

The enterprise is also undertaking price tag-regulate actions, this kind of as doing work with distributors to offset inflationary pressures and driving ongoing operating efficiencies. It is on track to incorporate 5 distribution facilities in the subsequent two fiscal a long time to enrich its provide-chain predicament.

TGT continues to be targeted on keeping power in frequency groups like Meals & Beverage, Household Necessities, and Magnificence. The corporation strategies to provide much less products in its household categories as shoppers have minimized discretionary spending because of to the ongoing inflation.

Actions to distinct extra stock, be it deep special discounts or cancellation of orders, are possible to weigh on margins. As a end result, management envisions a 2nd-quarter working margin amount of 2%, down from the aforementioned 5.3%.

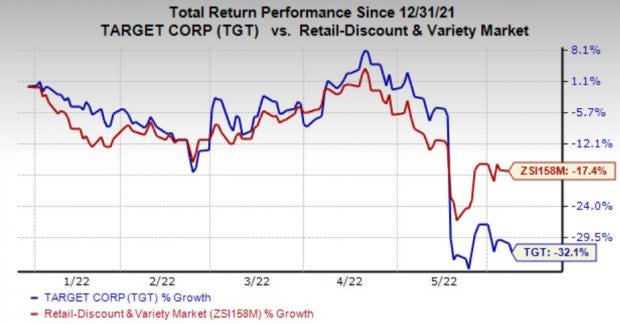

We notice that shares of this corporation have plunged 32.1% yr to day in comparison with the industry’s decrease of 17.4%.

Picture Supply: Zacks Expenditure Analysis

Even so, this Zacks Rank #3 (Maintain) stock expects to get back on monitor in the second 50 % of fiscal 2022 and outside of. Notably, TGT predicts an working margin charge of 6% for the next half of fiscal 2022. Also, the organization continues to foresee minimal to mid-single-digit income advancement for fiscal 2022.

Concentrate on has been undertaking several strategic endeavors — be it new merchants, owned model improvements, national brand name partnerships, or growth of same-day companies and rollout of sortation centers — to drive engagement, site visitors and sector share gains.

These have been contributing to the company’s gross sales overall performance, as obvious from initially-quarter fiscal 2022 results, wherein the prime line beat the Zacks Consensus Estimate and grew 12 months in excess of year. Similar revenue amplified for the 20th successive quarter, getting from advancement in both of those retailer and electronic channels. Focus on registered a sturdy general performance in Food & Beverage, Essentials and Magnificence types.

Stocks to Think about

Here are three better-rated shares to look at — Boot Barn Holdings BOOT, Dillard’s DDS and Kroger KR.

Dillard’s operates as a departmental shop chain, showcasing style attire and residence furnishings. It presently sporting activities a Zacks Rank #1 (Strong Obtain). DDS has a trailing 4-quarter earnings shock of 224.1%, on ordinary. You can see the comprehensive record of today’s Zacks #1 Rank shares right here.

The Zacks Consensus Estimate for Dillard’s latest financial-year product sales implies progress of 6.1%, whilst the very same for EPS signifies a decrease of 33.9% from the calendar year-ago period’s noted quantities. DDS has an expected EPS advancement level of 12.6% for 3-five years.

Boot Barn, which gives western and perform-linked footwear, apparel and components, at the moment has a Zacks Rank #2. The enterprise has a trailing 4-quarter earnings surprise of 25.2%, on regular.

The Zacks Consensus Estimate for Boot Barn’s existing fiscal-year sales and EPS implies growth of 17% and 4.4%, respectively, from the 12 months-back period’s described figures. BOOT has an envisioned EPS growth amount of 20% for a few-five decades.

Kroger, which supplies an array of goods ranging from domestic essentials, groceries and electronics to toys and apparel for males, women and young children, now carries a Zacks Rank #2. KR has a trailing 4-quarter earnings surprise of 22.1%, on common.

The Zacks Consensus Estimate for Kroger’s present fiscal-12 months gross sales and EPS suggests development of 3.2% and 4.1%, respectively, from the calendar year-ago period’s documented figures. KR has an expected EPS progress rate of 9.9% for 3-5 yrs.

Want the most recent suggestions from Zacks Expense Exploration? These days, you can download 7 Best Stocks for the Up coming 30 Days. Click to get this totally free report

Focus on Company (TGT) : Absolutely free Inventory Assessment Report

Dillard’s, Inc. (DDS) : Cost-free Stock Examination Report

The Kroger Co. (KR) : Absolutely free Inventory Examination Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Evaluation Report

To read through this write-up on Zacks.com click here.

Zacks Expense Analysis

)