Top 10 VC firms have ownership in 38% of all unicorns

Table of Contents

In a bid to response the dilemma of the place does major venture capital cash go to, a new evaluation appeared at the most the latest information on unicorns.

The all round range of organizations that exceed $1 billion in valuation has doubled in the earlier yr on your own, with enterprise money money liable for most of that progress.

The basic variations in societal versions, workflows, and industries the marketplace has witnessed led lots of of the major VC companies to make investments in the very same established of unicorns, most of which are possibly fintech or world wide web assistance companies.

Large VC firms all make investments in the similar unicorns

To locate out a lot more about what most venture funds firms spend in, BestBrokers analyzed the just lately posted investigate from CB Insights. CB Insights furnished a record of all of the world’s unicorns and matched it with details on their investors and industries.

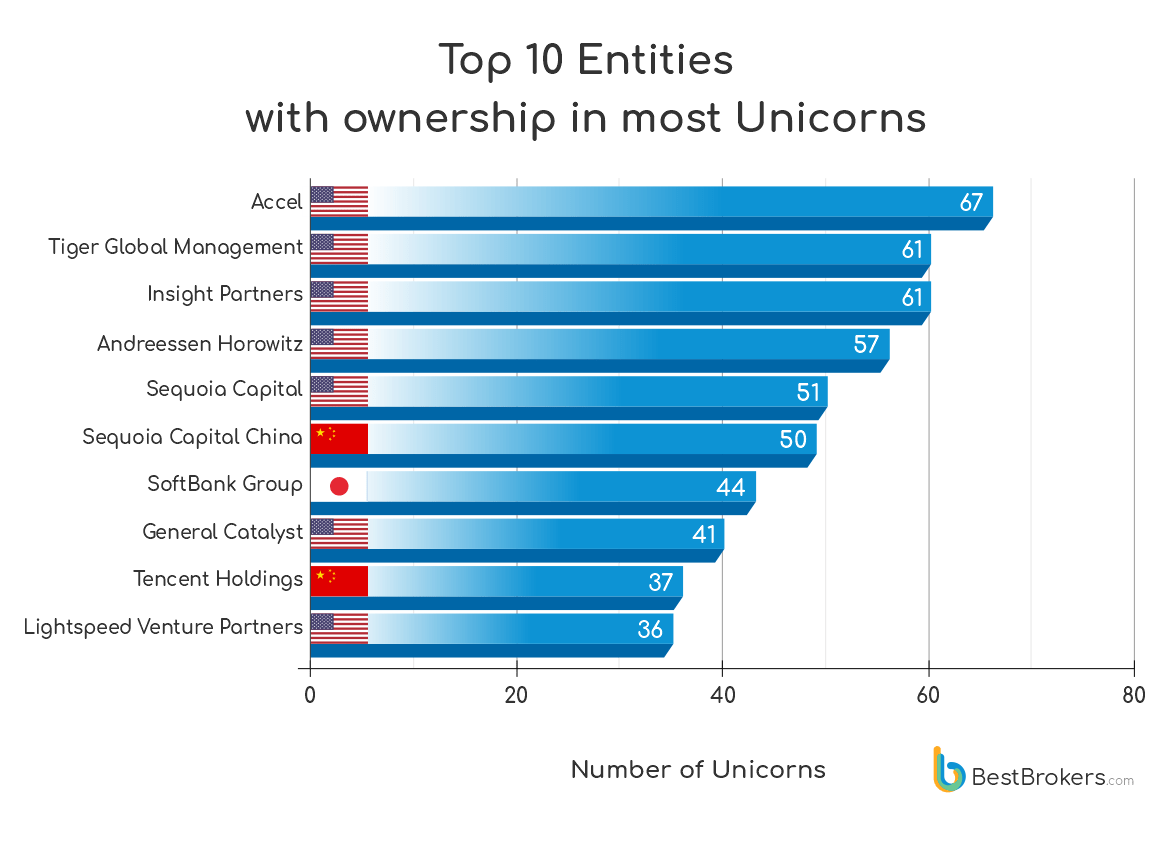

BestBroker’s report discovered the leading 10 entities that have invested in the most significant selection of unicorns. In accordance to the info, just ten firms personal 38% of all 1143 unicorns currently on the marketplace. Accel sales opportunities the way with ownership in a staggering 67 companies valued at over $1 billion, though Tiger Global Administration and Perception Associates equally invested in 61 unicorns.

Andreessen Horowitz, one of the most properly-known names in the VC world, has ownership in 57 unicorns.

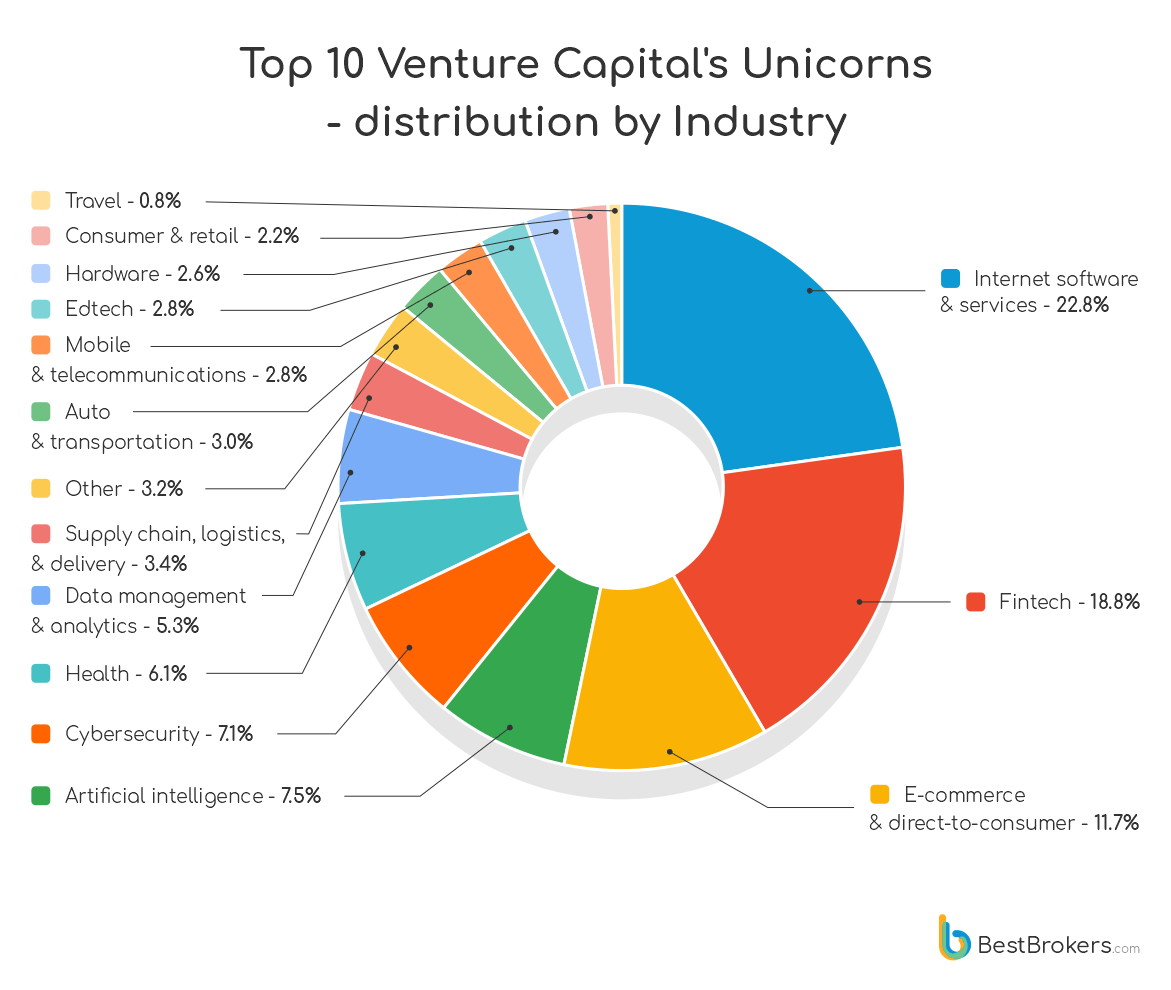

Grouping these unicorns by business reveals an plain craze — the vast majority of VC funds would seem to be heading to software program and fintech organizations.

Web computer software and solutions, fintech, and e-commerce account for around 50 percent of the whole selection of unicorns. The following four industries — AI, cybersecurity, wellbeing, and knowledge administration — amount to just above a quarter of the unicorns.

“Since the starting of 2021 fintech unicorns grew by a staggering 330%, followed by world-wide-web software and products and services with 274% and cybersecurity with 267%. Upcoming in the checklist are wellness, facts analytics, logistics, and AI. We can obviously see how the trending industries are motivated strongly by the pandemic and the modifications it brought about,” stated Alan Goldberg, an analyst at BestBrokers.

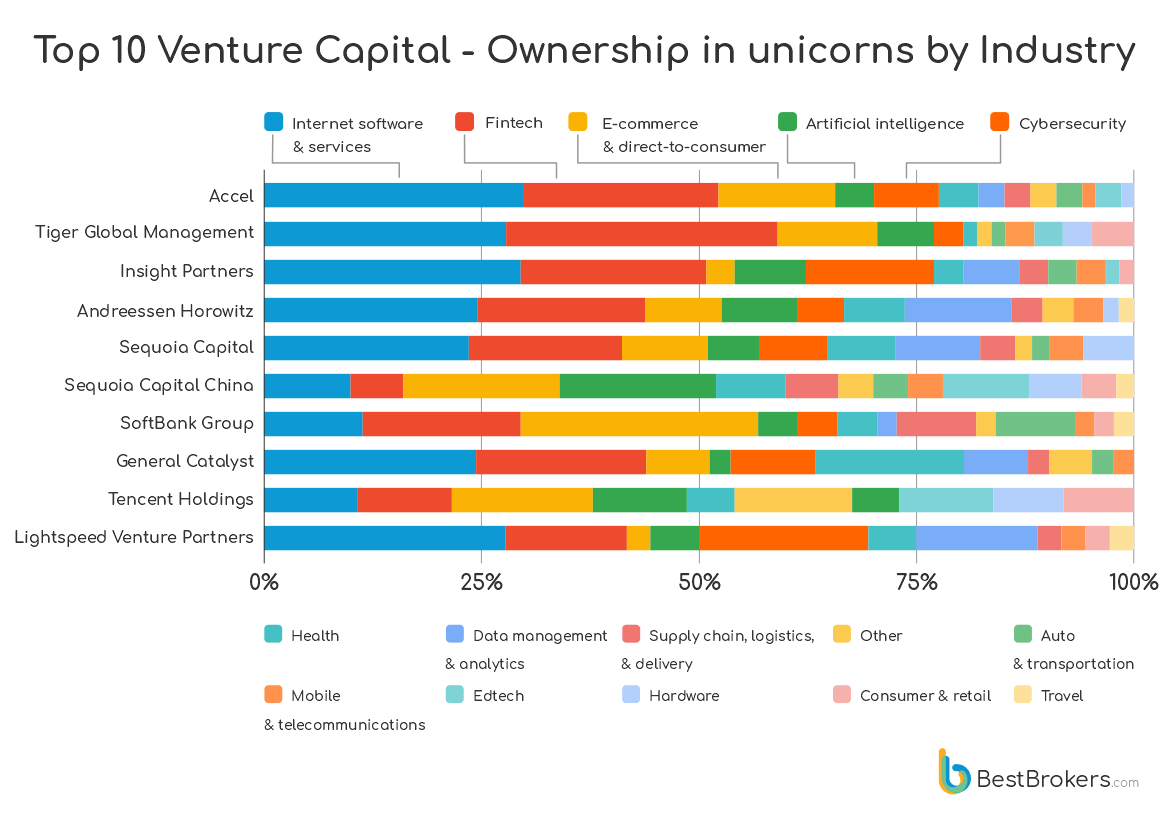

The improvements brought on by the pandemic are most obvious in the expansion we have found in e-commerce. E-commerce and immediate-to-shopper providers are strongly represented in the portfolios of all Asian entities on the listing, with the market getting initially position in all a few Asian firms.

Goldberg reported that this will come as no shock, specified that e-commerce revenues in Asia are predicted to attain $2 trillion by 2024.

However, the two main industries VC companies invested in are software package and fintech. And while CB Insight’s report teams crypto firms with legacy fintech corporations, it’s risk-free to think that crypto and blockchain businesses also make up a noteworthy part of these VCs’ portfolios.

As reported by CryptoSlate, a sizeable number of new unicorns that have been additional all over past 12 months arrived from the crypto market place. These providers include things like FTX, Ripple, OpenSea, Bitmain, Alchemy, Chainlysis, and others.