Warren Buffett Is Loading Up On Apple Stock. Should You?

Table of Contents

During a recent interview, legendary investor Warren Buffett said that he bought another $600 million in Apple stock (AAPL) – Get Apple Inc. Report “following a three-day decline” in Q1. The purchase should have increased Berkshire Hathaway’s already sizable AAPL holding that accounted for nearly 48% of the conglomerate’s portfolio as of December 2021.

The Oracle of Omaha seems very optimistic about Apple. But is he right in his convictions? The Apple Maven digs in to find out if individual investors should be equally bullish.

(Read more from the Apple Maven: 3 Key Takeaways: What Q2 Earnings Could Mean For Apple Stock)

Buffett and AAPL: what happened in Q1

Buffett’s $600 million purchase of Apple stock in Q1 sounds like an endless pile of money to us, mere mortals. But the amount represents only about 0.4% of Berkshire’s Apple position as of the end of March 2022.

The transaction probably happened either in late January or the first half of March. These two dates match the description of Mr. Buffett’s buy-the-dip move: (1) following a three-day decline, but (2) just before AAPL price climbed again, preventing him from buying more.

In either case, the purchase must have been at a share price of between $155 and $160. The $600 million investment means that Berkshire would have bought about 3.8 million AAPL shares, or about 5% of the average volume of Apple stock traded each day.

Pricey? Buffett seems to disagree

Apple has been doing well in the past many quarters. The Apple Maven has recently reported on the company’s fiscal Q2 earnings, and the results continue to look robust. The problem that many bears see in Apple stock are valuations.

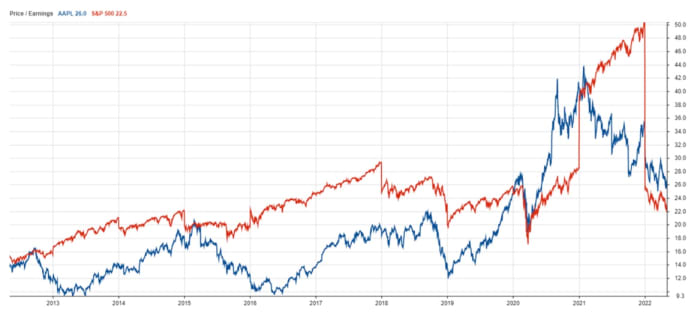

The chart below shows that AAPL’s P/E multiple, in blue, has consistently lagged the S&P 500’s ratio through most of the past decade. The noticeable exception was in 2020, when Apple was considered a defensive play in the face of the COVID-19 crisis and stay-at-home trends.

Figure 2: AAPL’s P/E multiple, in blue, has consistently lagged the S&P 500’s ratio through most of the past decade.

Today, Apple is again pricier than the broad market. While the S&P 500’s P/E stands at 22.5 times, AAPL’s earnings multiple is higher by about 3.5 turns at 26 times.

Of all people that care about valuations and about finding “a good deal”, Warren Buffett should be a top-of-mind name. Afterall, a disciple of Benjamin Graham, he is considered by many the ultimate value investor of the past 50-plus years.

But clearly, as suggested by Mr. Buffett’s own actions in Q1, Apple’s valuation does not need to fall off a cliff for the Oracle of Omaha to find the stock a compelling buy. His recent purchase happened while AAPL had corrected less than 15% off the early January peak, and while P/E remained firmly above 24 times.

Should investors load up?

When Apple is considered by many an expensive stock, but Warren Buffett buys minor dips following a three-day pullback, well… I think this is a good sign. At least investors who own AAPL should feel somewhat validated in their bullishness towards this stock.

I am slightly more cautious, at least in the short term. The market landscape seems unstable in the face of high inflation and rising interest rates in the US. Only a few days ago, the S&P 500 lost 3.5% in a single day, which is not a good read on investor sentiment.

Over the longer term, buying AAPL in correction territory has proven to be a good move, as I have discussed on this channel several times. So, provided that investors don’t check their brokerage accounts every two hours, buying Apple stock here could make sense over time.

Ask Twitter

Warren Buffett said that he has bought $600 million worth of AAPL shares on the dip in Q1. How does his purchase make you feel about owning Apple stock in your own portfolio?

Explore more data and graphs

The graph used in this report was provided by Stock Rover. I have been impressed with the breadth and depth of information on markets, stocks and ETFs that this platform provides. Stock Rover also helps to set up detailed filters, track custom portfolios and measure their performance relative to a number of benchmarks.

To learn more, check out stockrover.com and get started for as low as $7.99 a month. The premium plus plan that I have will give you access to all the information that went into my analysis and much more.

(Disclaimers: this is not investment advice. The author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting Apple Maven)