Tesla May Have Significant Trouble During A Recession (NASDAQ:TSLA)

Table of Contents

Justin Sullivan/Getty Images News

Tesla, Inc. (NASDAQ:TSLA) has seen a consistent decline in its share price over the last 8 months, with its market cap dropping by more than 40% or almost $500 billion. The company was in the news once again, with Elon Musk discussing how new car factories in Texas and Berlin are losing billions of dollars. As we’ll see throughout this article, Tesla might not survive the next recession.

Tesla New Factory Trouble

Tesla’s new factory trouble is foreboding and dangerous. Car factories are incredibly expensive to operate.

Elon Musk didn’t give specifics of the timeframe of the cost. However, he did specify:

“Overwhelmingly our concern is, how do we keep the factories operating so we can pay people and not go bankrupt?” he said.” – Axios

and

“Musk told Bloomberg earlier this week that supply constraints are the biggest threat to growth for Tesla as he confirmed job cuts of up to 3.5%.” – Axios

The company’s confirmed job cuts in an expensive, tough-to-hire industry when its peers haven’t had to do the same is dangerous and foreboding. Especially when the company is bringing up bankruptcy as a talking point when talking about how much money these factories are losing. That’s not something you want to hear from a $750 billion company.

The Austin factory is expected to be a $10+ billion project, producing 500k+ vehicles a year. In Shanghai, the company has also seen shutdowns, but production is expected to reach almost 1 million vehicles / year, assuming the company can get the components it needs and ramp production as expected. Right now, these are two big “ifs” for 1.5 million vehicles / year.

The focus will be the Model Y. This new factory trouble could delay the company’s ramp timeline by 1-2 years and cost billions.

Luxury In A Recession

At the same time, Tesla continues to have a more luxury brand. During the 2008 recession, luxury car sales dropped almost 35%, with strong drops in sales for normal cars as well. That could present an incredibly troubling position for Tesla, which has never been through such a downturn since it became a market leader, especially when the company is trying to allocate capital for a ramp-up.

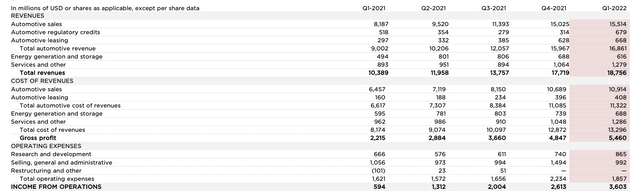

Estimates are that labor + material costs make up approximately 68% of a vehicle’s total costs. That means fixed costs are 32%. Let’s imagine a hypothetical scenario where there’s a 35% decline in sales with the company’s $18.8 billion in 1Q 2022 revenue (or $75 billion in annualized revenue assuming the growth stagnates).

From that $75 billion in revenue, the company’s total cost of revenues (including R&D etc.) are roughly $60 billion, implying $15 billion in gross margin. Out of that $60 billion, roughly $19.2 billion are fixed costs and $40.8 billion are variable costs, meaning a net 54% cost of revenue variable cost for manufacturing.

*Note: We use generic auto industry averages since Tesla doesn’t give an exact breakdown of fixed costs.

With a 35% revenue decline, Tesla’s $75 billion in revenue becomes $48.75 billion. The $19.2 billion fixed cost number remains the same, but the 54% variable costs becomes $26.3 billion in reduced costs. That puts the company’s total costs at $45.5 billion, meaning ~$750 million in quarterly profit or 20% of its current profit (and a P/E of 250+).

That weakness could suggest how Tesla struggles in a recession.

Competition

Tesla is entering the market with one of its weakest market positions in its history.

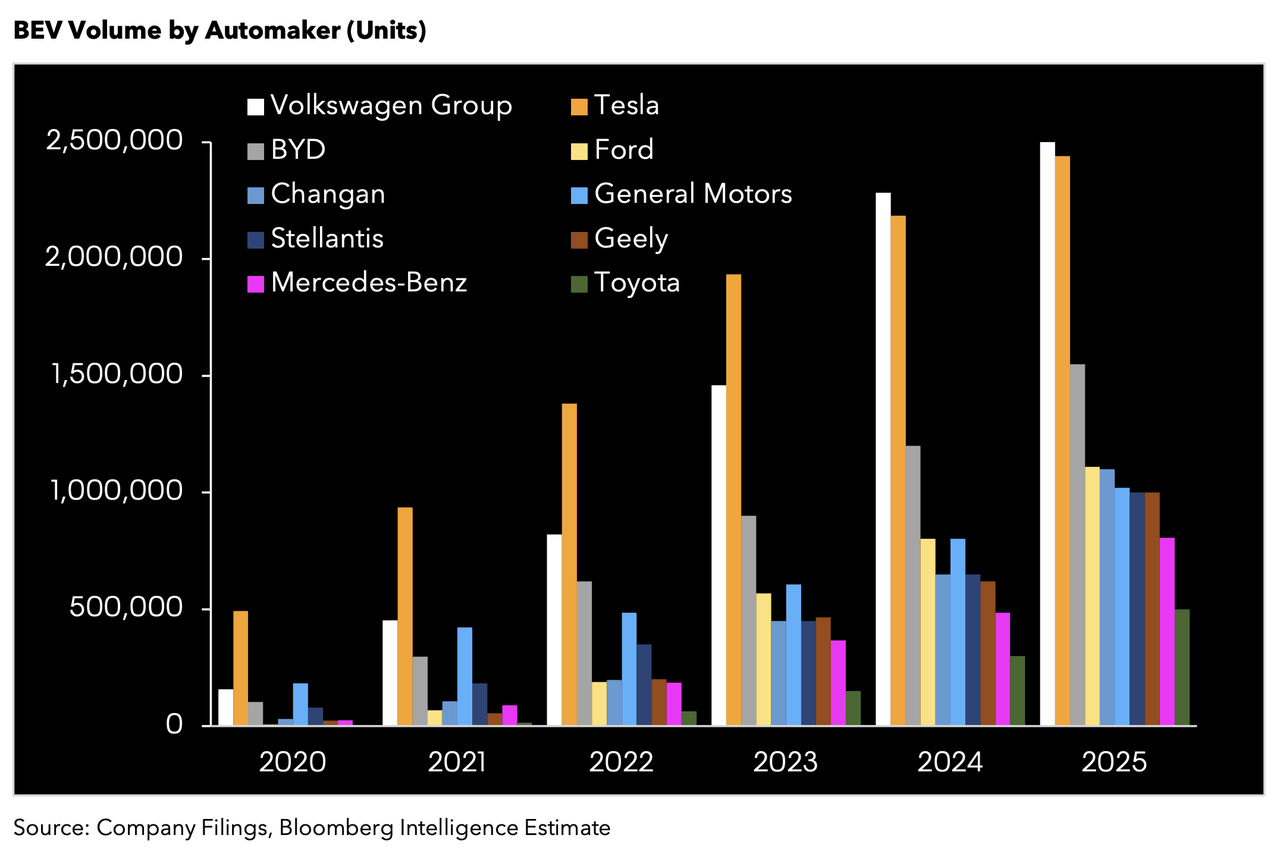

EV volumes are expected to rise across the industry, but Tesla’s competition is expected to get much more capable. By 2024, Tesla likely won’t be the largest BEV company, and BYD will have more than 50% of its volume. More importantly, among the high end models (for example Model S/X), where Tesla has higher margins, there’s much more competition from companies such as Mercedes.

There’s no denying that Tesla defined the industry. However, it also built itself up at a period when competition is minimal. We haven’t seen whether the company has the ability to compete financially with much larger car companies that don’t need profits from their EV segment. That remains a major risk to the company, given its valuation at more than most other companies.

Tesla’s Other Business

At the end of the day, something else we want to highlight is that in our view, Tesla is effectively a 1-trick pony.

They do have several other businesses:

- Self driving

- Solar

- Battery Storage.

However, in our view, these businesses aren’t ever going to be significant for Tesla. Self driving is a business where the company might not beat its competition. There’s a lot of value in being first, however, if the company’s not first it’ll be spending billions of dollars with no potential for a significant payback here.

The company also runs a minimal testing program, using primarily consumer vehicles. This has put it in the spotlight before. The company has also consistently pushed back the date of it coming online.

Solar is another one of the company’s business where it’s spent several $ billion. The company’s market share has been consistently decreasing and is now a low single digit percentage. The company’s solar roof has had consistent troubles since its launch, and on the scale of a company worth several hundred $ billion, we see it as an irrelevant business.

Lastly is battery storage. This is one of the company’s businesses that has the most potential to shine. However, the company has been unable to ramp the business, because the batteries get more value-add through being used for cars. However, at the end of the day unless Tesla’s batteries offer more storage density than everyone else, there’s no advantage here.

Overall, we expect these other businesses to never become a material part of Tesla’s financials.

Tesla Battery Storage

Despite this belief, we’ll discuss a single business that we think has the most outsized potential.

Tesla Powerwall / Megapack – Tesla Investor Presentation.

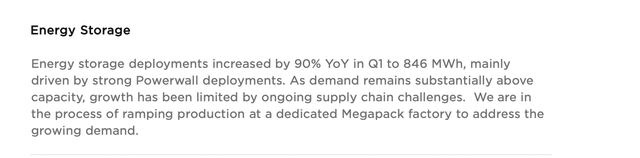

The company deployed 846 megawatts in the quarter, a 90% YoY increase but the weakest quarter since 2Q 2021. The company has said it’s working on a dedicated megapack facility, but given delays in its other facilities, we expect delays here as well. The company’s annualized deployment rate is at roughly 4 gigawatt hours / year.

A single megapack is roughly 3 MWh, with roughly $1 million each (before discounts), implying roughly $1 billion in annual revenue for the division. The company has said long-term it aims for the same margins and vehicles implying a 20% margin or $200 million in annual gross profit. That’s a fairly insignificant profit given the company’s size.

The energy storage market is expected to grow at roughly 8% annualized. That means the business will double by 2030 to roughly $400 million in profit (ideally). That would imply a business valuation of roughly $5 billion or <1% of the company’s current market capitalization. However, the business is also seeing growing competition which will pressure margins.

Valuation

Let’s put a valuation on each business.

Solar Panels / Roof

48 MW of deployment, down 48% YoY, with ~250 MW in annual deployment. Low single digit market share, and a business that the company has given up on.

Valuation: $500 million (based on valuation of peers and market share).

Energy Storage

A growing business but still earning just a few hundred million $ of profit. Growing and having significant demand, but competition is also beginning to ramp up. The business is primarily battery cost with a low barrier to entry.

Valuation: $5-15 billion (based on future earnings potential).

Vehicles

The business is the company’s only producing business. The business is currently producing at roughly 1.2 million vehicles / year although QoQ production remained flat and businesses have struggled. 2025 forecasts hit 2.5 million vehicles, however, we expect competition and costs to struggle significantly after that point.

Valuation: $55-100 billion (based on vehicle production relative to peers).

Self Driving

This is a business that the company has said it’s going to dominate for years but it continuously pushes back the expected timeline. There’s no guarantee that the company will be first to the table or that it’ll ever get here at all. Our valuation is tough to place as a result.

Valuation: -$10 billion – $100 billion (based on whether the company ever delivers self driving and has FSD liability or whether it can achieve it).

Putting this together, total valuation is roughly $135 billion, or a more than 80% decline from current prices. There’s a lot of volatility in that valuation, 33% of it comes from self-driving alone. However, regardless of what happens, it’s clear that we see significant downside for the company. It’s also worth noting that this doesn’t count any potential recession impacts.

Our View

Our view, with numerous economists predicting a likely recession, is that Tesla might be entering one of the toughest financial positions of its history.

The company’s new factories (Austin and Shanghai) are struggling to ramp up production. Per the CEO’s own announcements, these factories are currently costing the company billions of dollars. The company is struggling to actually produce the targeted production rate from these factories and find the interested customers.

Second, the company is seeing competition increase rapidly. Both on the high end and on the low end, the company is seeing its peers rapidly produce new models and increase production. These choices, even if they don’t out-compete Tesla, will at least result in a reduction in profits and hurt the company’s margins and returns.

Thesis Risk

The largest risk to our thesis is that Tesla has shown an ability to outcompete in the electric vehicle markets. The company could continue finding new ways to compete effectively and outperform, which could enable it to maintain margins. Even in that case, we think the company is overvalued, but it’s still worth paying close attention to.

Conclusion

Tesla has never faced a true market downturn as a market leader, and several factors could be coming together to put the company in a difficult position. The company has rapidly been building up new factories which are costing the company billions of dollars annually. Unless the company can ramp up production for these factories, they will remain major cost centers.

At the same time, competition is increasing rapidly. Even if the company’s offerings continue to be the best in the business, this new competition will continue to pressure margins. That will hurt the company’s returns and its ability to generate returns off of the current valuation will be much more difficult.