We Ran A Stock Scan For Earnings Growth And Supply Network (ASX:SNL) Passed With Ease

Table of Contents

The pleasure of investing in a company that can reverse its fortunes is a major attract for some speculators, so even providers that have no income, no revenue, and a record of falling short, can control to discover traders. Sometimes these stories can cloud the minds of traders, major them to make investments with their feelings alternatively than on the merit of good firm fundamentals. When a perfectly funded business may sustain losses for many years, it will need to have to crank out a earnings ultimately, or else buyers will move on and the firm will wither absent.

In distinction to all that, many traders favor to focus on businesses like Supply Network (ASX:SNL), which has not only revenues, but also income. Even if this enterprise is relatively valued by the market, buyers would agree that generating consistent revenue will keep on to supply Supply Network with the signifies to include extensive-time period worth to shareholders.

See our most current examination for Source Community

How Rapid Is Supply Network Increasing?

The market place is a voting equipment in the shorter term, but a weighing equipment in the prolonged phrase, so you’d expect share cost to follow earnings for every share (EPS) results inevitably. That would make EPS expansion an eye-catching high-quality for any firm. Impressively, Supply Network has developed EPS by 27% for each 12 months, compound, in the last 3 several years. If the business can maintain that form of advancement, we would anticipate shareholders to occur away satisfied.

It’s typically handy to take a seem at earnings in advance of fascination and tax (EBIT) margins, as properly as earnings development, to get another choose on the top quality of the firm’s progress. Supply Community shareholders can just take confidence from the actuality that EBIT margins are up from 12% to 14%, and profits is expanding. Which is wonderful to see, on each counts.

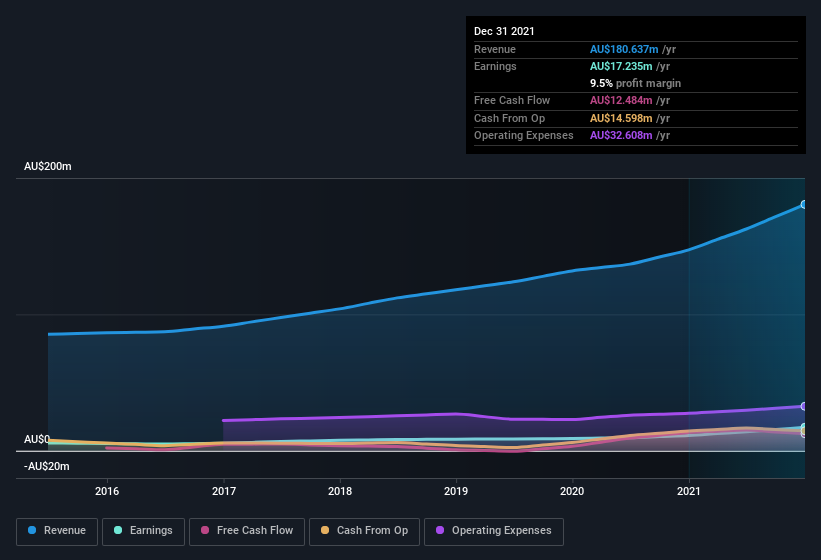

In the chart underneath, you can see how the organization has developed earnings and profits, over time. To see the real numbers, click on on the chart.

Considering the fact that Source Network is no large, with a market place capitalisation of AU$374m, you really should definitely check out its dollars and personal debt just before acquiring far too fired up about its prospective clients.

Are Offer Community Insiders Aligned With All Shareholders?

Theory would recommend that it really is an encouraging indicator to see large insider ownership of a firm, since it ties firm efficiency directly to the monetary results of its management. So as you can visualize, the fact that Offer Community insiders have a important number of shares definitely is desirable. To be actual, business insiders keep 65% of the company, so their decisions have a major affect on their investments. This need to be observed as a excellent issue, as it usually means insiders have a own fascination in providing the finest outcomes for shareholders. To give you an concept, the benefit of insiders’ holdings in the company are valued at AU$241m at the present share value. So there is certainly a good deal there to continue to keep them centered!

Should You Incorporate Offer Network To Your Watchlist?

You can’t deny that Supply Community has grown its earnings for each share at a extremely outstanding rate. That is beautiful. With EPS progress fees like that, it really is rarely astonishing to see firm increased-ups spot self-confidence in the organization through continuing to maintain a considerable expenditure. The advancement and insider confidence is appeared on effectively and so it’s worthwhile to look into even further with a look at to discern the stock’s legitimate benefit. Of course, just for the reason that Source Network is rising does not imply it is undervalued. If you’re wondering about the valuation, examine out this gauge of its price tag-to-earnings ratio, as in contrast to its field.

Whilst Supply Community definitely appears to be excellent, it may well attraction to extra buyers if insiders ended up shopping for up shares. If you like to see insider obtaining, then this cost-free listing of growing organizations that insiders are acquiring, could be precisely what you’re on the lookout for.

Please note the insider transactions reviewed in this write-up refer to reportable transactions in the appropriate jurisdiction.

Have responses on this report? Concerned about the content material? Get in contact with us directly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This short article by Merely Wall St is common in nature. We provide commentary centered on historic information and analyst forecasts only applying an impartial methodology and our content articles are not supposed to be money tips. It does not represent a suggestion to obtain or promote any stock, and does not just take account of your goals, or your financial problem. We intention to deliver you prolonged-expression focused investigation driven by basic facts. Notice that our assessment might not aspect in the most up-to-date rate-delicate enterprise bulletins or qualitative materials. Basically Wall St has no position in any shares outlined.