Here is What to Know Beyond Why Tesla, Inc. (TSLA) is a Trending Stock

Tesla (TSLA) has just lately been on Zacks.com’s list of the most searched shares. For that reason, you may well want to think about some of the key components that could impact the stock’s general performance in the near long term.

More than the previous thirty day period, shares of this electric vehicle maker have returned -3.1%, as opposed to the Zacks S&P 500 composite’s -6.6% transform. For the duration of this interval, the Zacks Automotive – Domestic field, which Tesla falls in, has misplaced 9.3%. The vital concern now is: What could be the stock’s long term direction?

While media releases or rumors about a sizeable modify in a company’s company prospects typically make its inventory ‘trending’ and guide to an immediate price tag adjust, there are generally some basic specifics that eventually dominate the get-and-hold final decision-making.

Earnings Estimate Revisions

In this article at Zacks, we prioritize appraising the transform in the projection of a company’s upcoming earnings above anything at all else. Which is simply because we believe that the current worth of its potential stream of earnings is what determines the truthful worth for its inventory.

We in essence glimpse at how provide-side analysts masking the stock are revising their earnings estimates to replicate the effect of the newest business enterprise trends. And if earnings estimates go up for a corporation, the honest value for its inventory goes up. A bigger reasonable price than the present market rate drives investors’ fascination in shopping for the stock, primary to its cost moving increased. This is why empirical study demonstrates a powerful correlation in between trends in earnings estimate revisions and close to-term inventory rate movements.

For the existing quarter, Tesla is expected to publish earnings of $2 per share, indicating a transform of +37.9% from the yr-ago quarter. The Zacks Consensus Estimate has modified -.4% more than the final 30 times.

For the current fiscal 12 months, the consensus earnings estimate of $11.17 points to a improve of +64.8% from the prior year. More than the previous 30 times, this estimate has changed -.7%.

For the upcoming fiscal 12 months, the consensus earnings estimate of $14.10 implies a adjust of +26.2% from what Tesla is predicted to report a calendar year in the past. Over the previous month, the estimate has transformed +1.2%.

Acquiring a potent externally audited observe record, our proprietary stock rating resource, the Zacks Rank, features a additional conclusive picture of a stock’s rate way in the close to time period, considering the fact that it efficiently harnesses the ability of earnings estimate revisions. Because of to the dimensions of the recent modify in the consensus estimate, along with 3 other components linked to earnings estimates, Tesla is rated Zacks Rank #3 (Hold).

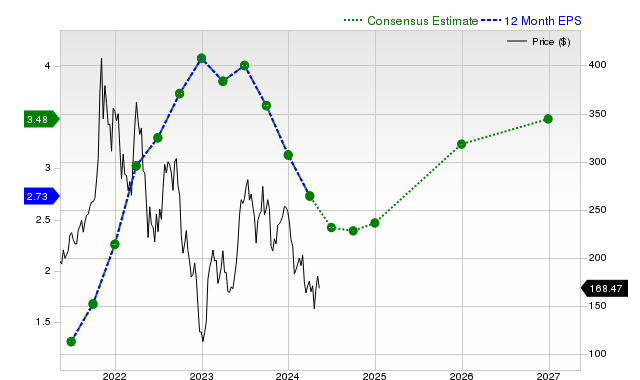

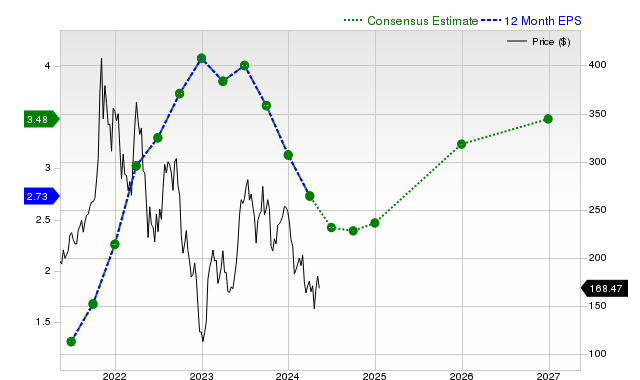

The chart below displays the evolution of the firm’s ahead 12-thirty day period consensus EPS estimate:

12 Thirty day period EPS

Profits Expansion Forecast

Even however a company’s earnings progress is arguably the greatest indicator of its economic wellbeing, absolutely nothing much comes about if it are unable to increase its revenues. It’s just about difficult for a organization to develop its earnings without having rising its revenue for long durations. For that reason, being aware of a firm’s potential revenue advancement is vital.

For Tesla, the consensus sales estimate for the current quarter of $17.92 billion signifies a year-in excess of-year improve of +49.9%. For the latest and future fiscal several years, $84.7 billion and $113.12 billion estimates show +57.4% and +33.6% improvements, respectively.

Very last Documented Effects and Shock Heritage

Tesla claimed revenues of $18.76 billion in the past described quarter, symbolizing a yr-about-year alter of +80.5%. EPS of $3.22 for the same interval compares with $.93 a yr in the past.

Compared to the Zacks Consensus Estimate of $17.28 billion, the claimed revenues represent a shock of +8.57%. The EPS surprise was +49.77%.

The firm conquer consensus EPS estimates in each individual of the trailing four quarters. The firm topped consensus profits estimates just about every time more than this period.

Valuation

With out contemplating a stock’s valuation, no investment final decision can be productive. In predicting a stock’s potential rate functionality, it truly is vital to ascertain whether its latest price tag properly demonstrates the intrinsic price of the fundamental business and the company’s expansion potential customers.

Though comparing the recent values of a firm’s valuation multiples, these as price-to-earnings (P/E), price tag-to-income (P/S) and rate-to-dollars move (P/CF), with its individual historic values aids identify no matter if its inventory is fairly valued, overvalued, or undervalued, comparing the organization relative to its friends on these parameters provides a superior sense of the reasonability of the stock’s selling price.

As part of the Zacks Type Scores method, the Zacks Price Design and style Rating (which evaluates both of those common and unconventional valuation metrics) organizes stocks into five groups ranging from A to F (A is improved than B B is far better than C and so on), producing it useful in identifying irrespective of whether a stock is overvalued, rightly valued, or briefly undervalued.

Tesla is graded D on this entrance, indicating that it is investing at a high quality to its friends. Simply click listed here to see the values of some of the valuation metrics that have pushed this quality.

Summary

The information talked over in this article and considerably other information on Zacks.com could possibly enable ascertain regardless of whether or not it truly is worthwhile paying interest to the industry excitement about Tesla. Even so, its Zacks Rank #3 does advise that it could accomplish in line with the broader industry in the around expression.

Want the latest recommendations from Zacks Expenditure Study? Today, you can obtain 7 Ideal Stocks for the Subsequent 30 Times. Click to get this totally free report

Tesla, Inc. (TSLA) : No cost Stock Investigation Report

To read through this post on Zacks.com simply click right here.

)