Buy Apple Stock? Check Chart Against FAANG

Although Apple (AAPL) – Get Apple Inc. Report is flirting with getting rid of its $2 trillion valuation mark, it’s even now the biggest-cap corporation in the U.S.

Soon after final week’s dip, the Nasdaq now sports activities a peak-to-trough drop of 34.8%. For Apple’s section, the stock is down 25%. It’s even now trading in close proximity to the 2022 lows when it was down 29.5%.

Until the newest dip in the industry, Apple was the only FAANG stock outperforming the Nasdaq. That changed last week after the index built new lows and Alphabet (GOOGL) – Get Alphabet Inc. Report (GOOG) – Get Alphabet Inc. Report did not — it sports a peak-to-trough decline of 32.8%.

It is apparent that investors are valuing these companies’ strong financials and regular funds flows.

Also, the outperformance vs. the other FAANG elements is stark, with Meta (formerly Facebook) (META) – Get Meta Platforms Inc. Report, Amazon (AMZN) – Get Amazon.com Inc. Report and Netflix (NFLX) – Get Netflix Inc. Report down 58.5%, 46% and 75%, respectively.

Microsoft (MSFT) – Get Microsoft Company Report is the lone megacap tech inventory you can include things like in Apple and Alphabet’s firm. The program major is at this time down 26% from its superior and was down 31% at its very low.

Withal, the issue is obvious: If it’s a tech stock, it needs a strong stability sheet and funds flow or the inventory is probably heading lessen. Even large-high quality holdings are down 40% to 50% or much more.

So in that gentle, should really investors be purchasing Apple stock?

Buying and selling Apple Inventory

Scroll to Continue on

The fear right here is uncomplicated: The generals drop previous.

The frequently utilized saying on Wall Road refers to the “last shares standing.” In a bear current market, every little thing goes tumbling, including the very best names. So though Apple has led the cost for megacap tech, it, too, will sooner or later succumb to the selling stress.

The issue now is: How a lot of that has currently been accounted for?

Since 2015, Apple stock has experienced three corrections, ranging involving 33% and 39%. So potentially we’re not quite there but in phrases of getting the reduced.

That stated, none of the corrections exceeded 40% and 1 could argue it is time to get started accumulating now that we’ve cracked the 30% threshold.

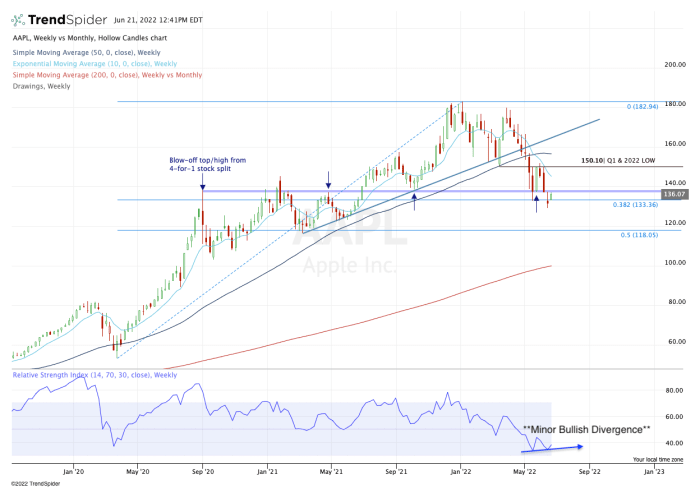

The stock is trading into a crucial location as we communicate. The bulls require Apple inventory to find support in the $133 to $138 place zone. The decreased end of that selection is the 38.2% retracement, when the higher end of that array is exactly where the blow-off top rated from August 2020 arrived into play immediately after Apple did a 4-for-one particular inventory break up.

The moment the inventory broke out above this big degree, it turned aid. Now, that help amount is getting drawn into dilemma as Apple hovers just beneath it in the mid-$130s.

If Apple can regain $138, bulls could see a rebound back again to the 10-7 days going typical, then the essential $150 region. This amount marked the to start with-quarter low and a solid layer of help that flipped to resistance in the 2nd quarter.

On the downside, continue to keep an eye on the June low and 2022 low close to $129. A break of that mark puts $118 to $120 — the 50% retracement from the all-time substantial down to the March 2020 reduced — in enjoy.