Opinion: Inflation hasn’t been bad for everyone — companies are producing outsized profits

Table of Contents

The maximum inflation premiums in 4 many years are squeezing the people today, but organizations are carrying out very nicely.

Even though wages and other kinds of personalized incomes go on to drop powering inflation, company profits obtaining been soaring, the government’s Bureau of Financial Assessment noted Thursday.

A lot more on the GDP report: GDP shrank at .6% annual tempo in second quarter, but it wasn’t all terrible information

After-tax company revenue rose at a 41% once-a-year level soon after inflation in the 2nd quarter of the 12 months and have risen at a 17% yearly pace considering that the pandemic recession ended two yrs back. Meanwhile, the inflation-altered purchasing electricity of individuals’ following-tax cash flow has fallen for five quarters in a row.

“ These details blow a incredibly big gap in the prevailing principle of inflation, which holds that prices are large since typical individuals have much too considerably money to expend. ”

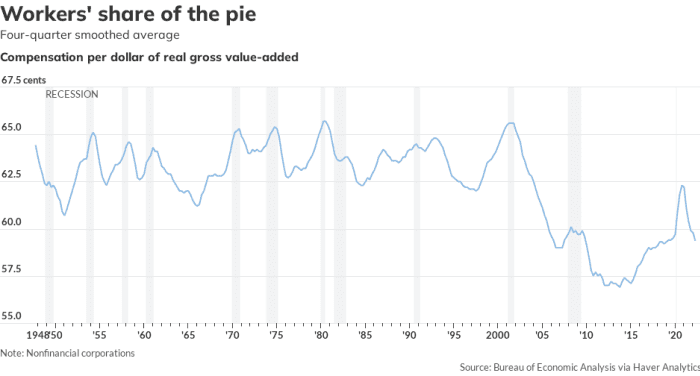

Stated simply just, workers’ share of the nationwide pie is shrinking, though corporate house owners are using considerably additional than they applied to.

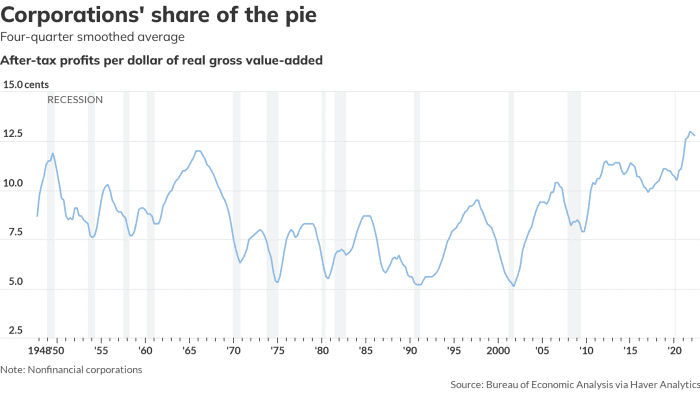

Immediately after-tax income margins have risen to document degrees because the pandemic recession ended.

MarketWatch

Gain margins are way up

The government details let us glance inside of the nonfinancial corporate sector, which has a gross benefit additional of far more than $13 trillion yearly. Gross value added is the price a business produces in the manufacturing process. It is the big difference among a company’s expenditures for the inputs it buys and the income income it receives.

For each and every dollar of gross worth included, personnel acquired 59 cents taxes, depreciation and other set costs took 28 cents and homeowners obtained the remaining 13 cents in just after-tax gains.

Financial gain margins established a record at 13.5% of gross valued extra in the second quarter of 2021 and have barely come down from that peak even with inflation raging at 40-yr highs. The last time inflation was this incredibly hot, income margins ended up only fifty percent as higher.

Far more on revenue margins: Corporate revenue is at a stage properly past what we have at any time viewed, and it is predicted to retain rising

The extended-time period averages for these numbers are 63% for workers’ wages and added benefits, 28% for taxes, depreciation and mounted prices, and 9% for owners’ revenue.

As opposed with the historic averages, the present increased earnings margins are coming at the expense of wages.

In advance of the pandemic, gain margins had hardly ever exceeded 13% and had topped 12% on just two situations: in 1949 and in 1965. In the very last eight quarters considering that the pandemic economic downturn ended, margins have accelerated previous 13% a few times and exceeded 12% in 3 other quarters.

Personnel wages and gains are a more compact share of gross worth included considering the fact that the pandemic finished.

MarketWatch

Companies hoard all the cash

These points blow a incredibly large gap in the prevailing concept of inflation, which retains that price ranges are significant due to the fact typical folks have too much funds to shell out. Better wages, it’s thought, are forcing companies to increase their offering rates, which then prompts personnel in switch to demand even bigger wages, and so forth.

This so-identified as wage-selling price spiral principle of inflation is the foundation of the Federal Reserve’s plan to starve inflation by slowing the expansion of individual money and thereby stopping the persons from hoping to purchase much more stuff than the financial state can make.

Some men and women — mainly Democrats — have proposed an substitute theory of inflation that places corporate incomes in the photograph. Whether or not you contact it selling price gouging, corporate greed or just organization as typical, this principle indicates that the pandemic broke a thing in the economic climate that previously experienced retained inflation in look at. For whatever explanation, companies regained the skill to established charges.

When businesses can raise selling prices devoid of hurting their profit margins, they will. The details unveiled by the federal government on Thursday is proof that charging bigger selling prices hasn’t damage corporations’ base line at all. In fact, greater price ranges have been a boon for corporations.

A lot more on company pricing electrical power: Organizations are applying the suffering of inflation as an prospect to increase earnings and line shareholder pockets, report exhibits

And this: Wsick providers keep on to elevate charges to maintain their history earnings margins?

And what about the staff? The information present that hourly payment declined at a 1.5% annual fee in the very first 50 percent of the yr soon after changing for bigger prices and is now down 2.3% considering the fact that the conclusion of the pandemic economic downturn.

That is a whole lot of figures to digest, I know. But here’s the bottom line: Immediately after changing for inflation, company gains are up, and hourly compensation is down.

That doesn’t sound like a entire world in which employees have the higher hand when it arrives to bargaining with their bosses. And it doesn’t seem like the textbooks that blame inflation on frequent individuals acquiring too a lot cash.

Rex Nutting is a columnist for MarketWatch who has been masking the economic system for a lot more than 25 many years.

Much more on inflation from Rex Nutting

Stop misreading the Fed: It is not getting cold toes about wrestling inflation to the ground

Inflation hasn’t peaked but for the reason that rents are however climbing rapidly

Why curiosity prices aren’t truly the suitable resource to control inflation