2 Reasons Why Now Is A Good Time To Buy Apple Stock

Table of Contents

Shares of Apple (AAPL) – Get Apple Inc. Report and other tech companies have been getting pummeled during the recent bear market. Down almost 25% YTD, shares of the Cupertino-based company may be an attractive investment at the moment. Even amidst a gloomy macroeconomic outlook, Apple’s fundamentals remain robust.

Here are a few reasons why buying Apple stock right now may bear fruit down the road.

(Read more from Apple Maven: Buy Apple Stock In July?)

The Best Strategy For Buying Apple

In an article posted on this channel about one year ago, we examined the best strategies for timing your purchases of Apple (AAPL) stock. A debate over buying AAPL on the dip led to a broader question: historically speaking, what is the best time to accumulate Apple stock?

We fully expect Apple will return to its all-time highs and, eventually, climb much higher than that. As plenty of Apple bulls are keen to point out, “Apple isn’t going anywhere.”

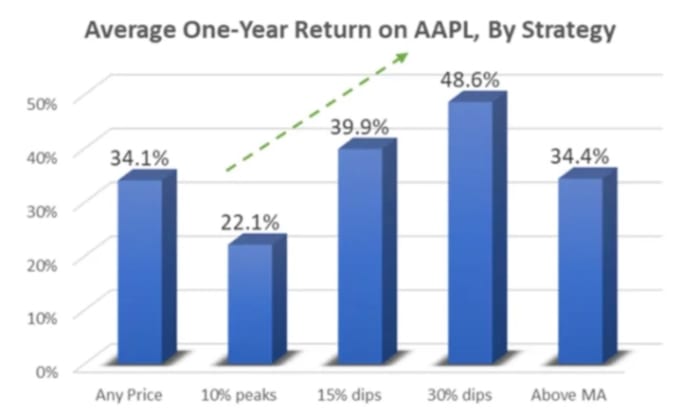

But pinpointing exactly when to buy Apple to maximize your returns is a tough task. In last year’s analysis, we took an approach based on a one-year average forward return metric. Using this metric as our guide, we ran five strategies through the historical data to see which generated the best returns.

Here’s a depiction of each of those strategies as well as how they fared.

1. Buying Apple regardless of price: 34% annual return on average.

2. Buying near peaks: 22% return on average.

3. Buying on 15% declines: 40% return on average.

4. Buying sharper corrections of 30%+: gains of almost 50% per year.

5. Buying above a certain moving average to ride momentum: returns an average of 34% (coincidentally, the same return as the “buy at any price” strategy).

At the time of writing, with Apple shares at a drawdown of 25%, buying the dip would imply a one-year return of between 40% and 50%, based on historical data. Effectively, the more Apple stock sinks, the better bargain investors can get.

Of course, Apple can also fall even further before it recovers. Equity investing is risky and shareholders have to keep that in mind.

Why Might July Be The Best Time To Buy?

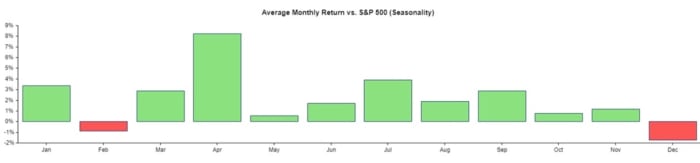

July and August have historically seen AAPL outperform the S&P 500 by 5% over the past decade.

This positive performance is likely correlated with increased investor sentiment preceding two major calendar events: the launch of the iPhone (usually in September) and the holiday shopping season.

Investors tend to snap up shares of Apple leading into these two key events, effectively “buying the rumor.” However, they also tend to “sell the news,” which is why Apple has historically performed poorly during the final months of the year.

Explore More Data And Graphs

Many of the graphs used by the Apple Maven are provided by Stock Rover. We have been impressed with the breadth and depth of information on markets, stocks and ETFs that this platform provides. Stock Rover also helps to set up detailed filters, track custom portfolios and measure their performance relative to a number of benchmarks.

To learn more, check out stockrover.com and get started for as low as $7.99 a month. The premium plus plan that we have will give you access to all the information that goes into our analysis and much more.

(Disclaimers: this is not investment advice. The author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting Apple Maven)