Crypto exchange Coinbase sacks staff amid price collapse

Table of Contents

Bitcoin has crashed below $24,000, reaching its lowest levels since the end of 2020.

More than $200 billion has been wiped off the entire cryptocurrency market on Monday morning.

It is the latest in a series of price crashes for the cryptocurrency, which has seen it drop more than 60 per cent in value over the last seven months.

While many crypto holders are liquidating their assets, crypto lender Celsius told customers that they would be temporarily unable to withdraw funds from the platform.

Crypto exchange Coinbase has also announced that it is culling over 1,000 employees after previously rescinding job offers. The company made $800 million last year.

Key points

Crypto prices this morning

08:32 , Adam Smith

Today, BItcoin is down 6.13 per cent to $21.072. Ethereum is down 8.52 per cent to $1,114.08.

MicroStrategy says it can withstand further volatility

07:30 , Vishwam Sankaran

US software developer MicroStrategy says it has not received a margin call against its bitcoin-backed loan, and could withstand more volatility in the crypto market.

“We can always contribute additional bitcoins to maintain the required loan-to-value ratio,” MicroStrategy said in a statement, according to Reuters.

“Even at current prices, we continue to maintain more than sufficient additional unpledged bitcoins to meet our requirements under the loan agreement,” the company reportedly said.

Bitcoin could tank further if it slips below $20K, expert says

07:00 , Vishwam Sankaran

Arthur Hayes, former BitMEX chief, has said if bitcoin’s value dips below the $20,000 mark, a “massive sell pressure” may ensue, which could further drive down prices of the leading cryptocurrency.

Ethereum’s price could also be impacted in a similar way if it slips below $1000, he said.

“If these levels break, $20k $BTC & $1k $ETH, we can expect massive sell pressure in the spot markets as dealers hedge themselves,” Mr Hayes said.

“We can also expect that there will be some otc dealers and that will be unable to hedge properly and might go belly up,” he added.

Bill Gates slams crypto as based on ‘greater fool’ theory

06:20 , Vishwam Sankaran

Bill Gates has dismissed crypto projects like NFTs as shams based on the “greater fool” theory.

Speaking at a climate conference on Tuesday, hosted by TechCrunch, the billionaire reportedly said he is neither long nor short on the entire sector.

“Obviously, expensive digital images of monkeys are going to improve the world immensely,” Mr Gates said sarcastically, according to Bloomberg.

Wall Street watchdog asks laid-off crypto employees to work with them

05:40 , Vishwam Sankaran

The chief of US Financial Industry Regulatory Authority (FINRA) Robert Cook has said the company is planning to increase its resources to monitor cryptocurrencies.

Amid the ongoing layoffs and hiring freezes by crypto firms including Coinbase, Blockfi, and Crypto.com, FINRA has said it wants to “bulk up” its capabilities to understand cryptocurrencies better.

“We’re going to need to be engaged and prepared to have the resources to do that, so anybody who is getting laid off from a crypto platform and wants to work for FINRA, give me a call,” Mr Cook said, according to Reuters.

stETH is crashing too

09:05 , Adam Smith

stETH has dropped to $4 billion from about $10 billion last month, due to holders selling as ether’s price crashes.

“In the short term, stETH will face tremendous selling pressure,” Huobi Research Institute’s report states. “Turbulence is expected in the near future.”

Crypto has ‘not moved in step with traditional assets’

05:00 , Adam Smith

“[Cryptocurrencies] have in the past not moved in step with traditional assets such as equities, however in recent times the link between the two has grown ever closer,” Simon Peters, an analyst at the online trading platform eToro, wrote in a note on Monday.

“Now the clearest signal yet that cryptoassets such as bitcoin and ether are moving in lockstep with equities has flashed, as inflation worries have sent stocks and crypto tumbling. The reasons for this are varied, but much of it comes down to institutional holders, which calibrate their risk assets in similar ways, be they tech stocks or bitcoin.”

Bank of England chief warns people about crypto investment

04:40 , Vishwam Sankaran

Bank of England governor Andrew Bailey has warned people to prepare for huge losses if they invest in digital assets.

“If you want to invest in these assets, OK. But be prepared to lose all your money,” Mr Bailey said on Monday amid the crypto market crash as Celsius Network froze withdrawals and transfers between accounts citing “extreme market conditions”.

Bitcoin, altcoins marginally rise in value

03:34 , Vishwam Sankaran

Bitcoin has grown by about 3 per cent compared to its value a day earlier.

However, the leading cryptocurrency is still hovering around the $22,000 mark over the last 24 hours.

Other top cryptocurrencies, including ethereum, cardano, and dogecoin, have surged by about 8 to 10 per cent in the last day, but are still down by 25 to 30 per cent compared to their values a week earlier.

The overall crypto market is up by about 4 per cent in the last 24 hours but its value is still below the $1 tn mark.

Coinbase says a ‘crypto winter’ could come

02:00 , Adam Smith

Crypto exchange Coinbase will sack 18 per cent of staff amid fears of an incoming “crypto winter”.

Brian Armstrong, Coinbase’s chief executive and co-founder, said that he admitted the company had grown too quickly and was to blame for at least some of its problems.

But it now faced a situation in which it had to sack a large proportion of its staff in order to keep the company secure through any future economic downturn, he said.

Coinbase employees were to receive emails from HR to tell them if their job was affected, he said. Those would be sent to their personal email addresses, since the people being sacked would immediately lose access to the company’s systems.

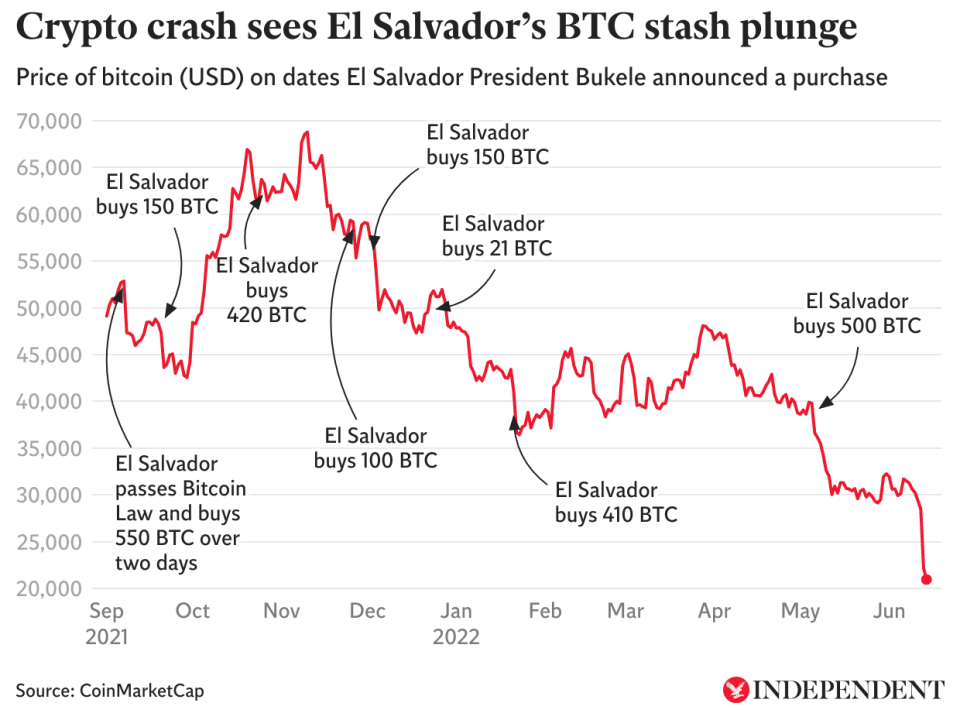

El Salvador says financial risk is ‘minimal’

Tuesday 14 June 2022 23:00 , Adam Smith

As the crypto market continues to crash, El Salvador’s bitcoin stockpile is now worth less than 50 per cent of the price it acquired it for following the latest crypto market crash.

The losses, which total more than $50 million, pose an “extremely minimal” fiscal risk for the Central American country, according to Finance Minister Alejandro Zelaya.

“When they tell me that the fiscal risk for El Salvador because of bitcoin is really high, the only thing I can do is smile,” he said according to Reuters.

“The fiscal risk is extremely minimal. 40 million dollars does not even represent 0.5 per cent of our national general budget.”

The IMF “stressed that there are large risks associated with the use of bitcoin on financial stability, financial integrity, and consumer protection, as well as the associated fiscal contingent liabilities.”

Despite these warnings, the Central African Republic (CAR) voted in April to become the second country in the world to make bitcoin legal money.

Binance chief executive says it will carry on

Tuesday 14 June 2022 20:00 , Adam Smith

Binance’s chief executive has said that it will be hiring more – even as other companies are reducing staff.

“We have a very healthy war chest; we in fact are expanding hiring right now,” Zhao said, as Fortune reports. “If we are in a crypto winter, we will leverage that, we will use that to the max,” he said, adding that the company is “kicking into high gear in terms of M&A activity.”

This is Binance did not spend money on large promotions like Super Bowl ads or naming rights to sports arenas – which Crypto.com did.

Other crypto firms are reducing heads

Tuesday 14 June 2022 17:00 , Adam Smith

As well as Coinbase, BlockFi CEO Zac Prince has that the company will be “reducing [its] headcount by roughly 20 per cent”.

Crypto.com also announced that was laying off 260 employees.

Tuesday 14 June 2022 16:20 , Adam Smith

“If [Celcius] goes into full liquidation mode, then it will have to close out these positions,” said Omid Malekan, an adjunct professor at Columbia Business School, but a sell off of crypto assets is likely to only affect the crypto market – although inflation and a general crash among tech stocks has also happened recently.

Crypto investors are worried about another downturn

Tuesday 14 June 2022 16:00 , Adam Smith

“In the medium term, everyone is really bracing for more downside,” said Mikkel Morch, executive director of crypto hedge fund ARK36, told CNBC.

“Bear markets have a way of exposing previously hidden weaknesses and overleveraged projects so it is possible that we see events like last month’s unwinding of the Terra ecosystem repeat.”

Monsur Hussain, senior director of financial institutions at Fitch Ratings, also told the publication that the liquidation of Celsius’ assets would “further rock the valuation of cryptoassets, leading to a wider round of contagion within the crypto sphere.”

Tuesday 14 June 2022 15:40 , Adam Smith

El Salvador’s bitcoin plunges

Tuesday 14 June 2022 15:30 , Adam Smith

Coinbase users could lose their crypto

Tuesday 14 June 2022 15:14 , Adam Smith

Last month, Coinbase warned users that their cryptocurrency could be at risk if the exchange ever went bankrupt.

“Because custodially held crypto assets may be considered to be the property of a bankruptcy estate, in the event of a bankruptcy, the crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings and such customers could be treated as our general unsecured creditors”, the warning states.

Over 1000 people to leave Coinbase

Tuesday 14 June 2022 15:00 , Adam Smith

According to reports, Coinbase has roughly 5,000 full-time workers, translating to around 1,100 people who will lose their jobs.

Tuesday 14 June 2022 14:42 , Adam Smith

Coinbase employees are to receive emails from HR to tell them if their job was affected, he said. Those would be sent to their personal email addresses, since the people being sacked would immediately lose access to the company’s systems, Andrew Griffin reports.

Coinbase executives are $1.2 billion richer

Tuesday 14 June 2022 14:21 , Adam Smith

Coinbase‘s Brian Armstrong and Fred Ehrsam, along with two other executives, netted about $1.2 billion in proceeds from selling stock.

They sold the shares at prices ranging from $189 to $422. Coinbase opened at $381 on April 14, 2021, its first day of trading. On Wednesday, the stock closed at $67.17, the Wall Street Journal reports.

This huge profit comes as Coinbase culls over 1,000 members of staff.

Coinbase says a ‘crypto winter’ is coming

Tuesday 14 June 2022 16:16 , Adam Smith

Crypto exchange Coinbase will sack 18 per cent of staff amid fears of an incoming “crypto winter”.

Brian Armstrong, Coinbase’s chief executive and co-founder, said that he admitted the company had grown too quickly and was to blame for at least some of its problems.

But it now faced a situation in which it had to sack a large proportion of its staff in order to keep the company secure through any future economic downturn, he said.

Coinbase employees were to receive emails from HR to tell them if their job was affected, he said. Those would be sent to their personal email addresses, since the people being sacked would immediately lose access to the company’s systems.

Tuesday 14 June 2022 13:44 , Adam Smith

Coinbase made a net profit of more than $800 million in the final quarter of 2021, but has been rescinding job offers. More than 300 people have had their jobs pulled, according to Vice, with one person describing it as “reckless and negligent,” and another described it as “irresponsible.” Coinbase had no comment.

Coinbase CEO’s message

Tuesday 14 June 2022 13:30 , Adam Smith

In a blog post about the job losses, Coinbase’s chief executive Brian Armstrong said the reasons for the cuts were threefold:

“Economic conditions are changing rapidly: We appear to be entering a recession after a 10+ year economic boom. A recession could lead to another crypto winter, and could last for an extended period. In past crypto winters, trading revenue (our largest revenue source) has declined significantly. While it’s hard to predict the economy or the markets, we always plan for the worst so we can operate the business through any environment.

“Managing our costs is critical in down markets: Coinbase has survived through four major crypto winters, and we’ve created long term success by carefully managing our spending through every down period. Down markets are challenging to navigate and require a different mindset.

“We grew too quickly: At the beginning of 2021, we had 1,250 employees. At the time, we were in the early innings of the bull run and adoption of crypto products was exploding. There were new use cases enabled by crypto getting traction practically every week. We saw the opportunities but we needed to massively scale our team to be positioned to compete in a broad array of bets. It’s challenging to grow at just the right pace given the scale of our growth (~200% y/y since the beginning of 2021). While we tried our best to get this just right, in this case it is now clear to me that we over-hired.”

Coinbase announces restructuring

Tuesday 14 June 2022 13:14 , Adam Smith

Coinbase has today announced a restructring plan for its business – which includes cutting the company’s workforce by 1,100 employees.

‘This is a contagion fallout from the Terra crisis’

Tuesday 14 June 2022 13:09 , Adam Smith

The fallout from Celcius is the result of the Terra crisis that happened last month.

“Conspiracies circulate every day in crypto, and most are not worthy of paying attention to, but the bottom line here is clear: this is a contagion fallout from the Terra crisis, and any yield-paying product’s risk spiked massively in the wake of the Terra crisis”, writes data analyst Dan Ashmore.

“Confidence in the long-term model is now gone, and that itself is a killer blow”.

El Salvador’s finance minister ‘smiles’ at bitcoin loss

Tuesday 14 June 2022 12:45 , Adam Smith

El Salvador, which has stockpiling bitcoin, has now lost 50 per cent of the value of its cryptocurrency.

However the losses, which which total more than $50 million, pose an “extremely minimal” fiscal risk for the Central American country, according to Finance Minister Alejandro Zelaya.

Speaking at a press conference on Monday, when the losses were closer to $40 million, Mr Zelaya played down the impact of the latest bitcoin price crash on the country’s finances, Anthony Cuthbertson reports.

“When they tell me that the fiscal risk for El Salvador because of bitcoin is really high, the only thing I can do is smile,” he said according to Reuters.

“The fiscal risk is extremely minimal. 40 million dollars does not even represent 0.5 per cent of our national general budget.”

Celsius freezing withdrawals ‘will only add to jitters over market’

Tuesday 14 June 2022 12:28 , Adam Smith

Celsius Network freezing withdrawals “will only add to jitters over the stability of the market in cryptocurrencies, which had already been stoked recently by the collapse of the Luna and Terra tokens”, said Adrian Lowery, a financial analyst at Bestinvest.

“The steep falls in crypto values are aggravated by a further consideration, which is that it is a market – unlike equities – dominated by retail investors. As inflation and growth fears have accumulated recently, investors have rapidly liquidated holdings, partly because they fear further price drops but also to shore up bank balances and safety-net savings.

“Long-term institutional investors in equities, while they have obviously been selling out of some markets, have not pulled the trigger to the same extent.”

Bitcoin is entering a period where ‘worlds collide’

Tuesday 14 June 2022 12:00 , Adam Smith

“BTC is entering a period where two worlds collide. Short term sellers on the back of the negative tone to risk are running into medium term investors who view levels approaching 20,000 as good long term value. This will lead to volatile and choppy trading”, predicts head of OTC trading at BCB group, Richard Usher

“As BTC approaches 20,000 and ETH dips below 1100 we are entering a period where two different approaches collide. With the broader risk sentiment firmly negative the sellers have had it all their own way for a few days, however we are starting to see medium term investors buying at these levels. This looks set to continue as we see plenty of demand starting to finally show up. It will take a shift in the overall risk sentiment to turn the price around significantly and we are more likely to see choppy trading between 1750 and 25500 for a period as the two different strategies play out.”

NFT trading volumes surge amid crypto crash

Tuesday 14 June 2022 07:12 , Vishwam Sankaran

NFT trading volumes have surged in the last day even as the crypto market has tanked.

Top NFT projects including Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and Crypto Punks have seen 100 per cent increases in the last 24 hours, according to CryptoSlam.

However, data suggests a small number of rich investors may be behind the moves.

Over $100M offloaded from US crypto funds last week

Tuesday 14 June 2022 06:08 , Vishwam Sankaran

Digital assets worth about $102M were offloaded from US crypto funds last week “in anticipation of hawkish monetary policy” from the US Federal Reserve, according to CoinShares.

The latest edition of the weekly Digital Asset Fund Flows report from CoinShares notes that outflows between 6 and 10 June were mainly led by investors from the Americas at $98M, while Europe accounted for just $2M.

“Bitcoin saw outflows totalling $57M last week bring month-to-date outflows to US$91M,” the report noted, adding that Ethereum saw outflows of $41M bringing its total year-to-date outflows to $387M.

Bitcoin drops below $22,000 mark again

Tuesday 14 June 2022 05:46 , Vishwam Sankaran

After briefly rising to a value of over $22,000, bitcoin has dropped below the value again in the last hour.

The leading cryptocurrency is currently fluctuating around this mark.

It is still down by about 15 per cent in the last day and by over 25 per cent compared to its value last week.

The overall crypto market is down by about 12 per cent in the last day, and is valued at about $924 bn amid the risk of mass liquidations.

El Salvador minister says crypto crash poses ‘extremely minimal’ risk

Tuesday 14 June 2022 05:18 , Vishwam Sankaran

El Salvador’s Finance Minister Alejandro Zelaya said on Monday that the current crypto market crash poses an “extremely minimal” fiscal risk to the South American nation.

“When they tell me that the fiscal risk for El Salvador because of Bitcoin is really high, the only thing I can do is smile. The fiscal risk is extremely minimal,” Mr Zelaya said at a press conference, according to Reuters.

The country has purchased 2,301 Bitcoin, which are currently worth about $51M at the time of publishing – about 50 percent of the $105.6M that the country has invested in the cryptocurrency.

Mr Zelaya said the country’s bitcoin portfolio had lost some $40M in value, citing an earlier estimate from Deutsche Welles.

“Forty million dollars does not even represent 0.5% of our national general budget,” he said.

Coinbase drops by over 11 per cent as Bitcoin nosedives

Tuesday 14 June 2022 05:08 , Vishwam Sankaran

Coinbase shares were down more than 11 per cent on Monday amid the latest crypto market crash.

This appears to be linked to bitcoin trading at its lowest levels since December 2020, and the overall crypto market value dropping below the $1 tn mark.

Shares of the crypto trading platform were already down 76 percent over the last year, and the company had announced a hiring freeze and cancelled accepted job offers.

Crypto.com, BlockFi lays off workers amid ‘crypto winter’

Tuesday 14 June 2022 04:40 , Vishwam Sankaran

Cryptocurrency companies including Crypto.com and BlockFi have announced they’ve laid off employees amid the recent crypto market crash and a bearish industry.

Kris Marszalek of Crypto.com said the company is making adjustments to the market conditions by “making targeted reductions of approximately 260 or 5% of our corporate workforce.”

“We will continue to evaluate how to best optimize our resources to position ourselves as the strongest builders during the down cycle to become the biggest winners during the next bull run,” he tweeted.

BlockFi founders Zac Prince and Floria Marquez also said in a blog post on Monday that the reason the company laid off employees was due to the crypto crash.

Bitcoin down by 16 per cent

Tuesday 14 June 2022 04:09 , Vishwam Sankaran

Bitcoin is down by about 16 per cent in the last day and is inching closer to the $21,000 mark.

The world’s leading cryptocurrency has sunk in value by nearly 27 per cent compared to its price last week amid the latest crypto market crash.

Other leading cryptocurrencies, including ethereum, and dogecoin have also dropped in value by around 15 per cent in the last 24 hours.

Solana and cardano are also down by over 5 to 8 per cent in the last day.

The overall crypto market is continuing its downward trend, and is currently close to a value of $900M, sinking by over 12 per cent in the last 24 hours.

El Salvador loses half its Bitcoin investment as crypto market plunges

Tuesday 14 June 2022 03:58 , Vishwam Sankaran

El Salvador currently has 2,301 Bitcoin, worth about $50 million at the time of publishing.

This is about 50 percent of the $105.6 million that the country’s president Nayib Bukele invested.

The country has bought the dip several times in the past.

In October 2021, it bought 420 bitcoins, paying the highest price per bitcoin. Then on 9 May, Mr Bukele again “bought the dip” and bought 500 bitcoins for over $30,700 each.

But amid the latest crypto market crash, with bitcoin’s price inching closer to the $21,000 mark, it remains to be seen if the country would keep hodling its bitcoin assets to recoup some of the money lost.

How bad is the latest bitcoin crash?

Monday 13 June 2022 20:36 , Anthony Cuthbertson

Crypto market analysts are divided over whether we’re nearing the end of the bear market, or still firmly in the middle of it.

With more than 60 per cent losses for bitcoin since its November 2021 price peak, some believe it could still rival the 80 per cent+ losses seen during the market corrections of 2013 and 2017.

After dropping below $1 trillion today for the first time since 2020, we’ve asked analysts which way they think the crypto market is heading from here.

You can read all about it here:

How bad is the latest bitcoin crash?

Bitcoin’s crash continues

Monday 13 June 2022 17:40 , Adam Smith

Crypto’s crash continues – the Celsius cryptocurrency has lost nearly 80 per cent of its value, as The Independent’s Anthony Cuthbertson documents.

Elsewhere, Bitcoin has crashed more than 10 per cent at the start of the week, falling below $25,000 for the first time since December 2020.

We will be continuing our updates tomorrow – stay tuned!

The FCA is coming for crypto

Monday 13 June 2022 17:30 , Adam Smith

Bitcoin’s volitlity at this time is unlikely to sweeten it to the Financial Conduct Authority in the UK, which is looking to regulate crypto more.

Nikhil Rathi, head of the organisation, said that crypto is “a vector for serious organized crime and money laundering” and told a Treasury Committee that “anyone who invests in them must be ready to lose all their money.”

In the past two years, Bloomberg notes, the FCA has all-but-banned Binance in the UK and set high standards for doing busines sin the country so that most digital currency companies can’t operate.

“In the US we have an alphabet soup of regulators,” Eugene Soltes, a Harvard Business School professor who studies regulation, says. “We’re trying to figure out still who is the regulator, not how we should regulate them. The FCA already has one up.”

Severe losses moving forward, expert predicts

Monday 13 June 2022 17:20 , Adam Smith

“We could be facing even more severe losses moving forward. Economic growth is clearly slowing, and reports already suggest the U.S. could see a recession in the next year,” said Manuel Ortiz-Olave, co-founder at equity tokens firm Brickken, in an email to CoinDesk.

“Higher inflation will continue forcing higher interest rates, and higher interest rates are also negative for economic growth.”

He continued: “Some of the most important companies in the world like Apple, Microsoft or Nike have already reported slowdowns in sales, and Tesla has indicated that layoffs will come soon. These are clearly negative headlines, which combined with higher food and fuel prices, make people be careful about their savings.”

‘Bitcoin and ether are continuing to get a severe bruising in the ring’

Monday 13 June 2022 16:55 , Adam Smith

Susannah Streeter, investment and markets analyst at Hargreaves Lansdown, told This Is Money: “As inflation proves to be an even trickier opponent to beat than expected, bitcoin and ether are continuing to get a severe bruising in the ring.

“They are prime victims of the flight away from risky assets as investors fret about spiraling consumer prices around the world.

“The worry is that inflation is becoming too hot to handle by central banks who will be forced to douse economies with jets of freezing water, in the form of much steeper interest rate rises, to get it under control.

“With the era of cheap money coming rapidly to an end, traders are becoming much more risk averse and turning their backs on crypto assets.”

Binance still blocking withdrawals

Monday 13 June 2022 16:43 , Adam Smith

Binance said that it would allow users to withdraw their bitcoin – admidst the market crash – three hours ago after a “stuck transaction causing a backlog”.

However, that has not happened. “This is only impacting the Bitcoin network. You can still withdraw Bitcoin on other networks like BEP-20”, Binance chief executive Changpeng Zhao tweeted.

“Likely this is going to take a bit longer to fix than my initial estimate. More updates soon. Thanks for your patience and understanding.”

Rising inflation is weighing on stocks

Monday 13 June 2022 16:30 , Adam Smith

“Bitcoin prices suffered after US CPI rose to a four-decade high. With fundamentals currently driving price action, the economic calendar remains key for digital assets. Throughout the week, the release of high-impact economic data has exacerbated fears of rising inflation, weighing on stocks and cryptos alike. With Bitcoin prices currently trading within a well-defined range, the key psychological level of $30,000 continues to provide a firm level of support and resistance for price action, holding both bulls and bears at bay”, Tammy Da Costa, analyst at DailyFX, a portal for financial market news.

“As the war in Ukraine rages on, rising food and energy costs continue to support higher prices, placing additional pressure on policymakers to implement more aggressive monetary tightening measures in an effort to drive inflation lower. With investors pricing in a negative growth outlook and a higher probability for the Federal Reserve to increase rates more aggressively than initially anticipated, Bitcoin bears were able to gain traction before finding support at around the $29,000 mark”, says Ms Da Costa.

“At the time of writing, Bitcoin has fallen by 37 per cent (YTD) as the speculative asset remains vulnerable to the geopolitical backdrop. Although fundamentals remain the prominent driver for price action, major technical levels may act as an additional catalyst for both the immediate and longer-term move.”

‘An unconfortable moment’

Monday 13 June 2022 16:20 , Adam Smith

“It’s still an uncomfortable moment, and there’s some contagion risk around crypto more broadly,” said Joseph Edwards, head of financial strategy at fund management firm Solrise Finance, as per Reuters.

Monday 13 June 2022 16:15 , Adam Smith

In April this year, UK chancellor Rishi Sunak tweeted that he was “working to make the UK a global cryptoassets hub” with the “businesses of tomorrow, and the jobs they create, here in the UK.”

Since that tweet, commentators have pointed out, Bitcoin has dropped 50 per cent.

Monday 13 June 2022 15:55 , Adam Smith

Mr Saylor himself has tweeted: In #Bitcoin We Trust.

Monday 13 June 2022 15:45 , Adam Smith

However, MicroStrategy does still hold “quite a bit” of uncollateralized Bitcoin that could assist it.

“As you can see, we mentioned previously we have quite a bit of uncollateralized Bitcoin,” Le said.

“So we have more that we could contribute in the case that we have a lot of downward volatility. But again, we’re talking about $21,000 before we get to a point where there needs to be more margin or more collateral contributors. So I think we’re in a pretty comfortable place where we are right now.”

Monday 13 June 2022 15:30 , Adam Smith

MicroStrategy’s chief financial officer Phong Le said in company’s first-quarter earnings call on Tuesday that if Bitcoin’s price falls below $21,000 the company will have to pay more cryptocurrency to maintain its $205 million Bitcoin-collateralized loan with Silvergate Bank – which was used to buy Bitcoin in the first place.

“We took out the loan at a 25% LTV; the margin call occurs at 50 per cent LTV,” Le said. “So essentially, Bitcoin needs to cut in half, or around $21,000, before we’d have a margin call.”

MicroStrategy might have to sell its holdings

Monday 13 June 2022 15:00 , Adam Smith

Business intelligence firm MicroStrategy have to sell a large amount of cryptocurrency should bitcoin drop further.

Chief executive Michael Saylor had the company stockpiling the cryptocurrency in August 2020.

MicroStrategy added another $215 million worth of Bitcoin at an average purchase price of $44,645 per coin in the first quarter.

Its total holding is 129,218 Bitcoins acquired for $3.97 billion, or $30,700 per coin, Fortune reports.

Celsius collapse: Crypto plunges after withdrawals suspended

Monday 13 June 2022 14:36 , Adam Smith

The Celsius cryptocurrency has now lost nearly 80 per cent of its value amid a major collapse that has wiped more than $400 billion from the crypto market.

The CEL token is affiliated with the lending platform Celsius Network, which suspended customer withdrawals on Sunday evening citing “extreme market conditions”.

Nexo co-founder Antoni Trenchev said on Monday that it had been in contact with Celsius “to discuss the acquisition of its collateralised loan portfolio”.

The Independent has reached out to Celsius for comment.

Monday 13 June 2022 14:30 , Adam Smith

Celsius stopping customers withdrawing their funds comes as a major u-turn after spending days rebutting accusations that users could not take out their funds.

Chief executive Alex Mashinsky challenged critics at the weekend to find “even one person who has a problem withdrawing”, the Financial Times reported.

The group’s own coin, CEL, has lost half its value in the past 24 hours.

Monday 13 June 2022 14:00 , Adam Smith

President Bukele posted pictures of a scale model of the crypto-fuelled city, which will be constructed near the Conchagua volcano on the Gulf of Fonseca in the south-east of the Central American country.

There will be no property, income or municipal taxes, nor will it produce any carbon dioxide emissions, should it be successful.

Geothermal energy from the volcano will be used to power the city, as well as to mine bitcoin.

Monday 13 June 2022 13:40 , Adam Smith

The market crash could have significant effects for people – and countries – heavily invested in crypto.

In May El Salvador, whose president has said he is building a ‘crypto utopia’, bought the dip after the last crypto crash. The country purchased 500 coins at an average USD price of approxmiately $30,744.

Now, however, those coins will be worth less. “Bitcoin now down almost a quarter since El Salvador’s president “bought the dip” last month”, tweeted Financial Times columnist Jemima Kelly.

“That’s over $3 million down the drain just in that last round of buying, in a country where 1 in 4 live below the poverty line”.

Monday 13 June 2022 13:20 , Adam Smith

Bitcoin could be on the verge of a breakdown and a ‘crypto winter’ might be approaching, one expert has suggested.

“Crypto hobbles into the week somewhat beholden to the whims of the stock markets, clearly on pins and needles over May inflation numbers – the U.S. Consumer Price Index (CPI) report dropped on Friday; its bottom line, not what anybody wanted to hear. Economists expected the CPI to rise 8.3% year over year, but the headline inflation level actually came in at 8.6%. Wall Street was groping for a sign that inflation may have peaked. So is the Federal Reserve”, Rich Blake, a financial consultant at Uphold, told The Independent.

“Minutes before Friday’s CPI report, Bitcoin was battling to stay above $30K. Hours earlier, it was under $29,000 and appeared to be on the verge of a breakdown. A looming hazard of a ‘crypto winter’, now hangs in the balance.”

Crypto exchange Binance blocks bitcoin withdrawals amid market collapse

Monday 13 June 2022 13:11 , Adam Smith

A stuck transaction meant there was a backlog in the company’s systems and it was unable to fulfil people’s requests, the company said.

Changpeng Zhao, the Binance chief executive who goes by the name CZ, said on Twitter that people’s funds were safe.

Monday 13 June 2022 13:00 , Adam Smith

It has been suggested that this price plunge reveals that investors are not as keen on crypto’s risk as much as they were. Cryptocurrency is one of the most volitile assets.

“The crypto market has been under pressure from the Federal Reserve, hiking the interest rates to combat inflation over the past few months. Bitcoin, Ethereum, and most cryptocurrencies suffered losses over the weekend after a broad sell-off following the data showing US inflation hitting a 40-year high,” said Edul Patel Co-Founder and CEO of crypto investment platform Mudrex, told Financial Express.

“As investors seem to have panicked, the number of crypto liquidations has been high since Friday. Bitcoin and Ethereum plummeted as much as 7 per cent each and are currently trading at their lowest at US$25,000 and US$1,300. The bearish trend may likely continue in the next coming days”

Monday 13 June 2022 12:40 , Adam Smith

Bitcoin has declined for nearly twelve straight weeks – one of the asset’s biggest slides in its lifetime.

Monday 13 June 2022 12:20 , Adam Smith

The collapse of Terraform Labs’ Luna and UST token last month wiped more than $40 billion from investors’ holdings.

Monday 13 June 2022 12:00 , Adam Smith

Amid the liquidations, crypto lender Celsius told customers that they would be temporarily unable to withdraw funds from the platform. This has been seen before, with Binance stopping owners withdrawing when the TerraLuna cryptocurrency crashed.

Monday 13 June 2022 11:55 , Adam Smith

“Now the clearest signal yet that cryptoassets such as bitcoin and ether are moving in lockstep with equities has flashed, as inflation worries have sent stocks and crypto tumbling. The reasons for this are varied, but much of it comes down to institutional holders, which calibrate their risk assets in similar ways, be they tech stocks or bitcoin.”

Monday 13 June 2022 11:50 , Adam Smith

The market crash also coincided with a similar capitulation of tech stocks in recent days, leading analysts to speculate that the two are reacting in tandem to external market forces.

“[Cryptocurrencies] have in the past not moved in step with traditional assets such as equities, however in recent times the link between the two has grown ever closer,” Simon Peters, an analyst at the online trading platform eToro, wrote in a note on Monday.

Monday 13 June 2022 11:40 , Adam Smith

There are a number of factors that have influenced this sell-off. In the United States and the United Kingdom, inflation is rising heavily and interest rates are likely to be increased to match.

Monday 13 June 2022 11:22 , Adam Smith

The cryptocurrency market cap fell under $1 trillion on Monday for the first time since February 2021, according to CoinMarketCap data.

Coins crash as the market falls

Monday 13 June 2022 11:12 , Adam Smith

Welcome to The Independent’s live tracking of the market crash. We start with one sobering fact: Not a single cryptocurrency in CoinMarketCap’s top 100 rankings saw any gains over the last day.