Does B.P. Marsh & Partners (LON:BPM) Deserve A Spot On Your Watchlist?

Table of Contents

For newcomers, it can appear like a great notion (and an fascinating prospect) to buy a corporation that tells a great tale to buyers, even if it at the moment lacks a keep track of file of earnings and gain. From time to time these tales can cloud the minds of investors, major them to devote with their emotions somewhat than on the advantage of very good company fundamentals. A reduction-creating enterprise is yet to prove alone with gain, and ultimately the influx of external funds may possibly dry up.

Inspite of being in the age of tech-stock blue-sky investing, many buyers still adopt a additional common method buying shares in profitable providers like B.P. Marsh & Partners (LON:BPM). Even though revenue isn’t really the sole metric that must be regarded as when investing, it’s really worth recognising enterprises that can consistently produce it.

See our latest assessment for B.P. Marsh & Partners

How Speedy Is B.P. Marsh & Associates Growing?

Generally, corporations dealing with progress in earnings for every share (EPS) really should see related trends in share price. That signifies EPS development is regarded a serious favourable by most productive extended-expression buyers. In excess of the last 3 yrs, B.P. Marsh & Companions has developed EPS by 7.5% for every calendar year. This could not be placing the entire world alight, but it does present that EPS is on the upwards development.

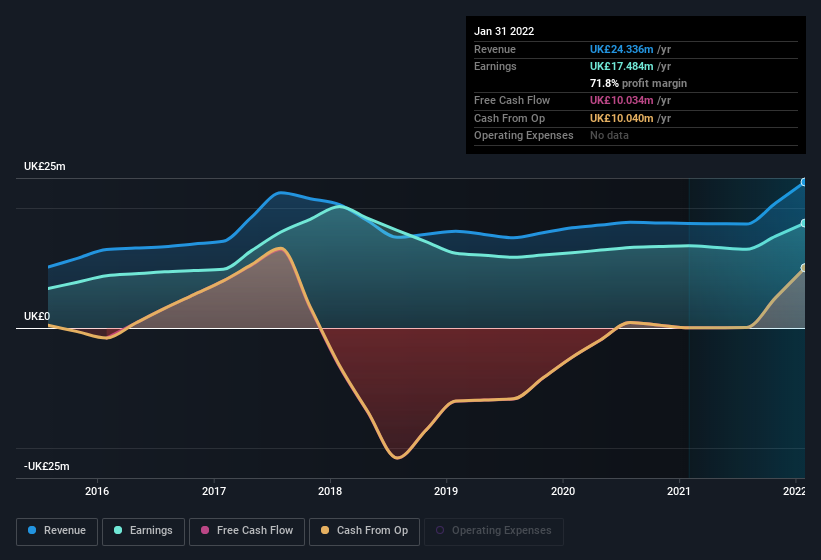

Top rated-line progress is a good indicator that advancement is sustainable, and merged with a large earnings in advance of desire and taxation (EBIT) margin, it’s a great way for a corporation to retain a competitive edge in the market place. Our evaluation has highlighted that B.P. Marsh & Partners’ profits from operations did not account for all of their income in the past 12 months, so our analysis of its margins could not accurately replicate the underlying business enterprise. B.P. Marsh & Associates maintained stable EBIT margins around the past year, all whilst growing income 40% to UK£24m. Which is a actual beneficial.

In the chart below, you can see how the organization has developed earnings and revenue, over time. Click on the chart to see the precise quantities.

B.P. Marsh & Associates just isn’t a substantial company, given its current market capitalisation of UK£116m. That makes it additional significant to verify on its equilibrium sheet power.

Are B.P. Marsh & Associates Insiders Aligned With All Shareholders?

Theory would propose that it can be an encouraging indicator to see high insider possession of a corporation, given that it ties organization efficiency right to the money accomplishment of its administration. So we are delighted to report that B.P. Marsh & Companions insiders own a significant share of the enterprise. Proudly owning 44% of the firm, insiders have plenty riding on the efficiency of the the share cost. People who are comforted by solid insider ownership like this ought to be content, as it implies that all those functioning the company are truly motivated to generate shareholder worth. In phrases of absolute value, insiders have UK£51m invested in the organization, at the present-day share price tag. So there’s loads there to retain them centered!

Is B.P. Marsh & Companions Value Maintaining An Eye On?

One good for B.P. Marsh & Associates is that it is expanding EPS. That’s pleasant to see. For all those who are wanting for a little extra than this, the substantial stage of insider possession boosts our enthusiasm for this growth. The blend certainly favoured by buyers so take into account trying to keep the enterprise on a watchlist. Before you get the following step you really should know about the 1 warning indication for B.P. Marsh & Companions that we have uncovered.

The beauty of investing is that you can spend in just about any company you want. But if you choose to concentration on stocks that have demonstrated insider shopping for, in this article is a checklist of companies with insider acquiring in the previous three months.

Please note the insider transactions discussed in this short article refer to reportable transactions in the applicable jurisdiction.

Have comments on this write-up? Anxious about the content material? Get in touch with us directly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This posting by Simply just Wall St is common in character. We deliver commentary based mostly on historical details and analyst forecasts only using an impartial methodology and our articles or blog posts are not meant to be fiscal advice. It does not constitute a advice to buy or offer any stock, and does not acquire account of your goals, or your fiscal problem. We goal to deliver you prolonged-phrase concentrated examination pushed by essential knowledge. Notice that our assessment may not factor in the hottest price tag-sensitive enterprise announcements or qualitative product. Only Wall St has no posture in any shares talked about.