Southern Company Q2 Earnings: Still A Hold; Less Margin Of Safety (NYSE:SO)

Table of Contents

WangAnQi

Introduction

As a dividend growth investor, I constantly seek opportunities to acquire income-producing assets. I own several dozens of shares in my dividend growth portfolio. Sometimes I add to existing positions when priced attractively. On other occasions, I start new positions in companies offering me additional exposure to industries where l lack exposure.

Southern Company (NYSE:SO) reported its results for the second quarter on July 28th. As a shareholder who hasn’t revisited and analyzed the stock for a couple of years, I saw it as an opportunity. The company is one of my holdings in the utility sector. It is a highly stable sector, and some investors might favor it, especially when the market becomes volatile.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

The Southern Company engages in the generation, transmission, and distribution of electricity. It operates through Gas Distribution Operations, Gas Pipeline Investments, Wholesale Gas Services, and Gas Marketing Services. The company also develops, constructs, acquires, owns, and manages power generation assets, including renewable energy projects, and sells electricity in the wholesale market.

Fundamentals

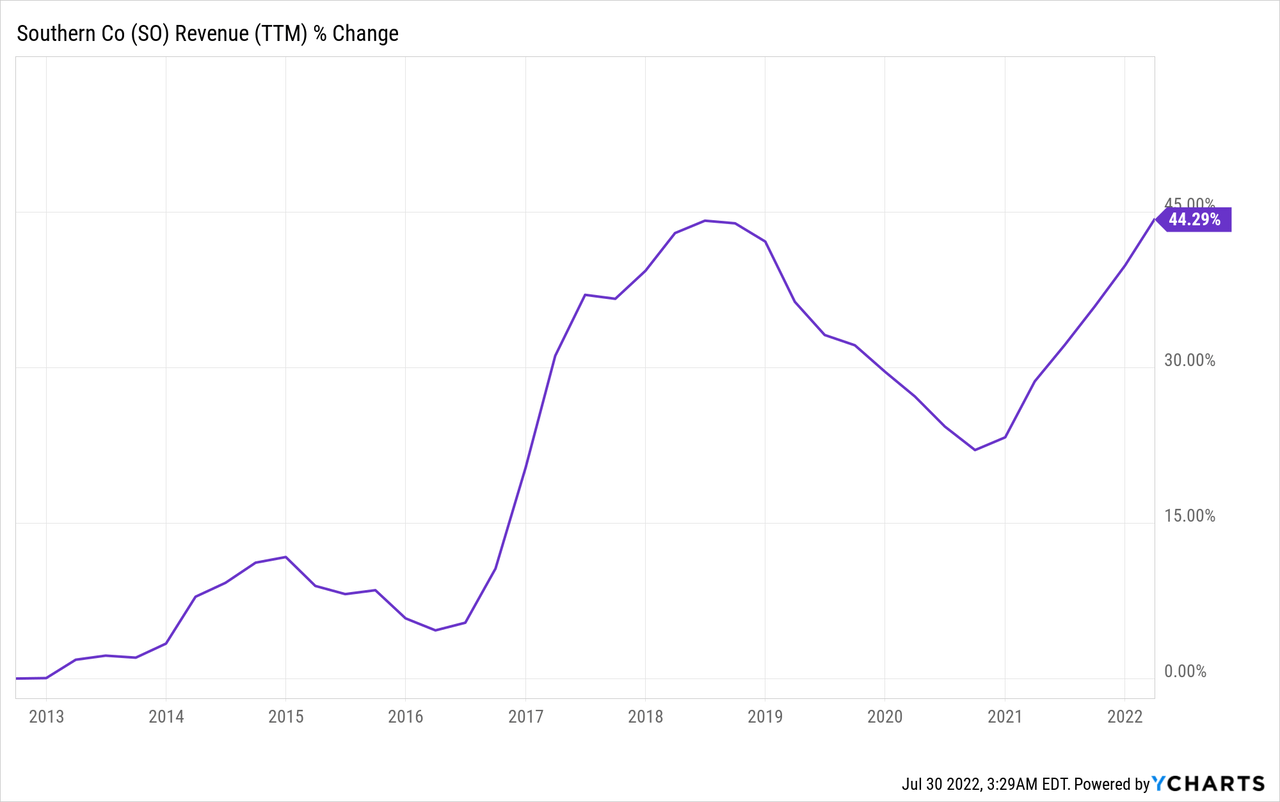

The revenues of Southern Company have increased by 44% over the last decade. It is a slow growth rate of ~3% annually, yet the growth rate is highly dependable in the long term. The company is growing by supplying additional power and gas to its clients. It also grows as the number of clients in the territory it serves increases. Acquisitions of peers are the third growth path for the company. In the future, analysts’ consensus, as seen on Seeking Alpha, expects The Southern Company to keep growing sales at an annual rate of ~4% in the medium term.

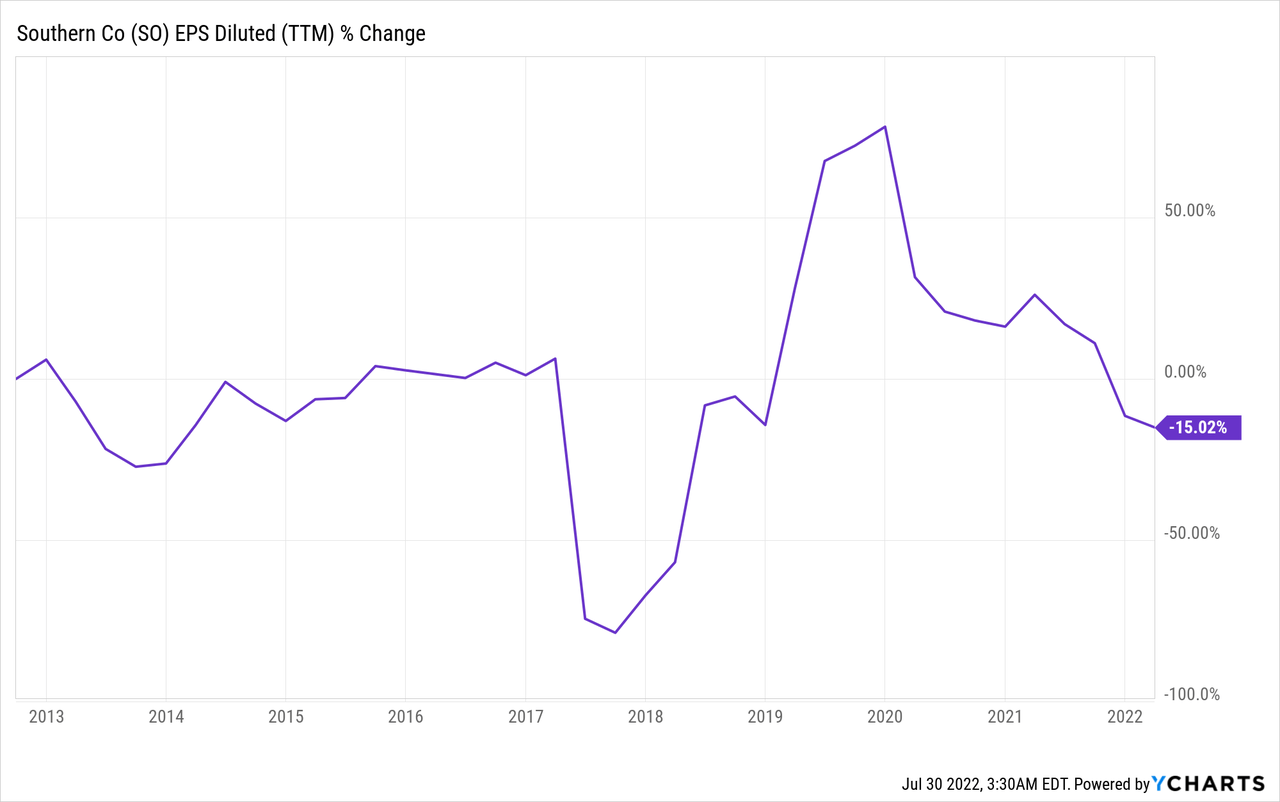

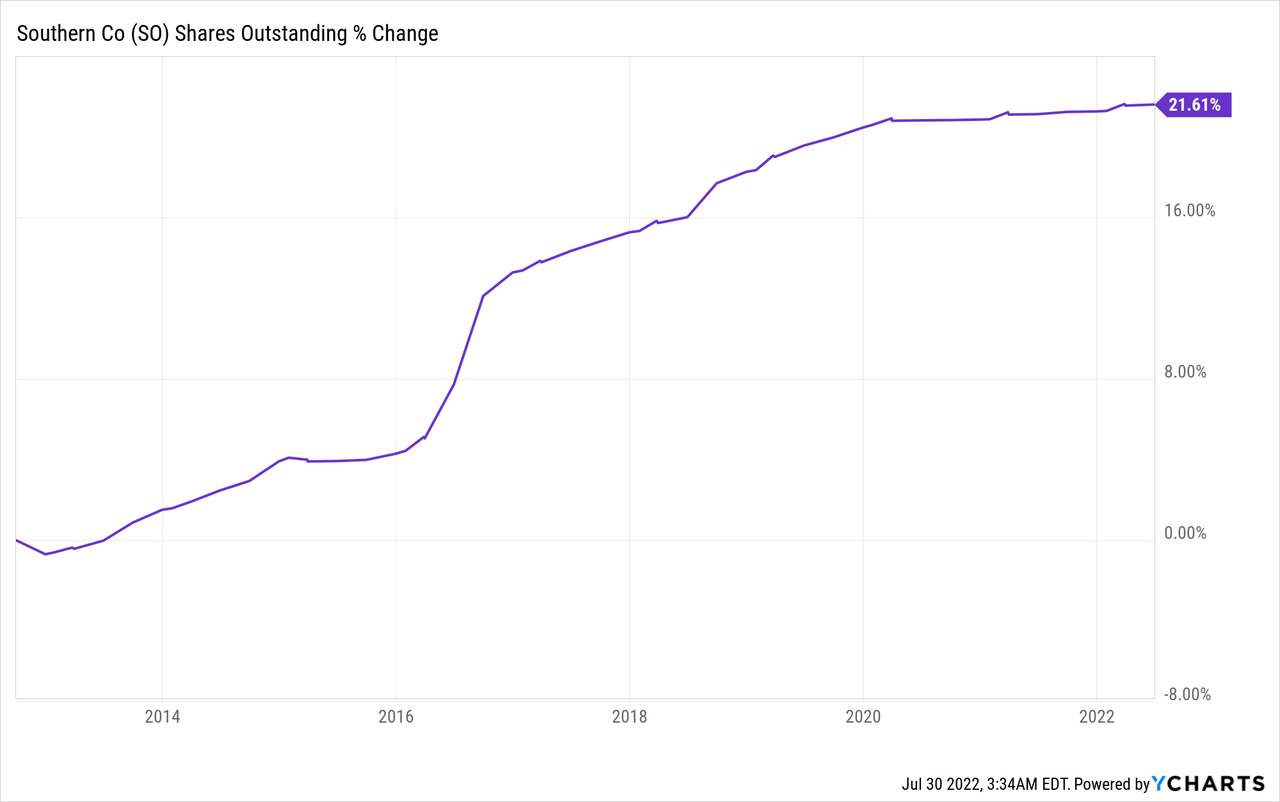

The EPS (earnings per share) may look a bit misleading. The GAAP numbers show that the company’s EPS declined by 15%. It is due to many accounting losses and one-time expenses associated with projects prolonging and going online. The non-GAAP figure shows a 27% increase in the EPS resulting from share issuance, diluting the sales growth. In the future, analysts’ consensus, as seen on Seeking Alpha, expects The Southern Company to keep growing EPS at an annual rate of ~6.5% in the medium term.

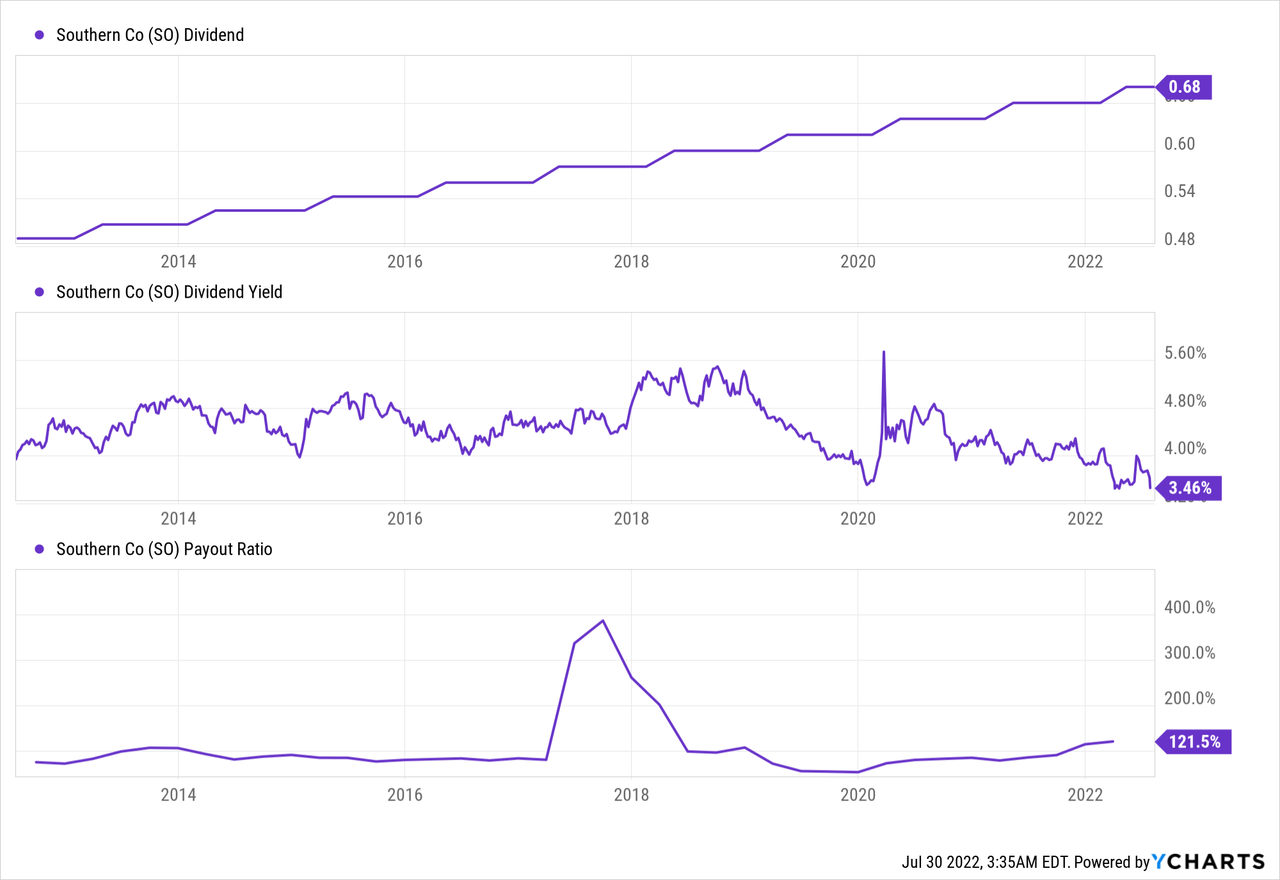

The dividend has been growing for 20 years in a row. The latest increase was a 3% increase in June. The current dividend yield is low compared to the last decade and stands below 3.5%. It is because investors flock to safer income-producing investments during that time. The current payout ratio may look unsustainable at 120%, but this is the figure using GAAP earnings. Non-GAAP payout ratio stands at 77%, which is high yet sustainable as the company is a regulated monopoly.

In addition to dividends, companies can return capital to shareholders via buybacks. Buybacks can support EPS growth for growing companies and are a good use of excess cash flow. Southern Company has diluted its shareholders. It did it to fund acquisitions and its growth projects as it needed additional resources due to cost overruns. Since the pandemic, the company doesn’t dilute its shareholders significantly, which is positive.

Valuation

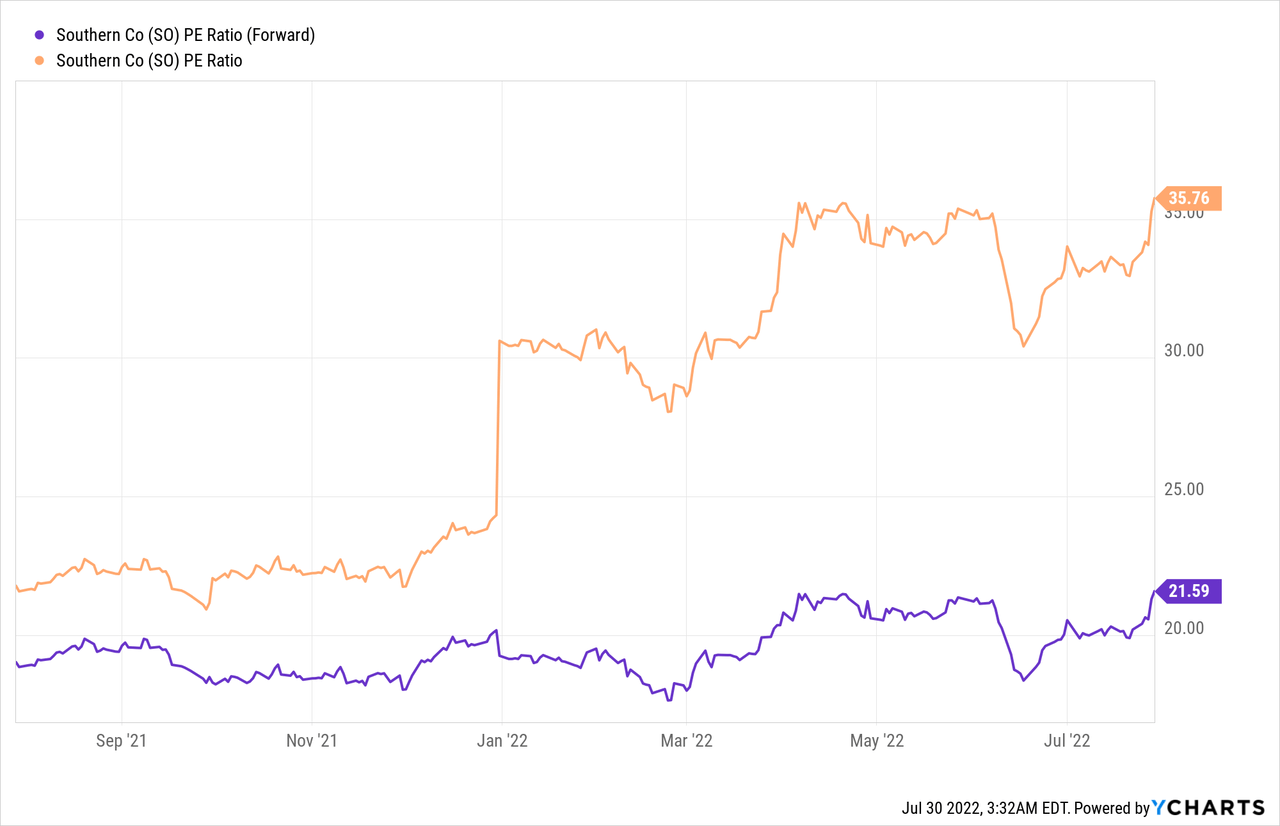

The P/E (price to earnings) ratio of Southern Company stands at 36 when looking at the GAAP earnings of 2021 and 21.5 when considering the current forecast for 2022. Both figures seem high, as paying 21 times earnings for a company that grows at 6.5% annually when interest rates are climbing is too risky. This valuation may leave investors with little to no margin of safety.

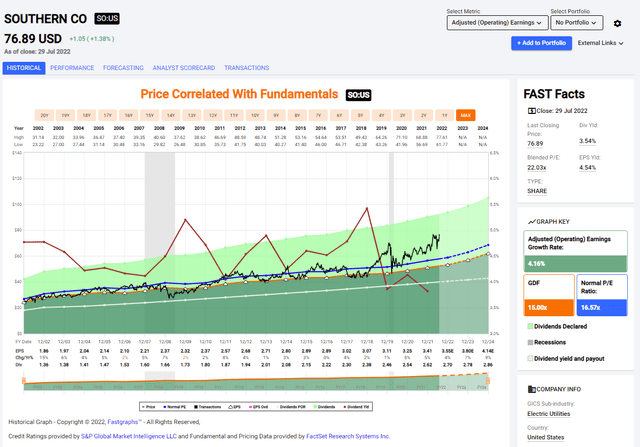

The graph below from Fastgraphs also shows how the company might be overvalued. The company’s average P/E ratio in the past 20 years was 16.5, significantly lower than the current 21.5. While the growth rate in the past was also lower than the company’s current forecast, I believe that the fundamentals do not justify this valuation gap. Investors likely choose safer stocks, but this trend may change in the medium term.

To conclude, Southern Company offers investors solid fundamentals despite its slow growth. It steadily grows the top and bottom line and fuels dividend growth for two decades. However, investors flocked to the stability of Southern Company, and the current valuation seems high to me. The company will have to offer extraordinary growth opportunities to justify such valuation when we remember that it is a regulated utility.

Opportunities

The Vogtle may finally go online. The company has been building units 3 and 4 for nearly a decade in a project that suffered severe delays and overruns. The project was supposed to be completed over a year ago, and right now, unit 3 may be online in 6-9 months and unit 4 in Q4 2023. It will allow the company to finally capitalize on its investments and, just as important, finish with the never-ending overruns as the construction cost is already estimated at $25B.

Demographics are another critical growth opportunity for Southern Company. The company serves clients mainly in the southern part of the U.S, which enjoys demographic growth. It helped the company as it added almost 12,000 residential electric customers and over 7,000 residential gas customers during the quarter. The demographic trend will continue to support the long-term demand for energy and gas.

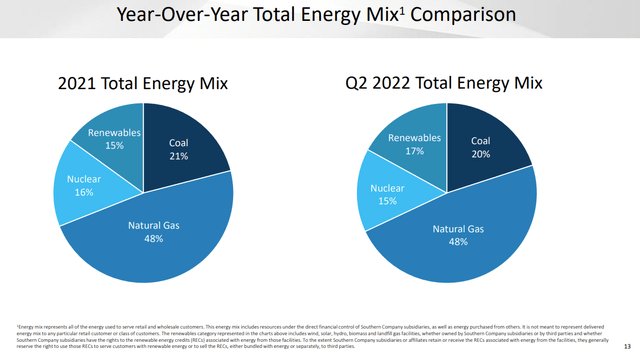

Another opportunity for Southern Company is its improvement in the energy mix. The company is shifting its production from coal to cleaner energies such as natural gas, nuclear, and renewables. In the last two quarters, the company increased its usage of renewables, and when Vogtle is online in 2023, coal’s share will decrease even more. There is high demand for clean energy, and it can justify price increases and a favorable regulatory environment.

Risks

There is a risk of execution in the short term. The company proved, especially as it battled with the Vogtle project, that it struggles to execute plans accordingly. It may be expected with large projects, yet we seek stability and transparency as investors. To maintain its long-term EPS growth trajectory, the company will have to prove that it can finish its projects in time and without exceeding the budget.

Long-term debt is another risk for Southern Company. The company has more than $52B in debt. The debt is paid for the construction of its projects and is managed carefully as the company pays billions of dollars annually. The current business environment will make the debt more expensive with higher interest rates. The company is expected to deal with higher interest expenses as time passes, and it has to refinance some debt.

Inflation is a risk for Southern Company as the prices of materials needed to produce energy and labor costs are increasing. The company may have to raise prices, but it will require regulatory approval from politicians who may be reluctant to suffer the backlash from their constituents and thus will try to delay it. Moreover, the current share price doesn’t price the risks, leaving the investors with a minimal margin of safety.

Conclusion

The Southern Company is reliable. It is the second largest utility company in the United States regarding client base. Thus, it enjoys a steady stream of revenues as people consume more electricity and gas. The continued growth in revenues and EPS leads to constant growth in dividends. The company also has several growth opportunities that will serve it going forward as it enjoys favorable demographics and the completion of critical projects.

However, there are also several risks to the investment thesis. The company struggles to execute, deals with a significant debt load, and leaves investors with little margin of safety. On top of that, the current valuation seems too high for me, and I don’t believe the company is justifying the premium with its future growth trajectory. Therefore, I think Southern Company is a HOLD at this price, and investors should wait until the P/E ratio of 16-18.