ASGN: High Margin Commercial Consulting Business Driving The Company Forward (NYSE:ASGN)

Table of Contents

Morsa Visuals

Intro

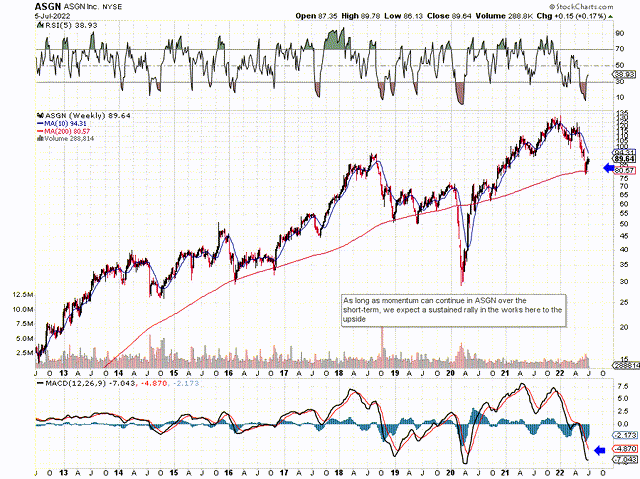

If we pull up a weekly chart of ASGN Integrated (NYSE:ASGN), we see shares seem to be to be closing in on a MACD get sign. The drop in the share cost was at last halted by the 200-week going normal and the 10-7 days going normal of $94+ for every share now appears to be in ASGN´s sights. We condition this due to the fact of the rising histogram in latest periods because of to ASGN´s powerful share-value general performance in new weeks. The most effective MACD invest in signals existing themselves when the crossover requires area well down below the zero line so it will be intriguing to see if momentum can carry on in ASGN going forward.

ASGN Honing In On A Long-Phrase Base (StockCharts)

Earnings Growth Outperforming

Whereas the technician studies the effect of sector movement, the fundamentalist focuses extra on the explanations why ASGN shares have been in bullish mode in excess of the previous three months or so. On this note, the company´s ahead-hunting earnings revisions continue on to obtain traction. ASGN´s fiscal 2022 base-line estimate of about $5.40 for every share has elevated by a lot more than 10%, for instance, more than the past three months alone. Given that earnings expansion is the principal driver of inventory price ranges on Wall Road, shares will proceed to rally if certainly forward-looking earnings revisions carry on to get marked up.

The technician on the other hand thinks human psychology performs a main function in how ASGN shares trade over the lengthy expression. What this suggests is that (as lengthy as the company´s fundamentals have not been impaired in a main way), consumers must continue on to step in when the company´s shares are on sale. We can see this on ASGN´s extensive-phrase chart in that shares far more generally than not have been in a position to bounce off extensive-expression guidance (200-week relocating average) thanks to purchasers inevitably stepping in. This “market place conquer” or psychology (which could incredibly properly be taking part in itself out at present in ASGN) between traders who trade and invest in this inventory tends not to adjust. Additionally, we can see underneath that the inventory has loads of runway for expansion from some encouraging developments in the company´s new financials.

For the to start with-quarter earnings phone, we witnessed better than anticipated top-line development within the Professional segment (Industrial Consulting, Resourceful Digital Advertising, Permanent Placement). As alluded to above regarding the company´s earnings revisions, ASGN´s figures go on to appear in ahead of goal and the industry is at last beginning to selling price this growth into the share price tag.

The company´s business consulting bookings (Funded work awarded) variety for the 1st quarter of virtually $300 million was a substantial enhance over the very same interval of 12 months prior, and this pattern, in certain, provides optimistic ramifications to the table for the organization.

Margin Expansion

For just one, gross margins go on to increase because of to solid development in this segment. Industrial consulting product sales rose by around 74% in the 1st quarter to hit practically $205 million and even though comps are predicted to be choppy more than the next handful of quarters, administration reaffirmed its bullish outlook for this phase. Suffice it to say, the better combine of commercial consulting is also driving EBITDA margins development additional down the profits assertion. ASGN´s adjusted EBITDA margins are now envisioned to hit at the very least 12.2% in fiscal 2022 which is even further proof of the developing substantial-margin business consulting organization. Additionally, the encouraging component of this craze is that greater margins experienced already been flagged by administration last yr, so more upside is anticipated in this article based on the bookings which have been claimed to day.

Electronic Transformation

Tailwinds in consulting stem from a really robust account foundation from which ASGN can proceed to insert worth via its ongoing answers. Regardless of whether the benefit is added by the cloud, facts evaluation, etcetera., the key is that ASGN´s shoppers merely want to keep on rolling out their electronic footprints to continue to be aggressive. This “need” limitations downside risk in ASGN as IT expending will carry on to improve irrespective of how financial situations modify heading ahead. Suffice it to say, we stay in the first innings of the digital revolution, so a good deal of runway for expansion stays right here.

Conclusion

For that reason, to sum up, with shares presently investing with a forward GAAP earnings several of 16.59 and a forward income numerous of 1.02, shares keep on to glimpse cheap given the developments we have talked over earlier mentioned. Let´s see if the organization can report still a different earnings conquer in the 2nd quarter. We glance forward to ongoing coverage.