How did Main Street fare in June?

Table of Contents

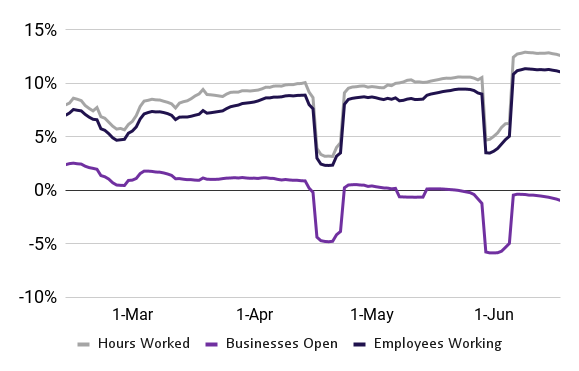

Main Road continues to be resilient irrespective of macroeconomic and geopolitical issues. Our essential Main Avenue Health and fitness Metrics — hrs worked and personnel functioning — are up in contrast to January of 2022. Info from mid-June continues to be steady with data from mid-May perhaps with a bias to the upside. General, functionality in our critical metrics keep on being reliable with tendencies observed in the pre-Covid time period.

Primary Road Wellbeing Metrics

(Rolling 7-day ordinary relative to Jan. 2022)

Staff members Doing work1

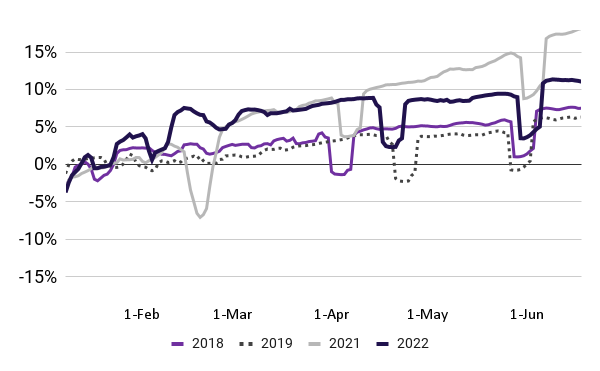

(Rolling 7-working day regular relative to Jan. of documented calendar year)

-

Some important dips because of to big U.S. holidays. Pronounced dip in mid-February 2021 coincides with the interval which include the Texas electric power disaster and critical temperature in the Midwest. Source: Homebase data.

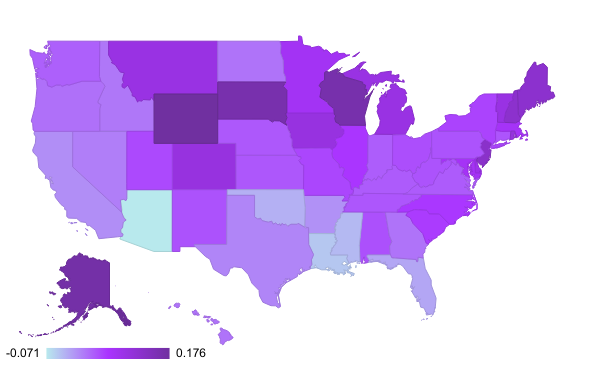

Regional discrepancies

Countrywide tendencies in our vital Key Avenue Health metrics mask some differences throughout locations, states and MSAs. For illustration, our hrs labored metric showed continued power in New England, The Plains, Terrific Lakes, and the mid-Atlantic regions. The Rocky Mountains, in flip, surged in terms of employees performing (from a looking through of 1.1% in mid-May to 7% in mid-June).

% Adjust in Hours Worked

(Mid-June vs. mid-May well using Jan. 2022 baseline)

-

June 12-18 vs. Could 8-14. Several hours worked is calculated from several hours recorded in Homebase timecards and reflects the share of employees performing in a offered interval relative to the baseline reference interval.

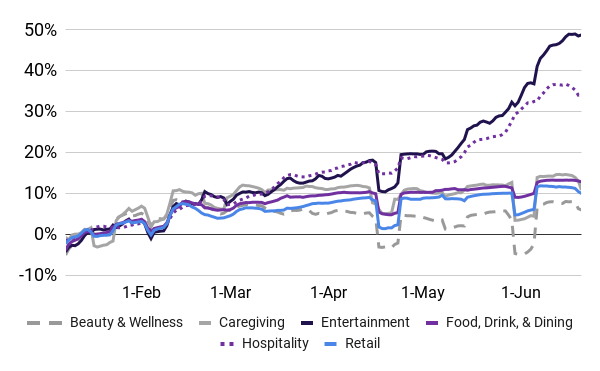

Leisure and hospitality continue on to appreciably outperform in comparison with the starting of 2022. In conditions of sector efficiency discrepancies in the percentage of workers working, mid-June 2022 resembled the corresponding period of time in the pre-Covid yr of 2019. Enjoyment (+21%) and hospitality (+13%) surged in June. Splendor & wellness (+7%) and retail (+3%) rebounded relative to mid-Might of this calendar year.

Percent Alter in Workers Performing for Select Industries

(In comparison to January 2022 baseline working with 7-day rolling average)

1. Pronounced dips frequently coincide with big US Holiday seasons. Source: Homebase details

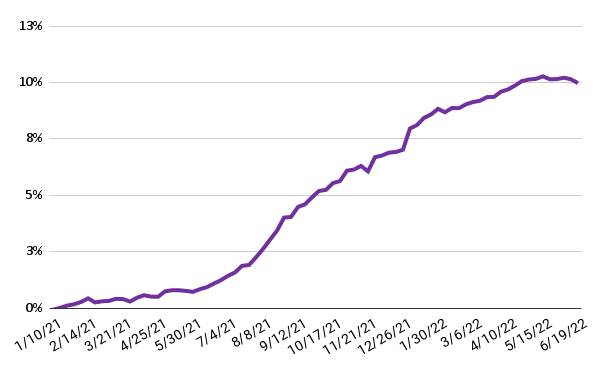

Nominal normal hourly wages are up nearly 10% considering the fact that the starting of 2021. Average (nominal) hourly wages in mid-June remained close to 10% higher than estimates from January of 2021. Nevertheless, evidence from mid-June implies that wage inflation has moderated month-around-thirty day period.

% Transform in Nominal Regular Hourly Wages Relative to January 2021

1. Nominal regular hourly wage changes calculated relative to January 2021 baseline. .Supply: Homebase info