Here is What You Should Know

Tesla (TSLA) has been just one of the most searched-for stocks on Zacks.com lately. So, you might want to look at some of the information that could shape the stock’s performance in the near expression.

Shares of this electrical automobile maker have returned -12.8% around the earlier thirty day period versus the Zacks S&P 500 composite’s -.5% improve. The Zacks Automotive – Domestic field, to which Tesla belongs, has lost 11.2% over this period. Now the vital dilemma is: Where by could the stock be headed in the close to term?

While media releases or rumors about a substantial change in a company’s company potential clients commonly make its stock ‘trending’ and guide to an immediate price tag adjust, there are usually some essential specifics that inevitably dominate the acquire-and-hold conclusion-creating.

Earnings Estimate Revisions

Somewhat than focusing on just about anything else, we at Zacks prioritize evaluating the modify in a firm’s earnings projection. This is simply because we consider the fair price for its stock is determined by the current value of its long term stream of earnings.

We primarily glance at how market-aspect analysts covering the stock are revising their earnings estimates to reflect the affect of the most recent business enterprise traits. And if earnings estimates go up for a business, the honest price for its stock goes up. A larger truthful worth than the current marketplace cost drives investors’ interest in obtaining the stock, leading to its value relocating larger. This is why empirical study displays a strong correlation between trends in earnings estimate revisions and around-term inventory value actions.

Tesla is predicted to write-up earnings of $2.13 per share for the current quarter, representing a calendar year-about-yr improve of +46.9%. Above the final 30 times, the Zacks Consensus Estimate has modified -10.7%.

For the current fiscal yr, the consensus earnings estimate of $11.18 details to a change of +64.9% from the prior calendar year. In excess of the past 30 days, this estimate has altered -.5%.

For the future fiscal year, the consensus earnings estimate of $13.48 suggests a change of +20.6% from what Tesla is envisioned to report a yr in the past. Around the earlier thirty day period, the estimate has transformed +105.9%.

Having a solid externally audited keep track of report, our proprietary inventory score device, the Zacks Rank, offers a far more conclusive photo of a stock’s cost way in the near phrase, because it correctly harnesses the power of earnings estimate revisions. Owing to the dimension of the recent alter in the consensus estimate, together with 3 other factors connected to earnings estimates, Tesla is rated Zacks Rank #3 (Hold).

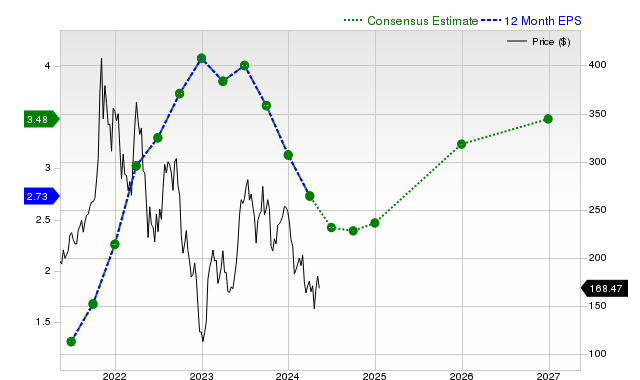

The chart beneath reveals the evolution of the company’s ahead 12-thirty day period consensus EPS estimate:

12 Thirty day period EPS

Profits Expansion Forecast

Even however a company’s earnings development is arguably the most effective indicator of its financial wellness, absolutely nothing considerably takes place if it are unable to elevate its revenues. It truly is practically not possible for a organization to improve its earnings with out developing its income for prolonged intervals. Thus, realizing a firm’s potential revenue expansion is very important.

In the circumstance of Tesla, the consensus income estimate of $18.59 billion for the latest quarter factors to a 12 months-in excess of-year modify of +55.5%. The $85.77 billion and $113.05 billion estimates for the current and up coming fiscal decades suggest adjustments of +59.4% and +31.8%, respectively.

Very last Claimed Effects and Surprise History

Tesla documented revenues of $18.76 billion in the final noted quarter, representing a calendar year-around-year change of +80.5%. EPS of $3.22 for the exact time period compares with $.93 a 12 months in the past.

As opposed to the Zacks Consensus Estimate of $17.28 billion, the noted revenues represent a shock of +8.57%. The EPS surprise was +49.77%.

The firm defeat consensus EPS estimates in each of the trailing 4 quarters. The firm topped consensus revenue estimates just about every time in excess of this time period.

Valuation

With out taking into consideration a stock’s valuation, no expenditure decision can be successful. In predicting a stock’s long term rate functionality, it really is very important to ascertain irrespective of whether its recent value accurately displays the intrinsic worth of the fundamental company and the company’s advancement potential clients.

Evaluating the present-day price of a firm’s valuation multiples, this kind of as its value-to-earnings (P/E), value-to-gross sales (P/S), and cost-to-dollars circulation (P/CF), to its personal historic values allows ascertain no matter if its inventory is rather valued, overvalued, or undervalued, while comparing the business relative to its peers on these parameters provides a very good perception of how fair its stock price is.

The Zacks Benefit Fashion Rating (component of the Zacks Model Scores program), which pays shut consideration to the two common and unconventional valuation metrics to grade shares from A to F (an An is greater than a B a B is much better than a C and so on), is fairly practical in identifying irrespective of whether a inventory is overvalued, rightly valued, or temporarily undervalued.

Tesla is graded D on this front, indicating that it is trading at a quality to its friends. Click right here to see the values of some of the valuation metrics that have driven this grade.

Conclusion

The information discussed in this article and a lot other info on Zacks.com may well enable identify regardless of whether or not it is really worthwhile paying interest to the marketplace buzz about Tesla. However, its Zacks Rank #3 does recommend that it may carry out in line with the broader market place in the in the vicinity of phrase.

Want the most current tips from Zacks Investment decision Investigation? These days, you can obtain 7 Greatest Stocks for the Subsequent 30 Days. Simply click to get this free report

Tesla, Inc. (TSLA) : Absolutely free Inventory Evaluation Report

To go through this short article on Zacks.com simply click below.

)