Betastore gets $2.5M to solve stock-outs, financing challenges for informal retailers in West and Central Africa – TechCrunch

About 80% of residence retail in sub-Saharan Africa is shipped by means of informal channels, which perennially experience a number of issues like stockouts, foremost to an instability in earnings, and a lack of attractiveness to financiers. These problems befall tens of millions of micro-merchants throughout the continent, and Betastore, a B2B retail market for casual merchants, is doing the job to resolve in Nigeria, Ivory Coast and Senegal.

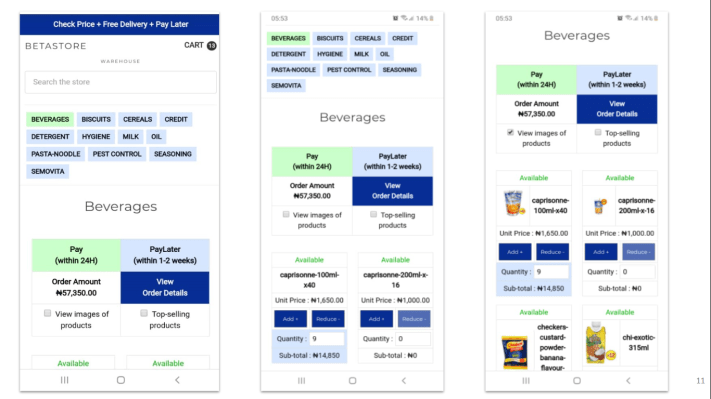

The Betastore market permits casual traders to resource speedy shifting customer merchandise (FMCGs) specifically from makers or distributors – which retains the rates of the products competitive by doing away with interactions with income agents. It also works with logistics companions to guarantee the supply of products inside 24 hours.

The Nigeria-based mostly startup ideas to supply these providers beyond its current three marketplaces by increasing to Ghana, the Democratic Republic of Congo and Cameroon by the stop of this year, just after closing $2.5 million in pre-collection A funding from 500 Worldwide, VestedWorld, and Loyal VC. Betastore has to date raised $3 million in funding.

“What is seriously vital for us is to be ready to continue on to scale by leveraging our asset-light design. We strategy to enter new marketplaces right before the stop of the year and to grow to 100 metropolitan areas across Nigeria, Ivory Coastline and Senegal. We are also arranging to fortify our technological innovation and management groups, and to provide in new goods and to enhance present kinds,” stated Betastore CEO, Steve Dakayi-Kamga, who co-established the startup with Leo-Armel Tchoudjang mid 2020.

The asset-light design implies Betastore does not have any capital and labor intense assets like warehouses or its have fleet of motor vehicles for shipping. Dakayi-Kamga mentioned that this has served the startup to enhance its technologies to make sure that stores supply products from the closest distributors. On average, a retailer utilizing Betastore will make 4.4 orders for every month.

“Our technological innovation enables merchants to purchase on demand, obtain a range of solutions and solves logistics complications for them too. With Betastore, they really don’t have to near their shops to go get goods from distributors suppliers or the market, and do not have to eliminate near to 50 % of the margins in in the logistics,” explained Dakayi-Kamga, who earlier worked for Jumia, the place he led the e-commerce platform’s logistics, warehousing and market fulfillment office.

The B2B ecommerce platform is established to introduce financing in July, a launch that follows a pilot system involving 200 vendors that the startup carried out very last 12 months.

The BNPL funding approach, Tchoudjang says, will be based on retailers’ income and will go a very long way in serving to them to increase the worth of their browsing baskets, and in the end their companies. The startup designs to demand an interest based on merchandise margins.

Betastore is now integrating its technology into a community of financing companions together with fintechs and financial institutions.

“The mandate of some of the companions we have on board is to guidance the overall economy by funding modest businesses, but are not ready to lend to them because they do not have the facts to notify conclusions. We have the visibility of what is taking place in this sector, and have data they can use to lengthen financing,” mentioned Tchoudjang, who earlier held government and management roles inside of the IFC-backed AccessHolding AG community in Africa. He has also aided multinationals rollout fintech and microfinance solutions for rising marketplaces in the previous.

Shops use the Betastore wallet to repay financial loans, deposit funds for their functions, and to deliver, acquire and conserve money.

“The wallet helps them separate their company money from their personal money, and it is right related to the total banking procedure, which means that retailers can acquire and deliver funds to any financial institution, and load dollars with any company banking platform,” explained Tchoudjang.

Because start, the startup promises to have grown its client base and revenues by 10 and 12 instances, respectively. The startup anticipates larger progress specially right after entering a lot more international locations and rolling out its purchase now pay later on (BNPL) product, as it faucets the retail current market in sub-Saharan, which was valued at $380 billion in 2021, contributing 20-50% of the region’s GDP on common.

“We want to simplify entry to items and products and services for the vendors and for the close consumer simply because we see the merchant as an agent able to make accessibility to products and services easier. We begun out in Nigeria, and we are increasing within just Francophone Africa on our way to becoming a pan African participant,” explained Dakayi-Kamga.

Amit Bhatti, the principal at 500 World wide even though commenting on the hottest funding spherical said, “We consider Betastore’s proficient team is making industry efficiencies that have the likely to boost the expansion of Africa’s vendors. With Betastore, retailers can get bigger transparency into wholesaler inventories and price details.”