Apple Stock: Fiscal Q2 Earnings Live Blog For Investors

The time has come! On April 28, after the closing bell, Apple (AAPL) – Get Apple Inc. Report will report fiscal Q2 results. The Apple Maven will follow the event in real time, via live blog. To skip the intro and the earnings preview recap, scroll straight down to “Live Blog Starts Here”.

Our coverage starts shortly after 4 p.m. EST, or 1 p.m. Pacific. Expect the press release to come out at around 1:30 p.m. PST, and for the earnings call to begin thirty minutes later. The meeting should last about one hour, with Q&A ending at around 3 p.m. PST.

(Read more from the Apple Maven: Apple Pre-Earnings: The iPhone Should Be A Killer in Q2)

We have been previewing Apple’s earnings for the past several days. Below is a very brief summary of what to expect this evening:

- Wall Street seems to agree that this will be a strong quarter for Apple. Consensus estimates for revenues and EPS growth are 5% and 2%, respectively — but I think that the Cupertino company will do better than this.

- The iPhone is likely to impress on the back of strong demand for the iPhone 13 and, maybe, the newly launched SE.

- The Mac will probably do fine as well, alongside the services segment as the installed base and device usage continue to grow. A revenue mix shift towards services should be a positive for margins too.

- Meanwhile, the iPad and wearables could be the soft spots, a result of supply chain challenges.

- I doubt that the management team will offer firm guidance, especially on revenues. But pay close attention to the narrative about Apple’s performance in the next several months, as macroeconomic challenges (e.g., inflation, economic deceleration in parts of the world), continue to mount.

- Apple stock heads into earnings day 14% below the all-time high. Could recent share price weakness set the stock up for a rally, in case of decent results?

(Read more from the Apple Maven: Apple Pre-Earnings: Could iPad or Wearables Steal The Show?)

Live Blog Starts Here!

2:59 p.m. PST: The conference call is over! Thanks for being with us today, have a great evening!

2:58 p.m. PST: Question on freight and geographic production footprint. CEO says that it is a huge challenge today, both on cost and availability. The focus now is to fulfil demand. Looking forward, the focus would be to do so more efficiently.

2:56 p.m. PST: Question on services and the consumer vs. enterprise split. CFO says that consumer is the main focus, although enterprise is also a source of potential growth. Apple is active in both verticals.

2:53 p.m. PST: Question on use of cash, why not acquire strategic assets — Netflix mentioned? CEO says that Apple does that already, and that company would not discard larger M&A. This is an interesting comment.

2:52 p.m. PST: Question on revenue guidance, the $4 billion to $8 billion drag… CFO somewhat repeats what has been said already. He adds that FX should be a 300-bp headwind to fiscal Q3, and Russia should be 150-bp drag. The good news is that demand remains solid, iPhone 13 doing great.

2:49 p.m. PST: Question on App Store and impact to this business. CFO says that it is too early to tell.

2:48 p.m. PST: Question on supply constraint again. CFO Maestri says that constraints were limited to silicon shortages, but now the restrictions in China due to COVID-19 are now playing a role too.

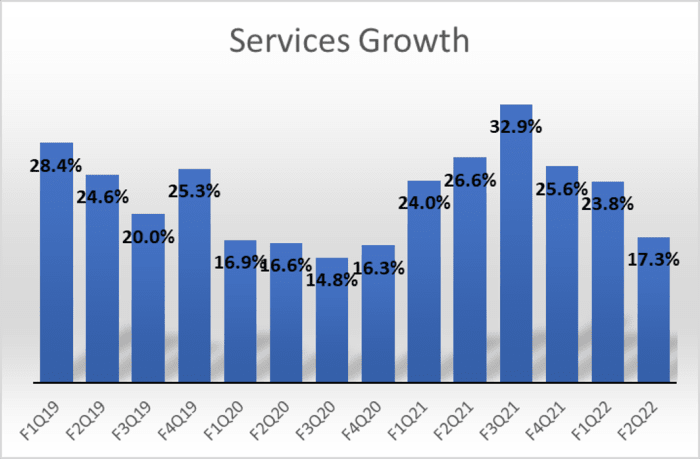

2:46 p.m. PST: Question on service growth slowdown, is this 17% rate what should be expected going forward (See graph above to help visualize)? CFO is happy with performance of segment, credits installed base, usage and new services launched. Luca says that COVID-19 can distort the picture a bit. For next quarter only, expect growth of less than 17% due to FX and Russia.

2:43 p.m. PST: Question on SE demand vs. previous SE cycles. Tim does not want to go into that level of detail, says that smartphone segment in general is performing well on the back of the iPhone 13 family.

2:41 p.m. PST: Follow up on timing of supply equilibrium. Tim does not want to predict it, there is much still to be known about supply, demand and economic strength. “There are varying levels of outcome”.

2:40 p.m. PST: Question on whether Apple will rethink supply chain and inventory management after all current issues are in the rearview mirror. Tim is “looking forward to that day”. Says that supply chain is global, Apple will keep looking to optimize it. CEO is happy with how the supply chain has performed in this tough environment. Company keeps learning and adapting, but he reminds that holding inventory (e.g., having a buffer on silicon) is not a good thing to do in this industry.

2:37 p.m. PST: Question on demand ex-Russia and other challenged sub-segments. CEO happy with the iPhone against tough comps. Americas did quite well, US specifically.

2:37 p.m. PST: More question on the $4 billion to $8 billion revenue drag. CEO reiterates that impact will be to most product categories, but that company will try to minimize impact.

2:35 p.m. PST: Question on component inflation and impact on Apple’s pricing power. CEO says that some component costs are falling, others rising. Apple doing a good job navigating the challenges.

2:33 p.m. PST: More question on supply constraint. Tim elaborates, saying that almost all final assembly plants have restarted in China.

2:31 p.m. PST: Question on supply chain impact, is this delayed demand or destroyed demand? Tim says some is lost, some can be recaptured, but it is hard to forecast. Also, most product categories will be impacted by this issue.

2:30 p.m. PST: Question on geo segment split. Americas was strong, CFO is happy. Europe was good, despite Russia impact — Western Europe was solid. China was a March quarter record, but iPhone launch timing played a role. Japan and APAC impacted by FX headwinds.

2:27 p.m. PST: Q&A starts with a broad macro question. Tim Cook says that Apple sees inflation, which is trickling into gross margin and opex. CEO is monitoring the impact on consumer behavior and demand, but the main focus remains on supply side. Regarding supply, silicon shortages and COVID-19 impact in Asia should continue, primarily around Shanghai corridor. But Tim sees a ramp up as facilities restart, sees reason for optimism.

2:24 p.m. PST: Gross margin guided to 42% to 43%; opex, to $12.7 billion to $12.9 billion; other income at negative $100; tax rate at 16%.

2:22 p.m. PST: No specific revenue guidance, as usual. YOY sales performance should be impacted by supply constraints, shortages. $4 billion to $8 billion should be the impact, much larger than recently. AAPL stock sinks after these comments.

2:21 p.m. PST: Share repurchases boosted by $90 billion, which I believe to be better than expected. Next, outlook for next quarter.

2:20 p.m. PST: Cash review… $193 billion in cash and equivalents, $73 billion net of debt.

2:20 p.m. PST: Luca Maestri now reviewing a few commercial contract wins in iPhone and iPad.

2:19 p.m. PST: Growing installed base and customer engagement are drivers of service growth. Paid subscribers have reached 825 million, 165 million higher over the past 12 months.

2:17 p.m. PST: Watch mentioned as a highlight in wearables.

2:17 p.m. PST: iPad Air remains strong; half of sales were from new users who did not own an iPad before.

2:16 p.m. PST: Mac revenue up on M1-powered MacBook Pro. Past 7 quarters have been the best 7 quarters ever. M1 has really been a game changer for Apple’s PC business.

2:15 p.m. PST: iPhone revenue up 5%, iPhone 13 and SE to credit. Developed and emerging markets did equally well. Satisfaction at a high.

2:14 p.m. PST: Gross margin benefited from favorable mix. Mix was also a positive in service margins.

2:13 p.m. PST: CFO Luca Maestri has the mic now.

2:12 p.m. PST: Tim Cook mentions the challenges: war, COVID-19, silicon shortage. But he seems confident that Apple will handle the issues well.

2:10 p.m. PST: As the CEO continues to talk about the highlights of the quarter, AAPL heads lower still… -1%. Shares lost steam fast!

2:08 p.m. PST: CODA mentioned for its Academy Award win. We’ve recently talked about it here.

2:07 p.m. PST: Tim Cook also praises iPad and Watch Series 7. The story so far remains the same: strong demand. This is expected of the prepared remarks.

2:06 p.m. PST: iPhone SE mentioned as a positive. Apple stock now turns negative in after hours. Oops!

2:05 p.m. PST: CEO says that Mac has suffered from supply chain disruptions, but that the segment still performed well on the back of Apple’s M1 chip family.

2:02 p.m. PST: Apple stock kicks off the earnings call up only +0.5% in after hours.

2:01 p.m. PST: The call is underway. Disclaimers first, then CEO Tim Cook, then CFO Luca Maestri. Finally, Q&A should start in about 30 min.

1:59 p.m. PST: Those that would like to listen to the earnings call can do so here.

1:57 p.m. PST: Apple’s earnings call starts in 3 minutes! Let’s dive in soon…

1:56 p.m. PST: Apple stock up +1.6% in after hours. I think that if shares had not rallied +4.5% during the day, they would be reacting better to this solid earnings print.

1:54 p.m. PST: To clarify, the +20% mentioned below is on a fiscal YTD basis, i.e. past six months.

1:53 p.m. PST: Cash flow from operations up +20% YOY. This is impressive, considering EPS growth of “only” 9%. Despite the tough environment, Apple continues to manage their cash very well!

1:51 p.m. PST: Operating expenses accounted for 12.9% of revenues vs. 11.7% this time last year. It will be interesting to hear from the company any commentary around this bump in costs.

1:49 p.m. PST: On gross margin, I had been anticipating 43.3% due, in part, to a revenue mix shift towards services and higher-end products. I thought I was overly optimistic here. Turns out I was not optimistic enough!

1:48 p.m. PST: Looking around the P&L, I am impressed by gross margin of 43.7%. This is a YOY increase of more than one percentage point — last year’s gross margin had climbed a whopping 4 percentage point.

1:46 p.m. PST: Tim Cook shared a brief comment with CNBC. He sounded very upbeat, as he should. The CEO did point out, however, that supply chain issues continue to hurt the iPad segment.

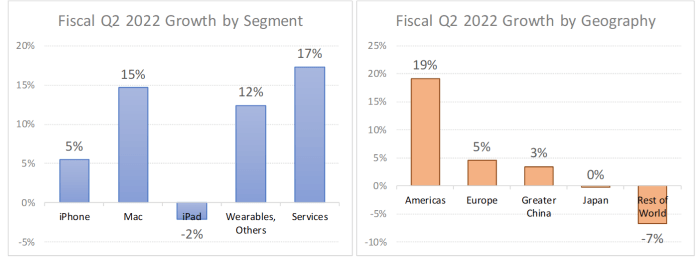

1:45 p.m. PST: Americas was the strong geographic segment, up +19%. Greater China up +3% is very good news, in my view. This was an area of concern.

1:43 p.m. PST: The iPhone did not lead the pack, as I expected. But wearables did well, and the Mac indeed performed against very tough comps.

1:42 p.m. PST: Ok, here come a couple of graphs…

1:38 p.m. PST: Give me just a few minutes, I am going to update my model and will be back soon.

1:37 p.m. PST: Wedbush’s Dan Ives says, “print this earnings report and frame it”. Apple stock up +2% in after hours.

1:35 p.m. PST: Services growth edged consensus by just a bit, but that was a slowdown compared to recent quarters.

1:35 p.m. PST: iPhone revenue of $50.6 billion vs. $47.9 billion consensus, and my estimate of $53.7 billion. Ok, I was a bit too optimistic here, but the number still looks great vs. estimates.

1:33 p.m. PST: Total revenue of $97.3 billion vs. $93.9 billion consensus, and my estimate of $95.5 billion. That was a beautiful top-line beat, revenue growth of nearly 9%!

1:32 p.m. PST: EPS of $1.52 vs. $1.43 consensus, and my estimate of $1.53.

1:31 p.m. PST: Beat on revenues, beat on EPS, beat on iPhone… dividend increase of 5%, buyback increase of $90 billion. This is all good news so far!

1:30 p.m. PST: Higher still, heading to +4%! Numbers are in!

1:30 p.m. PST: AAPL stock heading higher! +2%!

1:27 p.m. PST: Apple stock hovering around flat now, recovering small losses from a few minutes ago… it’s almost time! We are only 3 minutes to go! I am sooo ready for this, let’s go!

1:26 p.m. PST: Also, will Apple announce an increase to the share repurchase authorization and a dividend bump? $70 billion and 5%, respectively, would likely be the numbers to beat here.

1:24 p.m. PST: Back to earnings preview, I think that the iPhone and the Mac will shine. I am a bit concerned about iPad and wearables. Greater China could come in soft too. I will then be curious to hear from the management team about Europe (another potential soft spot) and sales expectations for the summer season.

1:22 p.m. PST: In after-hours, the Nasdaq 100 is giving up about one-third of its regular session gains. Keep in mind that Amazon represents 7% of that index — but Apple accounts for nearly 13%. AAPL will be a huge story, coming up in only 8 minutes!

1:19 p.m. PST: Wedbush’s Dan Ives is on CNBC right now, he sounds as optimistic as ever on Apple and the iPhone. I agree with him.

1:18 p.m. PST: For those following other stocks, ROKU is trading higher on the back of its earnings report, but Robinhood is hurting. Amazon down -9%. Apple is hanging on, but still in negative territory.

1:17 p.m. PST: How do you think Apple will perform today? You still have 15 minutes at most to chime in below:

1:15 p.m. PST: In after-hours trading, Apple stock is still down, but now by only -0.4%. Compared to the all-time high of around $182, AAPL is discounted by 10%, barely in correction territory.

1:14 p.m. PST: Another look at Wall Street’s expectations for Apple… revenue growth of 5% and EPS growth of 2% is the benchmark. I did my own estimate, and I think Apple will post revenue growth of 7% and EPS growth of 10%. Let’s see what happens in 15-20 minutes!

1:11 p.m. PST: Yet, Apple stock down -1.5% in after hours.

1:10 p.m. PST: Is Intel a good read through for Apple’s Mac business? I would say not. Apple seems to be executing very well on PCs, better than peers, driven by the introduction of the M1 chip. I wouldn’t worry here.

1:08 p.m. PST: FYI, Intel (INTC) – Get Intel Corporation Report has also posted results, and the stock is also down on soft guidance… -4% in after hours. Not a great start for tech this evening!

1:07 p.m. PST: So, as a quick recap… Apple’s results will be released at around 1:30 p.m. PST, i.e. in about 20-25 minutes, and the earnings call starts half an hour after that.

1:06 p.m. PST: Apple stock is down -0.5% in after hours… but this is probably just sympathy, following Amazon’s ill-received results. Expect a more meaningful movement in AAPL share price in about 25 minutes.

1:05 p.m. PST: Back to the market. Apple investors should be happy about this strong day of performance, but those who were waiting to see the results of fiscal Q2 before buying shares may be disappointed by this strong pre-earnings rally.

1:03 p.m. PST: By the way, Amazon’s earnings are in… and the stock is down -10% in after-hours trading! Ouch! Apple’s report will not come in until 1:30 p.m. PST.

1:02 p.m. PST: Check out these numbers… S&P 500 up +2.5% for the day, Apple stock up +4.5%! What a day!

1:00 p.m. PST: And the closing bell has rung! My name is Daniel, welcome to live coverage of Apple’s earnings day!

12:59 p.m. PST: Hello, everyone! It’s almost 1 p.m. in Cupertino… almost time for Apple’s earnings!

8:21 a.m. PST: I will meet you all back here right after 1 p.m. PST to start the live coverage and see if Apple will follow through with a strong print in fiscal Q2. See you then!

8:20 a.m. PST: Quick check in… Apple stock is off to the races already! Shares are up +3.8% this late morning in New York City, partly due to very bullish reaction to peer Facebook’s earnings report last night.

4:00 a.m. PST: Thanks for joining us today! Live coverage begins shortly after the closing bell.